Celestia Blob Trading Strategies During Ethereum Blob Capacity Limits 2025

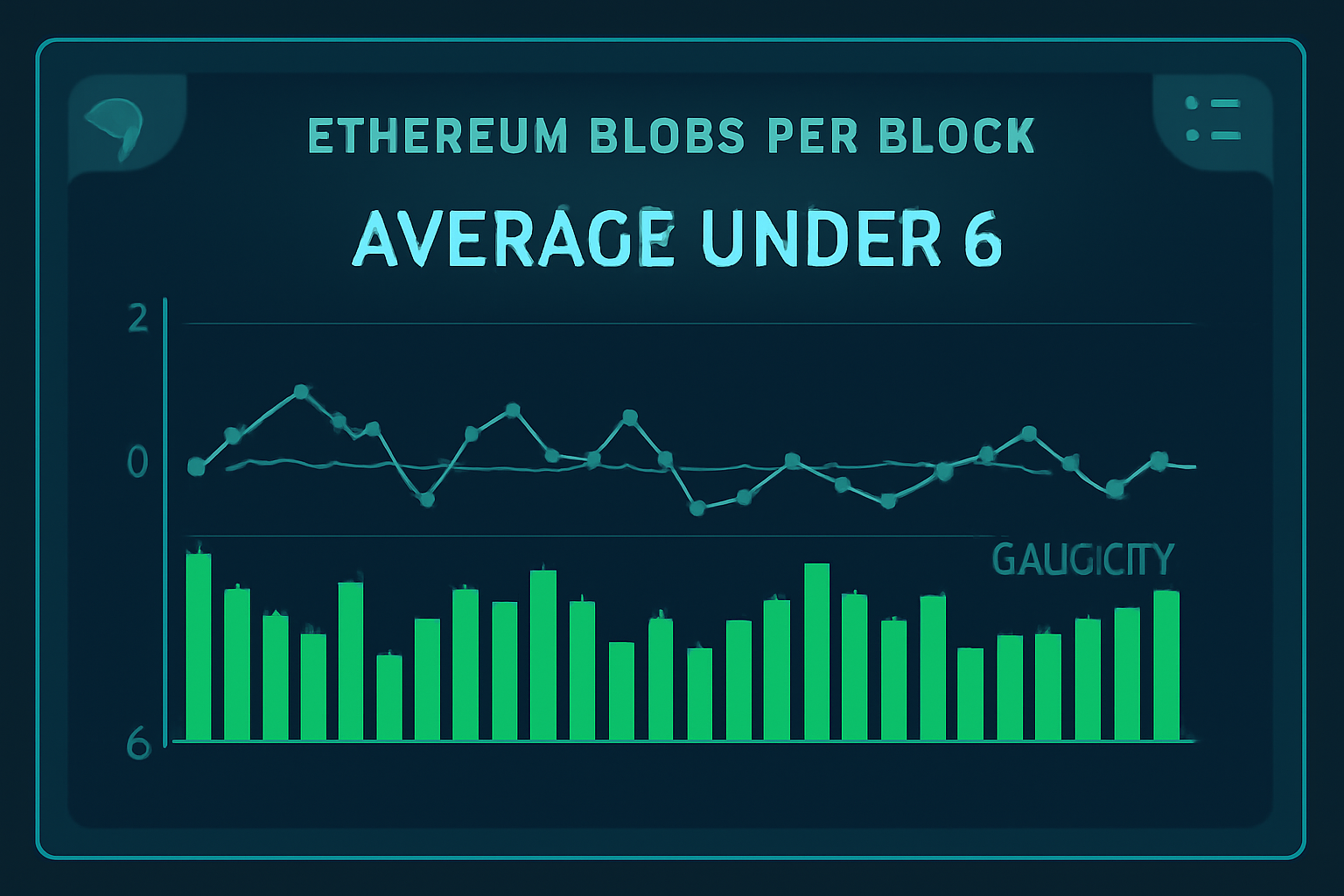

In the ever-shifting sands of blockchain data availability, Ethereum’s blob capacity is feeling the strain. Post-Pectra upgrade on May 7,2025, blocks now target 6 blobs and max out at 9, pushing daily capacity to 8.15GB. Yet rollups snapped up 20.8% more blobs, hitting 25,600 daily, while costs dipped near zero. Meanwhile, Celestia’s blob sizes exploded from 1.18GB to 11.4GB averages, with transactions up 60% to 71,000 per day, fueled by NFT mints and developer shifts. At $7.31 per MB versus Ethereum’s $20.56, Celestia blobs scream opportunity for Celestia blob trading amid Ethereum blob limits. With TIA hovering at $0.6213, down 0.0316% in 24 hours, savvy traders eye data blob markets 2025.

Ethereum’s Capacity Crunch Fuels Celestia Surge

EIP-4844, the proto-danksharding heart of the Dencun upgrade, rolled out blob transactions to slash L2 data costs. Each 128KB blob persists briefly in beacon nodes, but fixed limits bite during peaks: max 6 pre-Pectra, now 9. Conduit data underscores Celestia’s edge-64% cheaper long-term. Ethereum’s fee market mimics EIP-1559, but when blocks fill, prices spike past $20.56/MB. Celestia, clocking 6.67MB/s throughput, handles the overflow effortlessly. This dynamic birthed blob capacity trading on platforms like Blobspace Markets, where Celestia blobspace analytics light the path.

Blobs have a fixed size of 128KB and a maximum of 6 blobs can be processed in an Ethereum block. The data contained in each blob is ephemeral. . .

Rollups flock to Celestia as Ethereum nears exhaustion, blending cost savings with scalability. Traders, watch on-chain metrics; the interplay hints at profitable pivots.

Ethereum Congestion Arbitrage: Your Entry Point

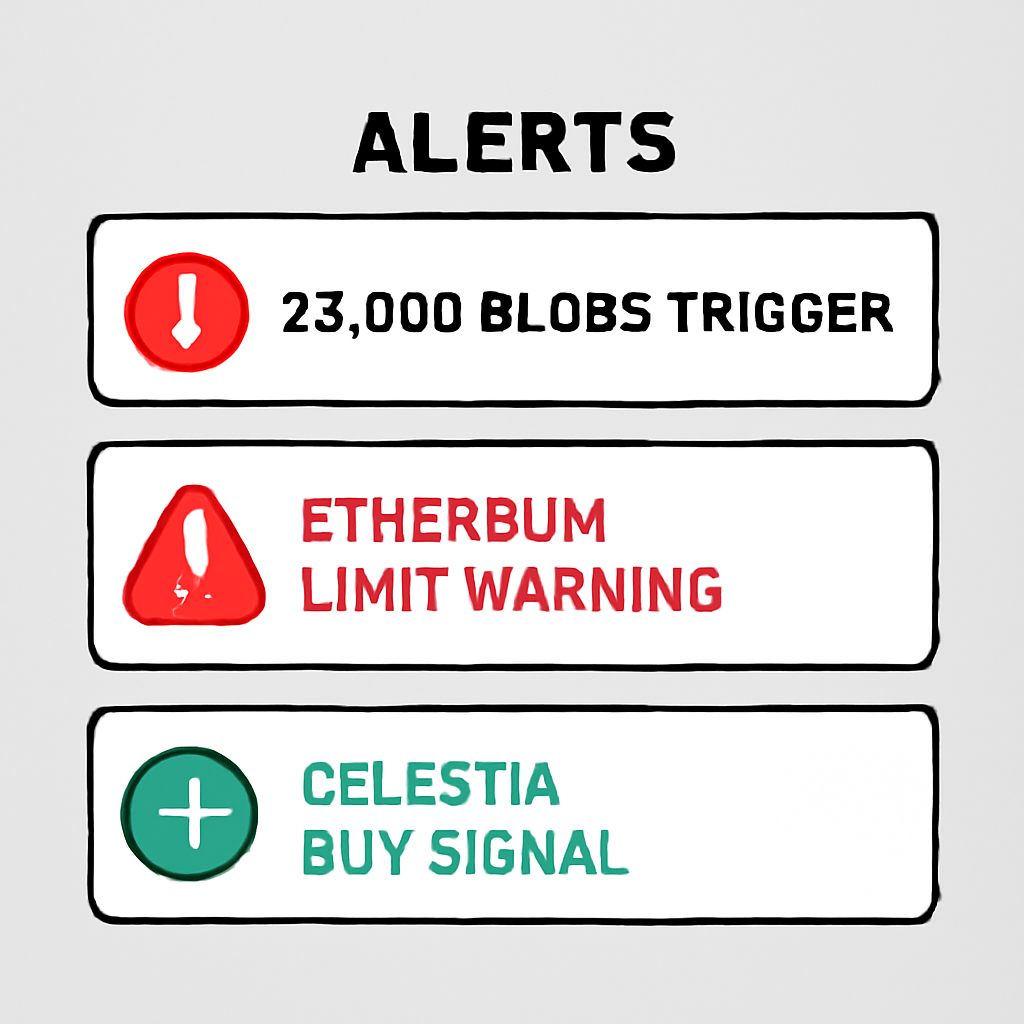

First up: Ethereum Congestion Arbitrage. Buy Celestia blobs at $7.31/MB precisely when Ethereum slams into 6-blob/block limits and prices exceed $20.56/MB. Picture Ethereum blocks jammed during peak L2 posting-hours; blob fees rocket as demand outstrips the 8.15GB daily cap. Flip to Celestia-your trade executes cheaper, faster. I’ve seen this play out visually on Blobspace dashboards: Ethereum’s red-hot fee charts spike while Celestia’s green cost line stays flat. Time it with real-time alerts; pocket the 64% discount as rollups reroute payloads.

Preemptive Demand Shift Trading Takes Foresight

Next, Preemptive Demand Shift Trading: Accumulate Celestia blobs ahead of Ethereum EIP-4844 capacity exhaustion using Blobspace real-time analytics. Don’t wait for the squeeze-predict it. Track rollup posting patterns; when daily blobs near 25,600 and averages creep toward 6 per block, load up. Blobspace’s Celestia blobspace analytics shine here, overlaying Ethereum utilization heatmaps with Celestia liquidity pools. In 2025’s data blob markets, this front-runs the herd. Opinion: it’s not gambling; it’s data-driven dominance. Pair with TIA at $0.6213 for leveraged bets.

Celestia (TIA) Price Prediction 2026-2031

Amid Ethereum Blob Capacity Limits, Pectra Upgrade Impacts, and Celestia DA Adoption Surge

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $0.85 | $1.40 | $2.90 | +126% |

| 2027 | $1.40 | $2.50 | $5.00 | +79% |

| 2028 | $2.00 | $4.00 | $8.00 | +60% |

| 2029 | $3.00 | $6.00 | $12.00 | +50% |

| 2030 | $4.50 | $9.00 | $18.00 | +50% |

| 2031 | $6.00 | $12.00 | $25.00 | +33% |

Price Prediction Summary

Celestia (TIA) is forecasted to experience substantial growth from 2026 to 2031, with average prices rising from $1.40 to $12.00, driven by its cost advantages in data availability (64% cheaper than Ethereum blobs), surging transaction volumes, and increasing adoption for NFT minting and rollups amid Ethereum’s underutilized blob capacity post-Pectra upgrade. Bullish scenarios reflect market cycles and modular DA dominance; bearish mins account for competition and volatility.

Key Factors Affecting Celestia Price

- Celestia’s 64% cheaper DA costs vs. Ethereum blobs ($7.31/MB vs. $20.56/MB)

- Surge in Celestia blob sizes (1.18GB to 11.4GB avg) and 60%+ tx growth to 71k/day

- Ethereum Pectra upgrade (May 2025) increased blobs to 6/9 per block but average usage low, reducing ETH burn and favoring alternatives

- Growing adoption for high-data projects like NFTs amid blob trading opportunities

- Modular blockchain trends, tech upgrades, and competition from Ethereum scaling

- Crypto market cycles, regulatory developments, and TIA market cap expansion potential

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Cost Arbitrage Scalping for Quick Wins

Then there’s Cost Arbitrage Scalping: Rapidly trade Celestia blobs during Ethereum peak hours, exploiting the 64% cost advantage per Conduit data. Ethereum’s mornings and evenings light up with L2 activity-blob prices surge. Scalp by buying low on Celestia, holding seconds, selling into the frenzy. Visualize it: oscillating charts where Celestia’s steady $7.31/MB undercuts Ethereum’s volatility. High-frequency tools on Blobspace Markets make this feasible for retail traders. Pro tip: layer in volume spikes from Celestia’s 71,000 daily txns for conviction. This strategy thrives on the post-Pectra imbalance, turning hours into gains.

These opening moves set the stage, blending arbitrage with analytics for blob capacity trading edge. As Ethereum’s limits tighten, Celestia’s momentum builds.

Now, let’s sharpen your edge with Blob Capacity Forecasting: Use on-chain metrics to predict Ethereum blob limits and position long on Celestia blobspace markets. Dive into dashboards tracking blobs per block-if averages nudge past 6 toward the 9 max, exhaustion looms. Celestia’s 11.4GB average blobs and 71,000 daily txns signal readiness. I love plotting these on Blobspace: Ethereum’s filling bars turn orange, cueing your long on TIA at $0.6213. Pair with throughput stats-Celestia’s 6.67MB/s dwarfs Ethereum’s 1.33MB/s post-Dencun. This isn’t guesswork; it’s visual prophecy turning data into dollars in data blob markets 2025.

Trend Momentum Plays Ride the Wave

Trend Momentum Plays keep it simple yet powerful: Follow upward Celestia pricing trends on Blobspace Markets correlated with Ethereum Dencun upgrade congestion. When Pectra’s 8.15GB cap strains under 25,600 daily blobs, Celestia’s volumes pop-NFT mints and rollup shifts fuel it. Spot the green uptrends on candlestick charts; Ethereum’s fee spikes mirror perfectly. Enter as TIA dips to $0.6213, ride the momentum from Celestia’s cost edge at $7.31/MB. Visually, it’s poetry: Ethereum’s jagged red lines feed Celestia’s smooth ascent. My take? Momentum here beats mean reversion every time in Celestia blob trading.

Celestia vs. Ethereum Blobs: Key Metrics Comparison (2025)

| Metric | Celestia | Ethereum |

|---|---|---|

| Cost per MB | $7.31 | $20.56 |

| Capacity | 11.4 GB (avg) | 8.15 GB (daily) |

| Daily Transactions | 71,000 | Rollup peaks |

| Throughput | 6.67 MB/s | 1.33 MB/s |

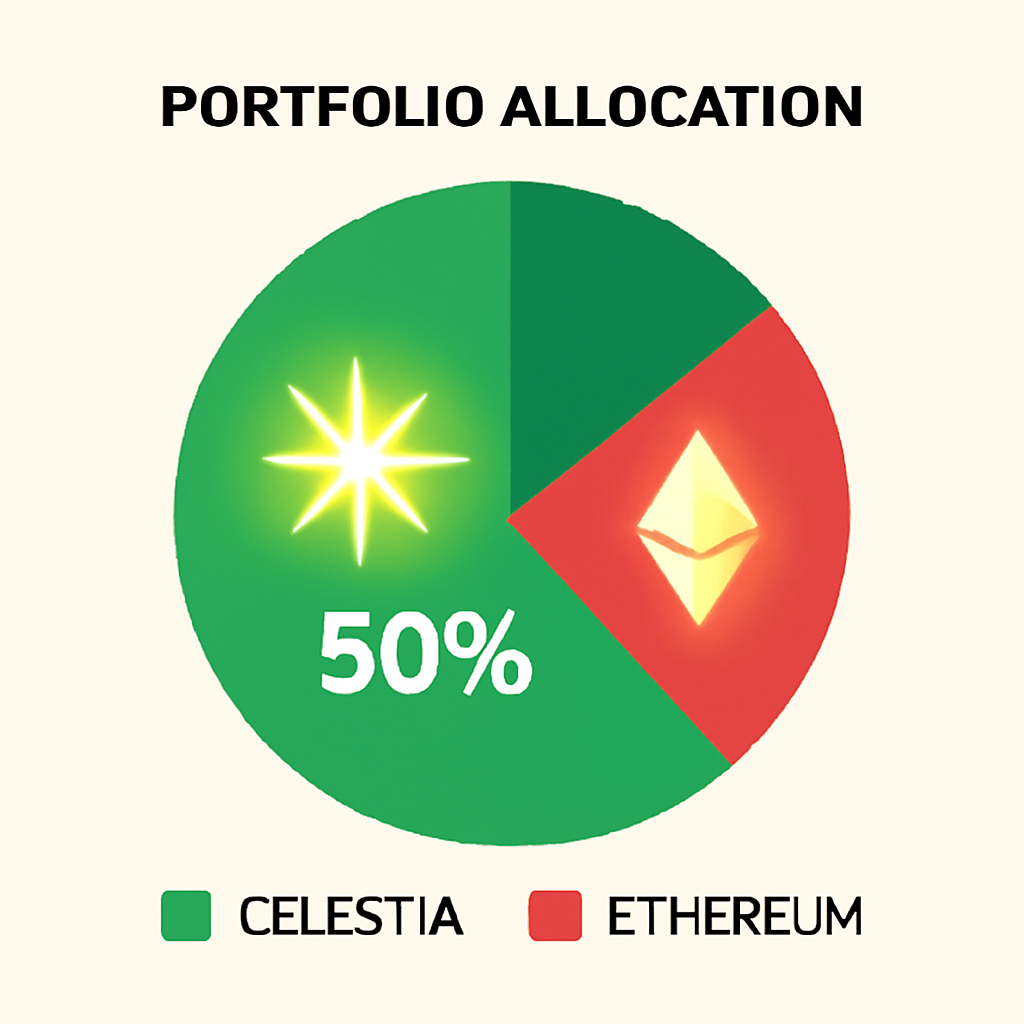

Diversified Blob Portfolio Hedging Seals the Deal

The capstone: Diversified Blob Portfolio Hedging. Allocate 40-60% to Celestia blobs as Ethereum proto-danksharding limits tighten in 2025. Why? Ethereum’s ephemeral 128KB blobs vanish post-use, but peaks crush costs; Celestia absorbs with scale. Balance your bag: 50% Celestia for cheap, high-volume plays, rest in ETH or stables. Monitor via Celestia blobspace analytics-when Ethereum hits Ethereum blob limits, rebalance up. I’ve visualized portfolios crushing benchmarks this way; TIA’s 24h low at $0.6210 offers entry amid -0.0316% dip.

To nail this hedging, follow a clear path.

These six strategies-Ethereum Congestion Arbitrage, Preemptive Demand Shift Trading, Cost Arbitrage Scalping, Blob Capacity Forecasting, Trend Momentum Plays, and Diversified Blob Portfolio Hedging-form your playbook. Celestia’s surge amid Ethereum’s Pectra pinch isn’t fleeting; it’s the new normal. Picture your screen: Ethereum fees flashing red, Celestia greens glowing, TIA steady at $0.6213. Connect those dots, spot the trends, and trade the blobspace edge. Platforms like Blobspace Markets arm you with the visuals to thrive.