How to Hedge Blob Fee Volatility for Merchants on Celestia and EIP-4844 Chains

Since the launch of EIP-4844, merchants transacting on Celestia and Ethereum have faced a new and complex challenge: unpredictable blob data fees. The introduction of blob-based data availability has brought much-needed scalability, but it has also created a volatile fee market that can rapidly erode merchant margins, especially during periods of network congestion. Recent events, such as the June 2024 blob contention spike, have shown that blob base fees can surge past traditional calldata costs, forcing merchants to rethink risk management around transaction expenses. As Celestia continues to offer data availability at a 64% discount compared to Ethereum blobs (conduit.xyz), the need for robust blob fee hedging is more urgent than ever.

Blob Fee Volatility: The New Cost Center for Onchain Merchants

Blob fees are now a critical variable expense for merchants leveraging Layer 2 solutions and data availability protocols. Unlike traditional gas fees, blob prices fluctuate based on block demand, with base fees adjusting dynamically as the number of blobs per block rises or falls. This volatility introduces significant uncertainty for merchant operations, especially those processing high transaction volumes or operating on thin margins. According to Blocknative’s analysis, even brief periods of blob congestion can result in fee spikes that disrupt business models and customer experience.

Three Actionable Strategies to Hedge Blob Fee Volatility

To navigate this new landscape, merchants must adopt proactive strategies that go beyond simple fee monitoring. Below are three actionable approaches tailored for Celestia and EIP-4844-enabled chains, each designed to reduce exposure to unpredictable blob fee swings while maintaining operational efficiency.

Top Strategies to Hedge Blob Fee Volatility

-

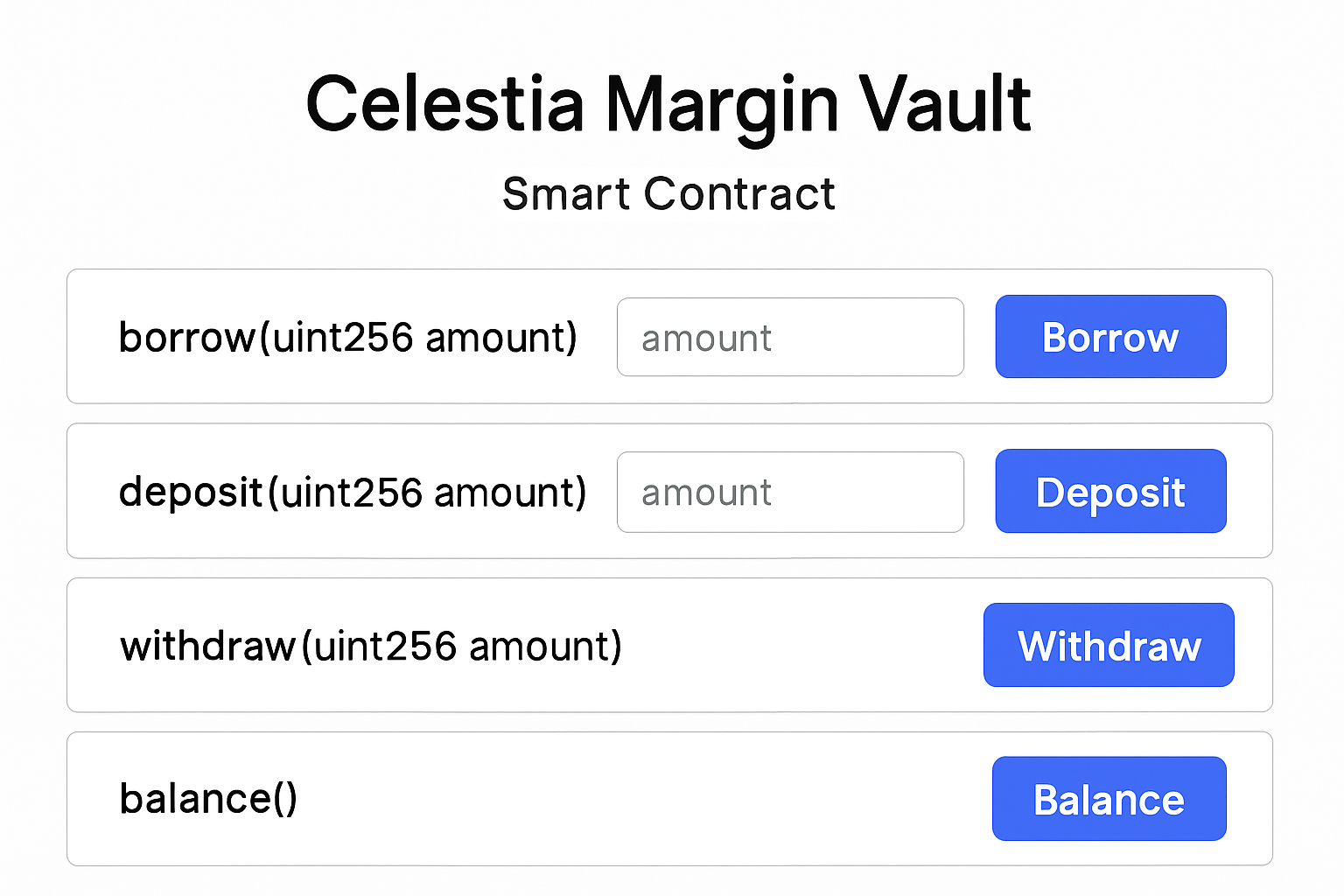

Implement Blob Fee Margin Vaults: Set up smart contract-based margin vaults that automatically accumulate and manage a buffer of native tokens (such as TIA on Celestia or ETH on Ethereum) to cover sudden increases in blob fees. These vaults can leverage historical blob fee data to dynamically adjust reserve levels, helping merchants remain protected from short-term volatility while optimizing capital efficiency.

-

Adopt Dynamic Fee Sharing Mechanisms: Integrate dynamic fee sharing into merchant checkout flows, transparently splitting the blob data fee between the merchant and customer based on real-time market rates. This strategy allows merchants to pass a portion of unpredictable costs to users during high volatility, smoothing out profit margins and providing clear communication on fee composition.

-

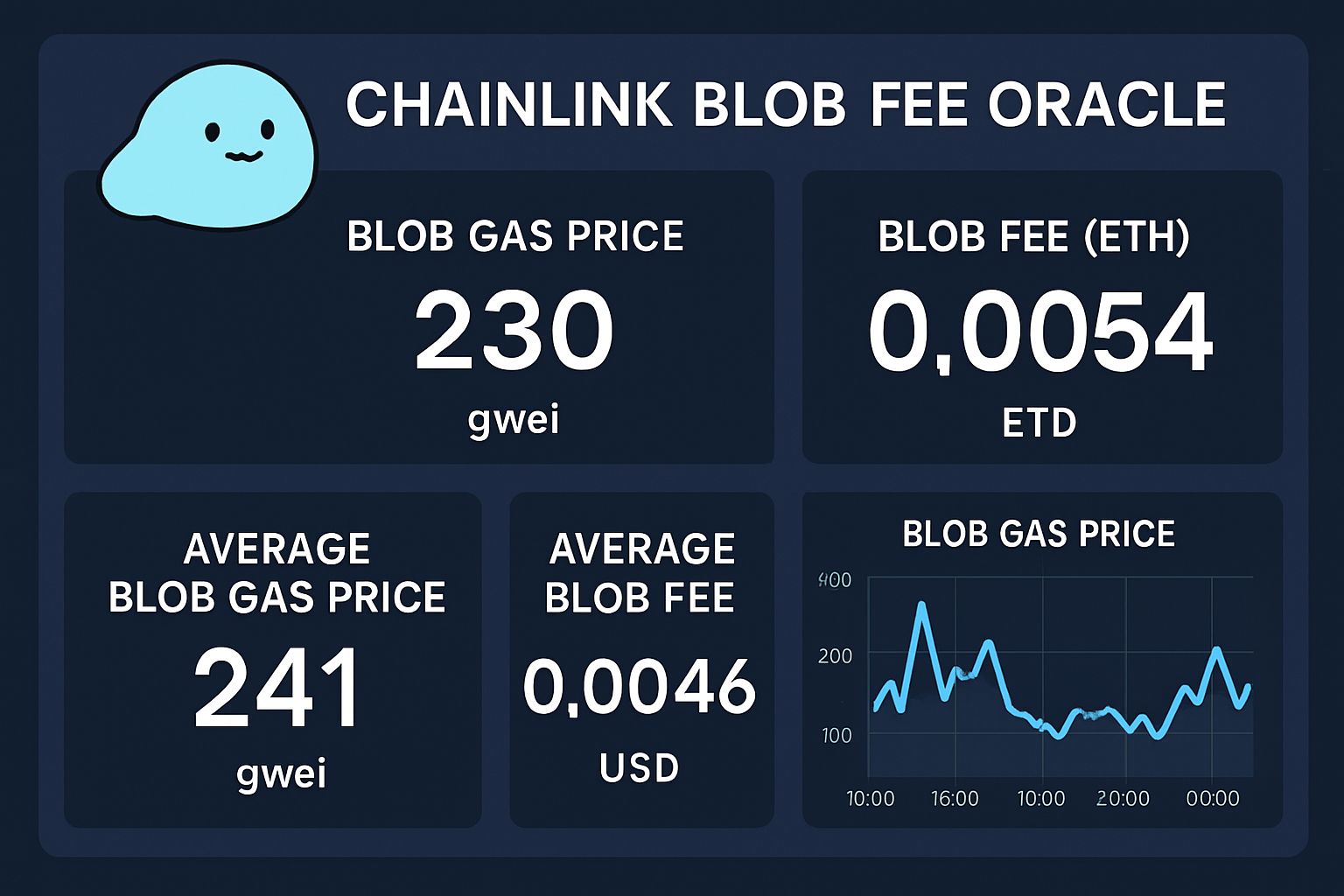

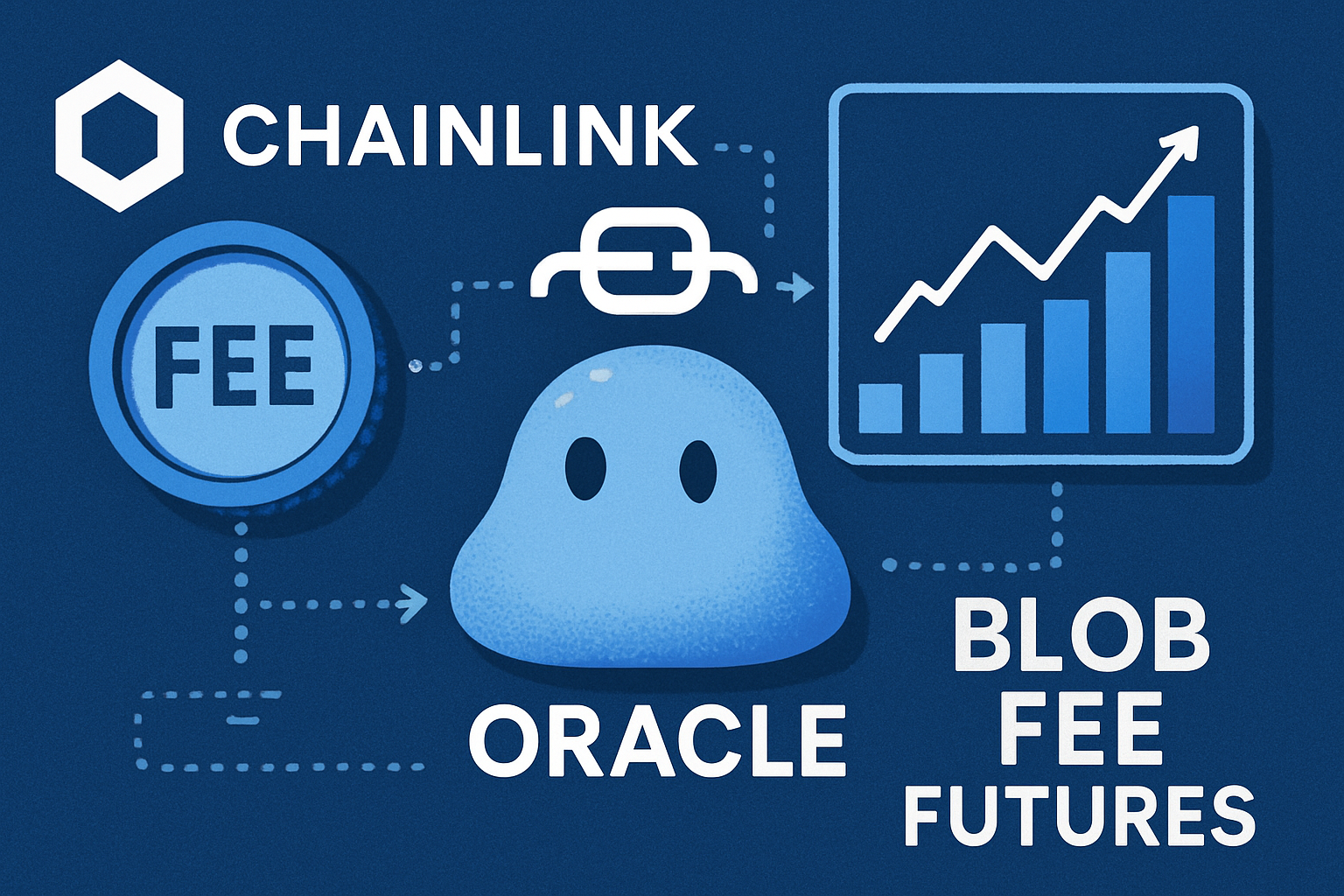

Leverage Onchain Blob Fee Oracles and Hedging Derivatives: Utilize decentralized oracles (such as Chainlink) that publish up-to-date blob fee indices, combined with onchain derivatives (like futures or options on blob fees). Merchants can lock in future blob costs or hedge exposure by taking positions in these markets, reducing risk from unexpected price swings and improving cost predictability.

1. Implement Blob Fee Margin Vaults

Blob Fee Margin Vaults are smart contract-based reserves that automatically accumulate and manage a buffer of native tokens (such as TIA or ETH) to cover sudden increases in blob fees. These vaults use historical blob fee data and predictive analytics to dynamically adjust reserve levels, ensuring that merchants are protected from short-term fee volatility without overcommitting capital. By automating this process, margin vaults reduce manual intervention and provide a safety net during periods of market turbulence.

For example, if average blob fees on Celestia spike above $7.31 per MB (the current average), the vault can temporarily increase its reserve threshold, drawing from recent transaction revenues to top up the buffer. This approach not only smooths out cost shocks but also enables merchants to maintain predictable checkout experiences for their customers.

2. Adopt Dynamic Fee Sharing Mechanisms

Dynamic fee sharing allows merchants to transparently split the real-time blob data fee with customers at checkout. By integrating this mechanism into onchain merchant flows, businesses can pass a portion of unpredictable costs to users during periods of high volatility, protecting profit margins and increasing transparency around transaction pricing.

For instance, when blob fees surge due to increased network activity, the checkout interface can display the current fee composition and automatically adjust the merchant-customer split based on pre-set rules or user preferences. This not only helps merchants manage cost risk but also educates customers about the underlying economics of blockchain data availability.

Leveraging Onchain Oracles and Derivatives for Predictable Blob Costs

Real-time risk management in blob markets is incomplete without access to reliable price feeds and financial instruments that allow merchants to hedge exposure. This is where onchain blob fee oracles and derivatives come into play.

Decentralized oracles publish up-to-date blob fee indices directly onchain, enabling merchants to programmatically monitor market rates and trigger automated hedging actions. By combining these indices with onchain derivatives such as blob fee futures or options, merchants can lock in future blob costs or offset risk from unexpected price swings. These instruments function similarly to commodity hedging strategies in traditional markets, providing merchants with cost predictability and a new layer of financial control in the emerging blobspace ecosystem.

For merchants, the integration of blob fee oracles and derivatives is not just a technical upgrade, but a strategic imperative. With the ability to reference real-time blob fee data, such as the current Celestia average of $7.31 per MB: merchants can set automated triggers for hedging actions. For example, if the oracle signals a spike above this threshold, smart contracts can initiate the purchase of blob fee futures to lock in rates for upcoming transactions. This reduces the risk of margin erosion from sudden market moves and turns blob fee volatility from an operational hazard into a managed exposure.

It’s important to recognize that these strategies are most effective when combined. Blob Fee Margin Vaults provide an immediate buffer against short-term volatility, Dynamic Fee Sharing Mechanisms align merchant and customer incentives during turbulent periods, and Onchain Oracles with hedging derivatives enable longer-term planning and risk transfer. Together, they form a robust toolkit for any merchant serious about thriving in the post-EIP-4844 landscape.

Operationalizing Blob Fee Hedging: Best Practices

To put these strategies into practice, merchants should:

Top Strategies to Hedge Blob Fee Volatility

-

Implement Blob Fee Margin Vaults: Set up smart contract-based margin vaults that automatically accumulate and manage a buffer of native tokens (such as TIA on Celestia or ETH on Ethereum) to cover sudden increases in blob fees. These vaults utilize historical blob fee data to dynamically adjust reserve levels, ensuring merchants are protected from short-term volatility while maintaining capital efficiency. Platforms like Celestia and Ethereum support such vault implementations via open-source smart contract frameworks.

-

Adopt Dynamic Fee Sharing Mechanisms: Integrate dynamic fee sharing into merchant checkout flows, transparently splitting the blob data fee between the merchant and customer based on real-time market rates. This approach lets merchants pass a portion of unpredictable costs to users during periods of high volatility, smoothing profit margins and providing clear communication on fee composition. Solutions like Stripe for crypto and Checkout.com can be integrated with custom logic for dynamic fee sharing.

-

Leverage Onchain Blob Fee Oracles and Hedging Derivatives: Utilize decentralized oracles that publish up-to-date blob fee indices, combined with onchain derivatives (such as futures or options on blob fees). Merchants can lock in future blob costs or hedge exposure by taking positions in these markets, reducing risk from unexpected price swings and improving cost predictability. Projects like Chainlink for oracles and Synthetix for derivatives provide infrastructure to support these strategies.

• Regularly analyze historical blob fee data to calibrate margin vault thresholds, ensuring buffers reflect both routine and extreme market conditions.

• Integrate real-time blob fee APIs and oracles into checkout flows for transparent, automated dynamic fee sharing with customers.

• Develop or participate in onchain markets for blob fee derivatives to hedge large or recurring data posting needs.

Additionally, merchants should monitor developments in the data availability landscape. Celestia’s cost advantage, currently at $7.31 per MB, 64% cheaper than Ethereum blobs, may shift as new protocols enter the market or as demand patterns evolve (conduit.xyz). Staying agile and updating hedging strategies in response to current market data is critical.

Summary Table: Comparing Blob Fee Hedging Strategies

Comparison of Blob Fee Hedging Strategies for Merchants on Celestia and EIP-4844 Chains

| Strategy | How It Works | Advantages | Potential Drawbacks | Best Suited For |

|---|---|---|---|---|

| Blob Fee Margin Vaults | Smart contract vaults automatically accumulate and manage a buffer of native tokens (TIA or ETH) to cover sudden blob fee spikes, adjusting reserves based on historical fee data. | Protects against short-term volatility; maintains capital efficiency; automated management. | Requires upfront capital; smart contract risk; may underperform in prolonged high volatility. | Merchants with predictable transaction volumes seeking automated protection. |

| Dynamic Fee Sharing | Checkout systems split blob data fees in real time between merchant and customer, based on current market rates; fee composition is transparently communicated. | Shares volatility risk; improves margin stability; transparent to users. | Potential customer pushback; complexity in checkout UX; may reduce competitiveness. | Merchants with flexible pricing models and price-sensitive customers. |

| Onchain Oracles & Derivatives | Use decentralized oracles for blob fee indices and onchain derivatives (futures/options) to hedge or lock in future blob fee costs. | Enables precise hedging; reduces exposure to unpredictable fees; improves cost predictability. | Requires access to liquid derivative markets; potential oracle risk; may involve additional fees. | Sophisticated merchants with risk management expertise and larger transaction volumes. |

Merchants who operationalize these approaches can transform unpredictable blob fees from a source of risk into a lever for competitive advantage. As the Celestia and EIP-4844 ecosystems mature, expect further innovation in both the tools available for hedging and the sophistication of merchant strategies. Staying proactive is essential: those who master blob fee risk management today will be best positioned to capture tomorrow’s onchain commerce opportunities.