Celestia Hits 6 Blobs Per Block Record: Trading Signals for Blobspace Markets

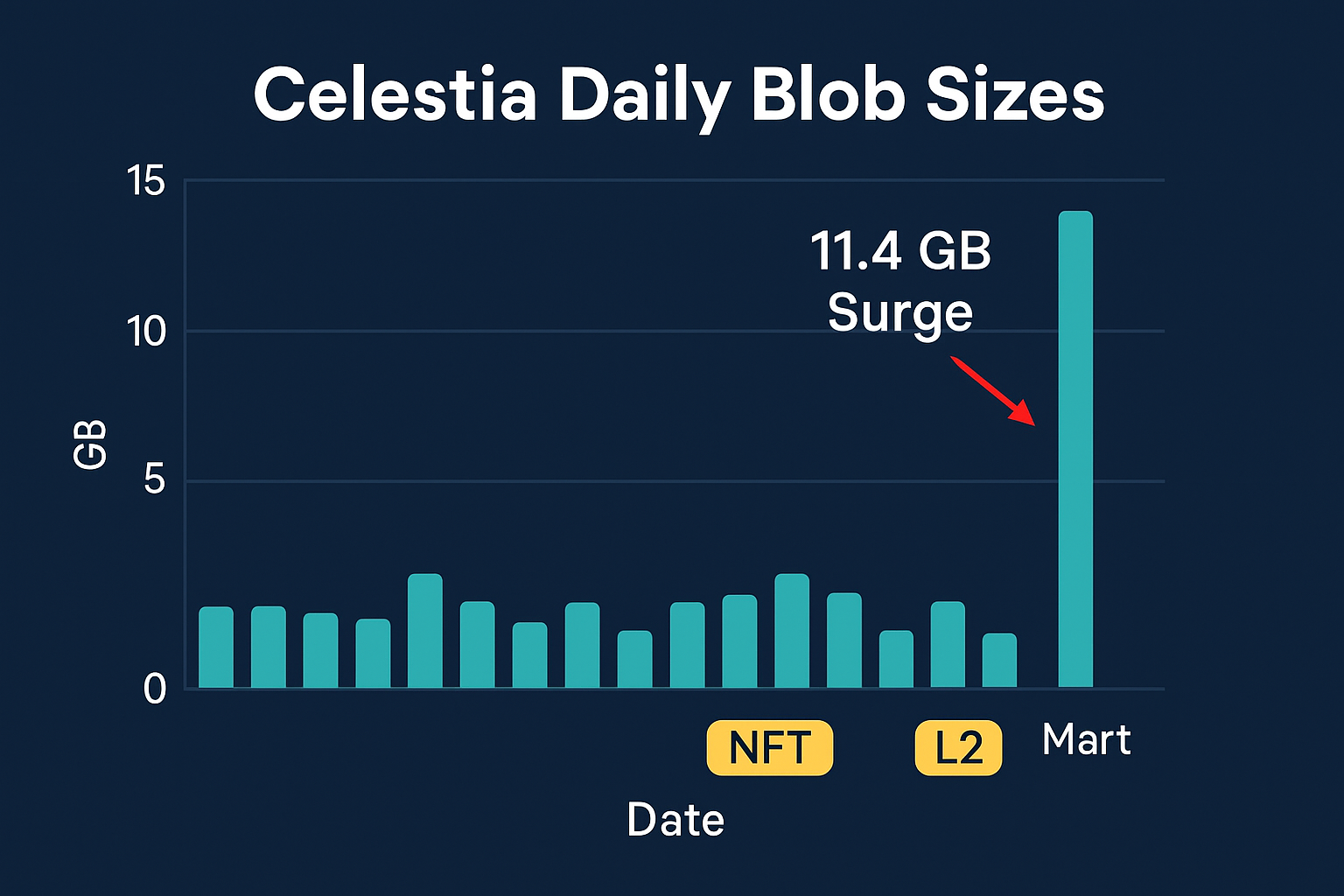

Celestia has shattered expectations by consistently hitting 6 blobs per block, a milestone that underscores its maturing role as the premier data availability layer in the blockchain ecosystem. With TIA trading at $0.6437, up $0.0287 or 0.0467% over the last 24 hours, this Celestia blob usage record signals surging demand in the blobspace markets. Daily blob sizes have ballooned nearly tenfold to 11.4 GB in recent weeks, fueled by NFT minting frenzies and fresh integrations like Eclipse and the RARI chain.

This isn’t just a numbers game; it’s a structural shift. Average daily transactions have climbed over 60% to 71,000, pushing blob fees past $2,000 routinely. Staking remains robust at 64% of TIA supply, hinting at sustained confidence amid volatility. For traders eyeing blob pricing trends 2025, these metrics scream opportunity, but only if you dissect them methodically.

The Mechanics of Celestia’s 6-Blob Milestone

At its core, Celestia’s block structure accommodates up to 8 MB post-Ginger upgrade, outpacing rivals like Ethereum’s EIP-4844 blobs. Hitting 6 blobs per block means real-world throughput is testing those limits, with excess demand amplifying fees nonlinearly. Think of it as a feedback loop: more blobs today beget steeper costs tomorrow, creating predictable volatility in Celestia data blob markets.

Between June and December 2024, average blob size hovered at 1.18 GB. Now? A staggering 11.4 GB surge in the past two weeks alone.

This escalation ties directly to Layer 2 adoption. Projects like Eclipse leverage Celestia for cheaper, scalable data posting, sidestepping Ethereum’s congested blob market where Pectra’s 6-blob target feels aspirational. Celestia’s edge lies in its modular design: block producers bundle blobs from multiple rollups efficiently, minimizing waste.

Unpacking Demand Drivers and Fee Dynamics

NFT activity has been the spark. Minting booms require massive, cheap data availability, and Celestia delivers. Add Eclipse’s SVM-compatible chain and RARI’s creative push, and you’ve got a perfect storm. Daily fees topping $2,000 reflect this; they’re not noise but a barometer for blobspace trading signals.

Yet, discipline is key. With 64% staking, TIA’s supply dynamics favor holders over speculators. Monitor on-chain volume via Celestia Explorer or Blobspace Markets’ dashboard, cross-reference with TradingView charts. Blob size and txn count are your anchors; ignore them at your peril.

Fees spike when utilization nears capacity, as seen in the Blob Data Leaderboard ranking namespaces by volume and cost. High median blob fees signal short-term tops, while volume uptrends foreshadow rallies. Pair this with TIA at $0.6437 – its 24-hour high of $0.6613 and low of $0.6084 show resilience.

Celestia (TIA) Price Prediction 2026-2031

Short-term to medium-term forecasts based on surging blob usage, 6 blobs/block milestone, rising fees, and modular DA adoption trends

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2026 | $0.85 | $2.90 | $7.20 |

| 2027 | $1.60 | $5.60 | $13.50 |

| 2028 | $2.40 | $10.20 | $24.00 |

| 2029 | $3.80 | $16.00 | $36.00 |

| 2030 | $5.50 | $23.00 | $52.00 |

| 2031 | $7.50 | $32.00 | $68.00 |

Price Prediction Summary

Celestia (TIA) is positioned for robust growth from its current $0.64 level, driven by 10x blob size surges, daily fees over $2,000, and high staking (64%). Average prices could 50x by 2031 in bullish adoption scenarios, with min/max reflecting bearish regulatory risks and optimistic L2 integrations amid crypto cycles.

Key Factors Affecting Celestia Price

- Surging blob transaction volume and sizes (11.4 GB avg recently, up 10x)

- Milestone of 6 blobs/block from NFT minting and projects like Eclipse/RARI

- Elevated blob fees ($2,000+ daily) boosting revenue

- 64% TIA staking enhancing network security

- Ginger upgrade enabling 8 MB/block capacity

- Competition from Ethereum blobs/Avail and regulatory developments

- Crypto market cycles, Bitcoin halvings, and modular blockchain adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Strategic Trading Signals from the Surge

For blobspace trading signals, focus on fee momentum. Daily fees over $2,000 correlate with TIA bounces; watch for stagnation as a fade cue. Staking flows at 64% bolster price floors, but unstaking waves could pressure $0.6437. Layer this with blobspace analytics: namespaces dominating volume often precede broader rallies.

Consider position sizing conservatively. The Ginger upgrade’s 8 MB cap provides headroom, but tipping points loom if L2s average beyond 5.4 blobs/block as Q4 data suggests. Tools like Blobspace Markets’ real-time dashboard reveal these edges. For deeper tactics, check our guide to trading Celestia data blobs.

That said, overreliance on momentum ignores Celestia’s unique risks. Blob fee volatility can whipsaw positions if L2 demand ebbs, as seen in prior cycles where averages dipped below 4 blobs per block. Pair TIA’s current $0.6437 price with staking metrics: 64% locked supply dampens downside, but validator exits could test the 24-hour low of $0.6084. Savvy traders hedge with correlated assets or options, preserving capital for sustained uptrends.

Key Metrics for Blobspace Decision-Making

Distilling data into actionable insights separates winners from speculators in Celestia data blob markets. Track these pillars: blob count per block, average size, fee revenue, and namespace dominance. The recent Celestia 6 blobs per block record isn’t isolated; it’s part of a trajectory where Q4 L2 averages hit 5.4, per industry observers. Cross-verify via Celestia Explorer for raw tx volume and Blockworks’ leaderboard for fee leaders.

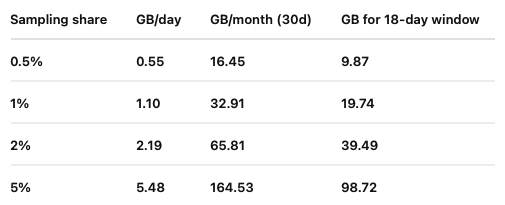

This table underscores the interplay: surging sizes amplify fees nonlinearly, rewarding early entrants. When blobs exceed 6 consistently, expect TIA support near $0.6437 as stakers reinforce floors. Conversely, sub-5 averages signal caution, potentially revisiting $0.6084 lows.

Benchmarking Against Ethereum’s Blob Evolution

Celestia’s lead shines brighter against Ethereum. Post-Pectra, Ethereum targets 6 blobs per block with a 9-blob ceiling, yet utilization lags due to higher costs and beacon chain frictions. Celestia block producers streamline multi-rollup bundling, hitting 6 blobs organically via Eclipse and RARI. Daily GB throughput at 11.4 dwarfs Ethereum’s blob market, where submission tx fees create bottlenecks. For blob pricing trends 2025, this gap favors Celestia: modular DA scales without mainnet drag, drawing more L2s.

L2s averaged 4.4 blobs/block pre-Q4; now 5.4, with 6 as the new norm. Excess demand accelerates fees exponentially.

Traders should weight this divergence. Ethereum’s blob fees, tied to consensus layer dynamics, spike erratically; Celestia’s prove steadier, correlating tighter with TIA at $0.6437. Use TradingView overlays of blob volume against price for confluence. Namespaces topping volume charts often presage 10-20% TIA moves, based on historical patterns.

Looking ahead, the Ginger upgrade’s 8 MB capacity buys time, but sustained 6 and blobs/block tests resilience. NFT mints may cool, yet RARI and Eclipse signal enduring L2 momentum. Staking at 64% anchors supply, while $2,000 and fees fund validators, perpetuating the flywheel. Position for asymmetry: dips to $0.6084 offer entries, with $0.6613 highs as upside beacons. Blobspace Markets’ tools, from dashboards to explorers, equip you to navigate this dynamism profitably.

In a crowded DA landscape, Celestia’s blobspace trading signals stand out for their clarity. Methodical analysis of these surges positions disciplined investors for sustainable gains, turning raw throughput into portfolio alpha.