Step-by-Step Guide to Trading Celestia Data Blobs on Blobspace Markets in 2026

Picture this: Celestia’s TIA token is holding steady at $0.3251, with a 24-hour gain of and $0.0208 ( and 0.0682%), fueled by the explosive growth in data blob activity. Thanks to the Matcha upgrade expanding block sizes to 128MB and the game-changing Fibre Blockspace delivering 1 terabit per second across 500 nodes, trading Celestia data blobs on Blobspace Markets has never been more thrilling. Blob sizes have surged 10x amid NFT mints and integrations like Eclipse and RARI chain, creating prime momentum plays for savvy traders. If you’re ready to dive into this Blobspace Markets trading guide, let’s build your edge step by step.

Master the Fundamentals of Celestia Blobspace

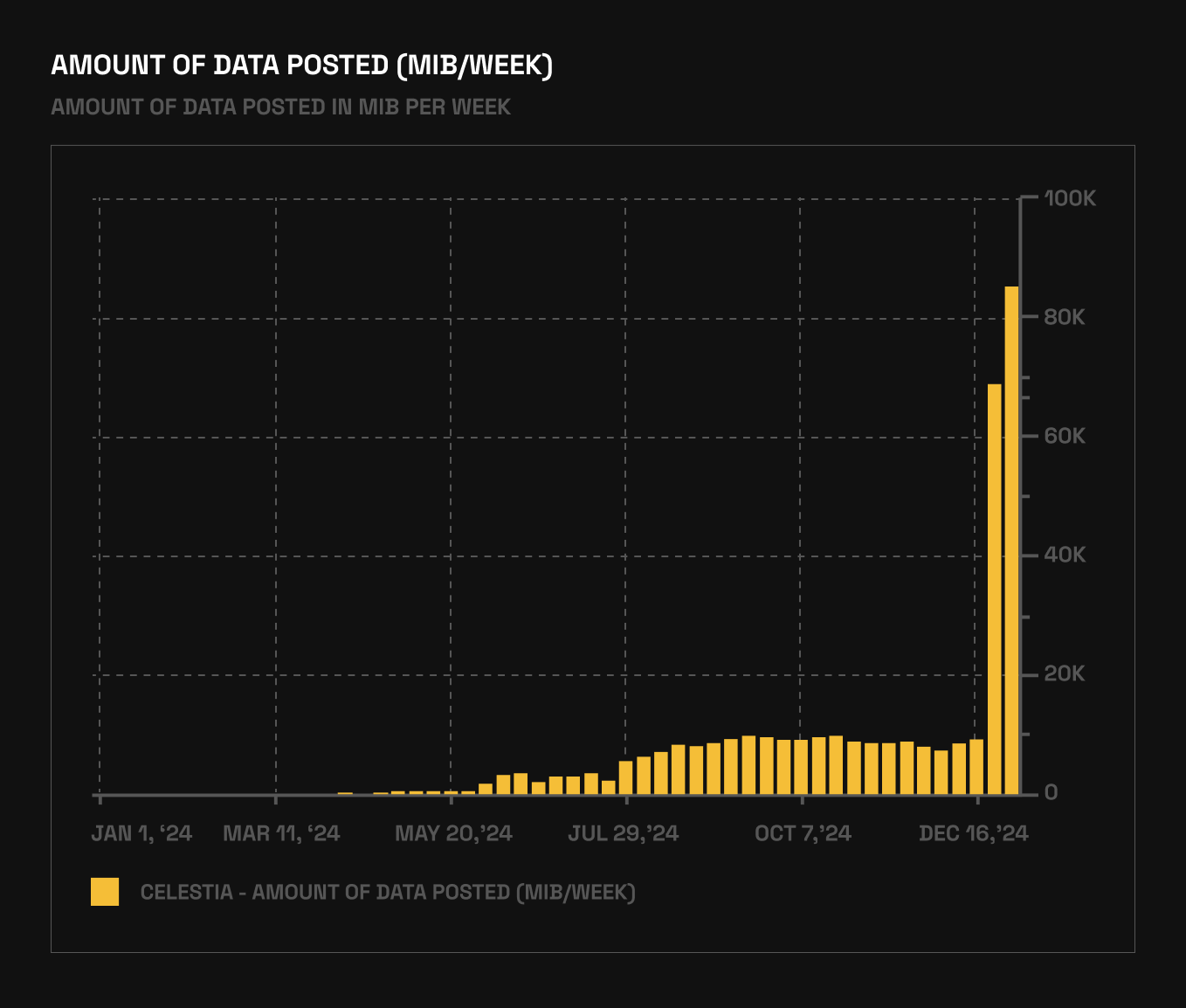

Before you trade, understand what makes Celestia blobspace tick. Data blobs are the backbone of modular blockchains, where Celestia acts as the data availability layer. Developers submit BlobTx transactions, packing in raw data for rollups, appchains, and beyond. With Fibre Blockspace, capacity hits 1TB/s, unlocking micropayments, fractionalized assets, and onchain data markets. Daily blob fees have skyrocketed 10x since late 2024, and Celestia now dominates 50% of the DA space, processing over 160GB of rollup data.

Blobspace Markets shines here, offering real-time pricing, analytics, and trading tools tailored for Celestia blob trading 2026. Track blob sizes in GB, fee trends, and demand spikes from sources like The Block’s charts. Momentum is your friend: when blob volumes jump, like the recent 10x surge, prices follow. Stay ahead by monitoring TIA at $0.3251 – a launchpad for the next leg up.

Celestia (TIA) Price Prediction 2027-2032

Realistic long-term forecast factoring blob growth, Fibre Blockspace, Matcha upgrades, and modular blockchain adoption

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.50 | $1.25 | $3.00 | +285% |

| 2028 | $1.00 | $2.75 | $6.00 | +120% |

| 2029 | $1.50 | $4.50 | $10.00 | +64% |

| 2030 | $2.50 | $7.00 | $15.00 | +56% |

| 2031 | $3.50 | $10.00 | $22.00 | +43% |

| 2032 | $5.00 | $14.00 | $30.00 | +40% |

Price Prediction Summary

From a 2026 baseline of $0.3251, Celestia (TIA) is poised for recovery and growth due to surging blob activity, Fibre’s 1TB/s capacity, Matcha-enabled 128MB blocks, and DA layer dominance. Bullish scenarios reflect adoption in rollups, NFTs, and onchain markets; bearish mins account for cycles and competition.

Key Factors Affecting Celestia Price

- Blob sizes surging 10x with NFT mints, Eclipse, RARI integrations

- Fibre Blockspace: 1 terabit/second across 500 nodes enabling new use cases

- Matcha upgrade expanding blocks to 128MB, boosting blob markets

- 50%+ market share in data availability amid modular blockchain trend

- Crypto market cycles with potential 2027-2028 bull resumption

- Regulatory progress favoring DA layers and institutional inflows

- Competition from Avail, EigenDA, but Celestia’s first-mover edge

- Daily blob fees grown 10x since 2024, supporting token demand

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Step 1: Sign Up and Secure Your Blobspace Markets Account

Hit the ground running. Head to Blobspace Markets and click ‘Sign Up. ‘ Use your email or connect a wallet like Keplr or Leap for Cosmos ecosystem seamless integration. Verify via email link – takes 30 seconds. Pro tip: Enable 2FA immediately for ironclad security in these volatile markets.

- Choose ‘Wallet Connect’ for non-custodial control.

- Confirm network: Celestia mainnet.

- Review terms, focusing on blob trading specifics.

Why Blobspace Markets? Intuitive dashboards beat generic exchanges, with blob-specific order books and analytics. Your account unlocks live feeds on data blob trading strategies, perfect for 2026’s scaled-up blobspace.

Celestia’s blob surge isn’t hype – it’s processing real demand from rollups and NFTs. Trade it smart.

Step 2: Fund Your Account and Explore the Dashboard

Bridge TIA or USDC from Ethereum, Arbitrum, or Cosmos hubs. Blobspace Markets supports low-fee swaps via integrated DEXs. Start with $500-1000 TIA equivalent at current $0.3251 levels to test waters without overexposure. Deposit via ‘Wallet’ tab: approve, confirm, done.

Dashboard mastery is key. Pin widgets for blob size (daily GB), fee auctions, and TIA price. Spot momentum: Rising blob txns signal fee spikes, prime for short-term longs. Use the analytics tab for historicals – post-Matcha, volumes exploded.

Dive into Celestia blobspace platform tools: Heatmaps show peak usage hours, ideal for timing entries. Risk tip: Set 2-3% stops below recent lows like $0.2986. You’re now primed for blob orders – next, we’ll craft your first trade.

For deeper data blob trading strategies, check this best practices guide. Momentum builds; let’s capture it.

With your dashboard humming and funds loaded, it’s time to strike. TIA’s steady at $0.3251, blob volumes roaring post-Matcha – perfect setup for your entry. I’ve ridden these waves for years; momentum from NFT floods and Fibre’s 1TB/s capacity turns small edges into real gains. Let’s lock in Step 3.

Step 3: Place and Manage Your First Blob Trade

Navigate to the ‘Trade’ tab on Blobspace Markets. Select ‘Blobs’ market – spot or perpetuals, depending on your risk appetite. For beginners, start with limit orders on blob fee futures, bidding above current auctions when volumes spike. Enter amount: say 10 TIA worth at $0.3251, set leverage at 3x max to keep drawdowns tame.

- Scan order book for depth – thick bids signal support.

- Check 15-min chart for breakouts above $0.3251.

- Hit ‘Buy/Long’ if blobs hit daily highs; reverse for shorts on fee dumps.

Confirm slippage under 0.5%. Position opens instantly on Celestia mainnet. Track via ‘Positions’ – unrealized P and amp;L updates live. My swing style? Trail stops at 1: 2 risk-reward, banking 4-6% on blob surges like the recent 10x.

Blobspace Markets edges out competitors with one-click blob analytics tied to trades. Watch how Eclipse integrations pump demand – that’s your cue.

Step 4: Scale Up with Proven Data Blob Trading Strategies

Don’t stop at basics. Layer in data blob trading strategies honed for Celestia blob trading 2026. Momentum trades shine: Enter longs when daily GB blobs cross 100GB average, exit on fee peaks. Pair with TIA spot at $0.3251 for hedges. Opinion: Fibre’s node swarm crushes rivals; bet on sustained 50% DA dominance.

5 Key Blob Trading Strategies

-

1. Momentum on Blob Size Surges: Ride explosive 10x blob size surges from NFT activity and Eclipse integrations. Track daily GB charts on The Block—enter long on breakouts for quick gains!

-

2. Fee Auction Sniping: Outbid rivals in Celestia’s BlobTx fee auctions during peak demand. Time entries post-Matcha upgrade’s 128MB blocks for profitable resales on Blobspace Markets—stay sharp!

-

3. TIA-Blob Correlation Plays: Trade TIA at $0.3251 (+6.82% 24h) alongside blob volume spikes. As blobs grow 10x since 2024, TIA follows—pair with Celestia analytics on Blockworks for leveraged wins!

-

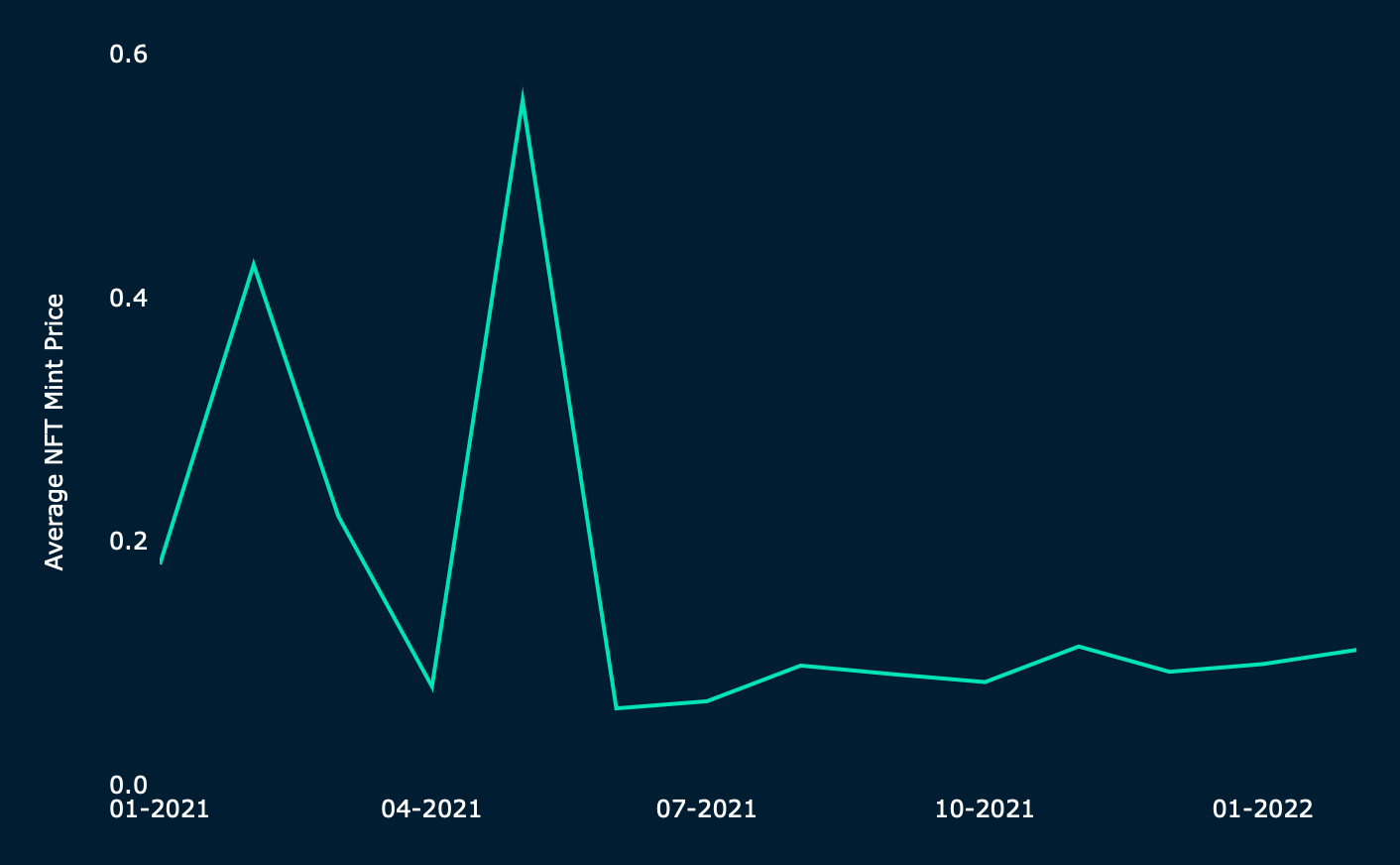

4. NFT Mint Volume Scalps: Scalp short-term pumps from RARI chain NFT mints flooding blobs. Post-Matcha, volumes exploded—monitor Blobspace Markets for entry/exit signals and stack profits fast!

-

5. Fibre Capacity Breakout Longs: Go long on Fibre’s 1TB/s blockspace across 500 nodes, unlocking onchain markets. With TIA at $0.3251, position for sustained rallies—check Celestia blog!

Backtest on platform historics – post-128MB blocks, winners cluster around volume breakouts. Risk-adjust: Never risk over 1% per trade. For fee volatility mastery, explore blob fee spike strategies.

Monitor, Adjust, and Stay Ahead in Blobspace

Trading’s a marathon. Pin alerts for TIA dips below $0.2986 or blob txns exploding. Weekly reviews: Log wins from RARI chain hype, tweak for next leg. Blobspace Markets’ tools – heatmaps, predictions – keep you nimble. As TIA holds $0.3251 amid bull whispers into 2026, compound small edges into portfolio rockets.

Common pitfalls? Overleveraging on hype, ignoring chain congestion. My fix: 60% position sizing rule, always. Enthusiasts, drill deeper via best practices. You’re equipped now.

Blobspace pulses with opportunity. Nail these steps, ride the surges, and watch your trades thrive. Momentum is your friend – grab it in 2026.