How to Analyze Celestia Data Blob Pricing Trends on Blobspace Markets

Celestia’s data blob market is rapidly evolving, with pricing trends reflecting both technological innovation and shifting demand from blockchain projects. As of today, Celestia (TIA) is priced at $1.05, marking a 24-hour increase of and $0.0470 ( and 0.0469%). This uptick is occurring alongside a surge in data blob sizes and transaction volumes, driven by the adoption of Celestia’s modular data availability layer by platforms like Eclipse and the proliferation of CLOB-based on-chain exchanges such as Hyperliquid and Hibachi. To make sense of these dynamic pricing movements, Blobspace Markets offers a robust analytics suite that enables users to dissect the market microstructure and uncover actionable insights.

Celestia Data Blob Pricing Dynamics in 2025: Real-Time Observations

Understanding Celestia data blob pricing requires a multi-factor analysis. The cost to store data on Celestia is determined by a combination of a flat fee per transaction and a variable component based on blob size, as documented in the Celestia Docs. This hybrid model allows rollup developers to predict costs with greater accuracy compared to legacy chains, while innovations like SuperBlobs have further compressed per-MB storage fees. According to recent data, Celestia’s average cost stands at $7.31 per MB, a significant discount compared to Ethereum’s $20.56 per MB, an advantage that is fueling adoption and increasing on-chain activity.

Blobspace Markets’ analytics dashboard surfaces these cost differentials in real time. The Blob Data Leaderboard ranks active namespaces by volume, total fees paid, and median cost per blob, offering granular visibility into which protocols are driving demand and how that impacts network-wide pricing. As the blob count per block rises, more TIA is bought and spent, directly linking data usage to token value accrual for validators and holders. This relationship is central to Celestia’s modular thesis: as more rollups and dApps leverage Celestia for affordable data availability, the market for blobs becomes increasingly liquid and efficient.

Tracking Blob Market Volatility and Volume Spikes

The recent surge in blob usage: notably from CLOB-based exchanges, has introduced new volatility into the pricing landscape. As Professor Jo noted on X, this uptick is reshaping the fee market and testing Celestia’s scalability promises. On-chain analytics show that daily transactions and average blob sizes have both reached historic highs in Q4 2025. This influx has two major effects: it increases competition for blobspace (potentially raising fees during peak periods) and validates Celestia’s claim of scalable, low-cost data availability for next-gen applications.

For traders and developers monitoring blobspace markets analytics, it’s critical to contextualize these volume spikes within broader network trends. Are fee increases temporary responses to specific launches or sustained shifts in baseline demand? The answer lies in tracking rolling averages of blob count, median cost per blob, and namespace-level activity, metrics that Blobspace Markets provides with precision.

Predictive Analytics: Where Is Celestia Blob Pricing Headed?

With Celestia (TIA) holding steady at $1.05, market participants are asking whether current pricing reflects a new equilibrium or if further volatility looms as adoption accelerates. Predictive analytics tools on Blobspace Markets leverage historical fee curves, transaction throughput, and macro trends in rollup adoption to forecast potential price movements. These models are especially relevant as alternative DA providers enter the fray and as Ethereum’s own blob space remains constrained by protocol limits.

Celestia (TIA) Price Prediction 2026-2031

Forecast based on Blobspace Demand Growth, Modular Blockchain Adoption, and Market Trends

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.90 | $1.30 | $2.10 | +24% | Bearish scenario: Post-hype correction; Bullish: Continued onboarding of L2s and rollups. |

| 2027 | $1.15 | $1.75 | $3.20 | +35% | Modular blockchain adoption accelerates; Blobspace demand rises with new DeFi protocols. |

| 2028 | $1.60 | $2.40 | $4.80 | +37% | Improved data compression and SuperBlobs adoption; regulatory clarity boosts institutional use. |

| 2029 | $2.10 | $3.30 | $6.20 | +37% | Blobspace market matures; Celestia expands to cross-chain ecosystems; competition intensifies. |

| 2030 | $2.80 | $4.25 | $8.00 | +29% | Mainstream adoption of modular DA; Celestia captures larger share of L2 data market. |

| 2031 | $3.60 | $5.10 | $10.50 | +20% | Blobspace becomes a standard commodity; further protocol upgrades enhance scalability and utility. |

Price Prediction Summary

Celestia (TIA) is poised for steady long-term growth as demand for modular data availability and blobspace intensifies. While short-term volatility is likely, driven by market cycles and competition, the underlying technological edge and adoption by major rollups position Celestia for significant appreciation through 2031, especially if it maintains its cost advantage over legacy DA providers.

Key Factors Affecting Celestia Price

- Blobspace demand and adoption by rollups and L2s

- Sustained cost advantage versus Ethereum and other DA providers

- Technological innovation (e.g., SuperBlobs, compression)

- Regulatory developments impacting modular blockchain adoption

- Competition from alternative data availability networks

- Overall crypto market sentiment and risk appetite

- Expansion of real-world use cases (DeFi, gaming, enterprise)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The interplay between supply (available blobspace) and demand (rollup transactions) will continue to define market structure. For a step-by-step breakdown of how to analyze these metrics using Blobspace Markets’ toolset, see our detailed guide. By combining real-time dashboards with predictive models, users gain an edge in navigating the fast-changing landscape of Celestia data blobs.

To further sharpen your strategy, it’s vital to watch for inflection points in blob pricing and network usage. For example, the introduction of innovations like SuperBlobs has already compressed storage costs, but future protocol upgrades or new dApp launches could trigger fresh volatility. As of October 2025, Celestia’s 24-hour price range ($0.9835 to $1.05) demonstrates a relatively tight spread, a sign that the market is absorbing increased transaction volume without outsized fee spikes. Still, as demand for blobspace ebbs and flows with ecosystem developments, short-term dislocations remain a key risk for traders and rollup operators alike.

Tools and Best Practices for Analyzing Data Blob Value

Blobspace Markets equips users with advanced analytics to dissect these trends. Key features include:

Top Analytics Tools for Celestia Blob Pricing Trends

-

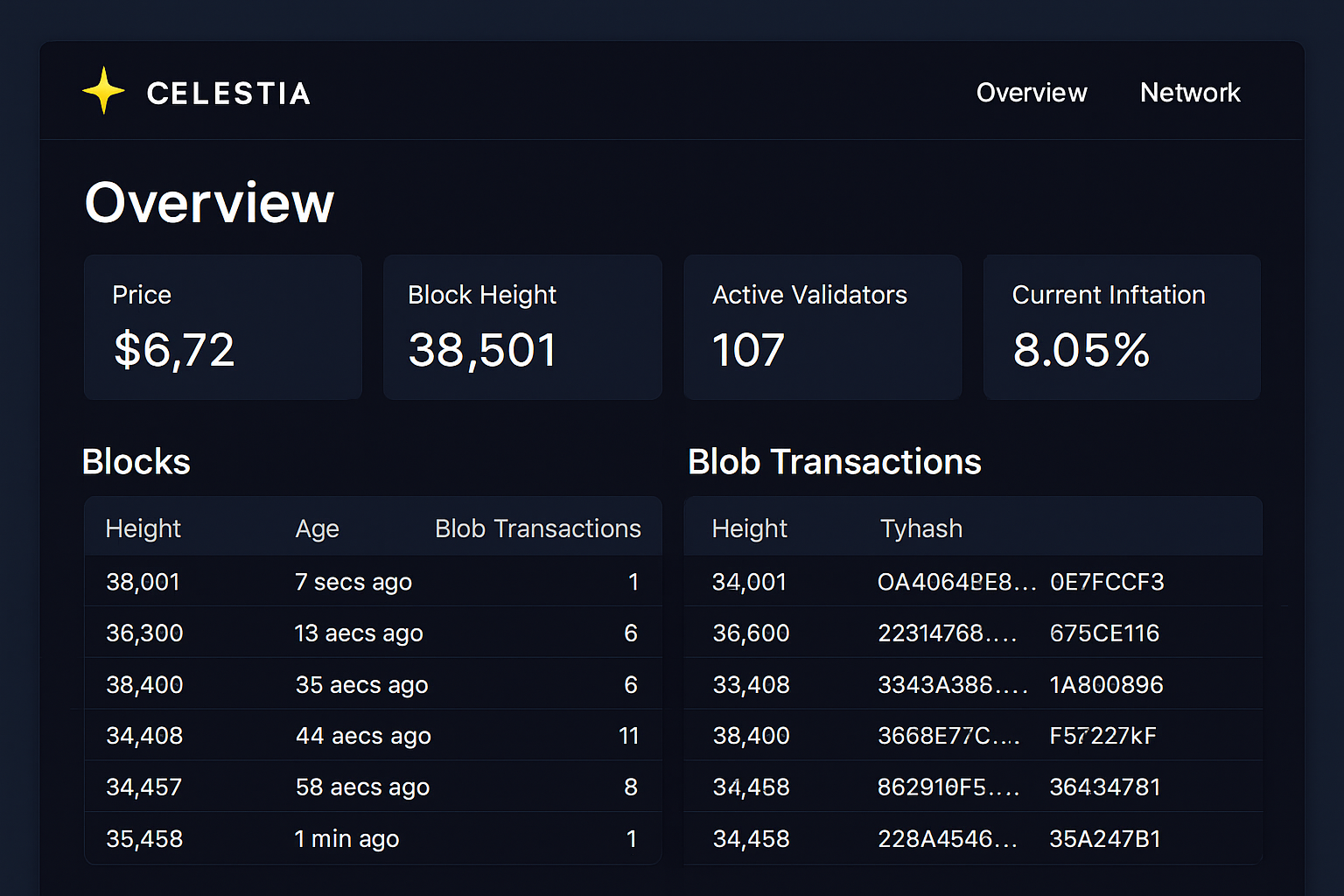

Celestia Explorer: The official Celestia Explorer provides real-time insights into blob transactions, pricing, and fee structures. Its analytics dashboard features a Blob Data Leaderboard, ranking active namespaces by volume, fees, and median cost per blob—crucial for tracking market activity and volatility.

-

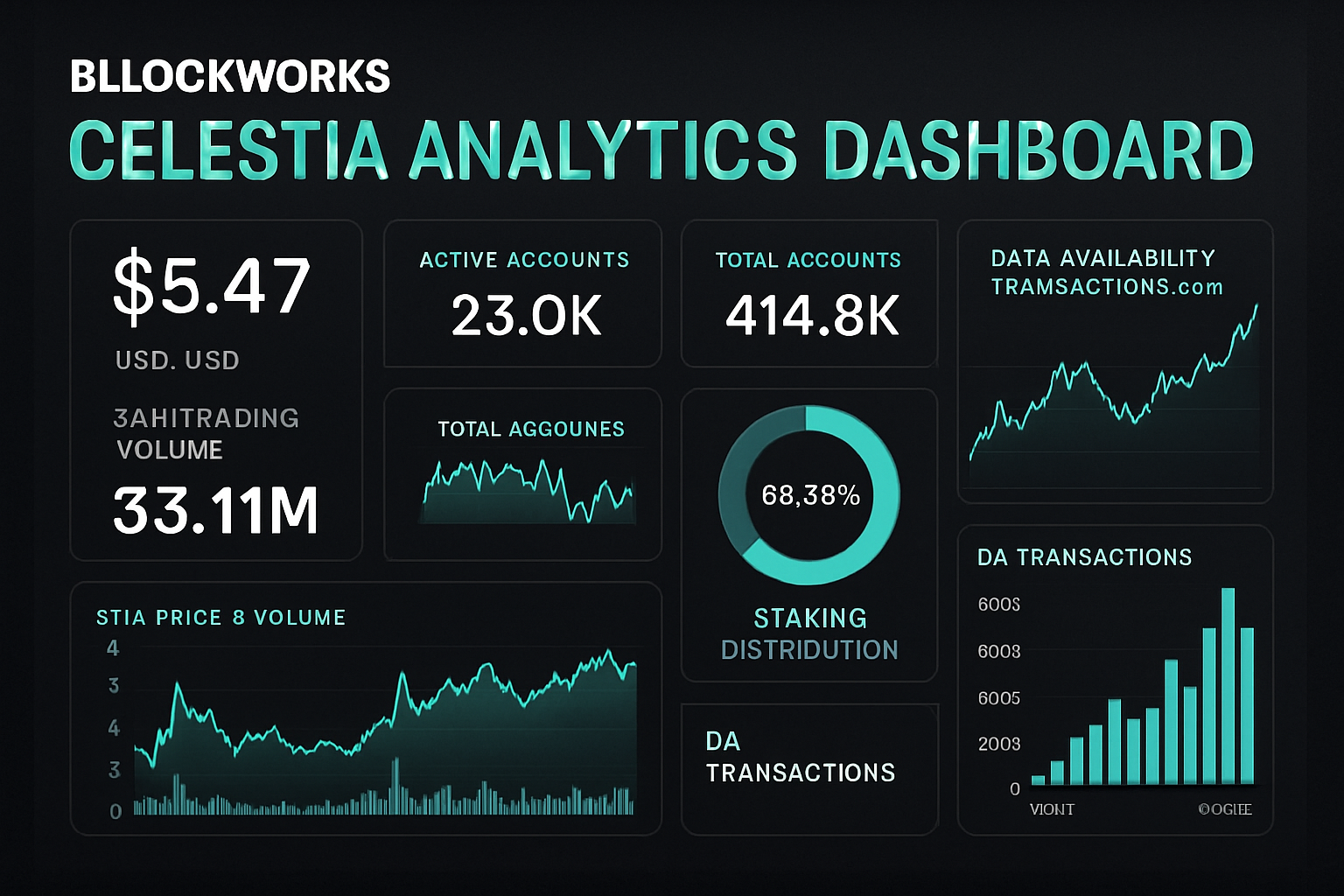

Blockworks Celestia Analytics Dashboard: Blockworks offers a comprehensive dashboard tracking historical blob pricing, volume, and fee trends on Celestia. Users can analyze daily transaction counts, blob sizes, and cost comparisons with other data availability providers.

-

Conduit Data Availability Analytics: Conduit’s analytics tools compare Celestia’s blob pricing and volatility against Ethereum and other alt DA providers. The platform highlights cost reductions, usage surges, and protocol adjustments impacting blobspace markets.

-

Coinglass Celestia Market Data: Coinglass aggregates current and historical Celestia (TIA) price data, including 24h highs/lows and percentage changes. This enables precise tracking of market sentiment and price volatility relevant to blobspace economics.

-

Celestia Docs: Blob Fee Market Insights: The official Celestia documentation details the blob fee market structure, including the flat and variable fee components per transaction. This resource is essential for understanding cost drivers and historical fee trends.

By leveraging these analytics, users can:

- Spot emerging demand clusters by monitoring namespace-level fee and volume data

- Identify periods of heightened volatility using rolling averages and real-time alerts

- Compare Celestia blob pricing with alternative DA solutions to assess competitive positioning

- Model fee exposure for rollup deployment based on historical cost curves

For those new to the space or seeking to optimize their decision process, our step-by-step guide offers a practical walkthrough of each tool and metric.

Actionable Insights: Navigating the Blob Market

Celestia’s blob market is maturing rapidly, with increased liquidity and more sophisticated actors entering the ecosystem. This maturation is reflected in the alignment between transaction growth and price stability at the $1.05 level. For developers, this means more predictable costs and the ability to plan rollup economics with greater confidence. For traders and data scientists, the focus shifts to exploiting short-term inefficiencies and arbitrage opportunities as new protocols and fee models are tested in production.

Staying ahead requires not just historical data but also real-time intelligence and predictive context. Blobspace Markets’ blend of live dashboards, automated alerts, and forward-looking analytics gives users a comprehensive toolkit to navigate these shifts. As the landscape evolves, expect further convergence between protocol innovation and market efficiency, with Celestia continuing to set the pace for data availability pricing.

For a deeper dive into how blob counts per block impact pricing and market opportunities, consult our focused analysis here.

Key Takeaways for Celestia Blob Market Participants

- Celestia (TIA) is currently priced at $1.05, reflecting robust demand and network expansion.

- Blobspace Markets analytics allow real-time tracking of pricing, volume, and fee trends at granular levels.

- Innovations like SuperBlobs and the rise of CLOB-based exchanges are reshaping both costs and market structure.

- Predictive analytics are essential for anticipating volatility and optimizing trading or deployment strategies.

Numbers never lie. By relying on precise data and advanced analytics, you can decode the signals behind Celestia’s blob market and position yourself for success in the modular blockchain era.