How the Celestia Fusaka Upgrade Impacts Blob Capacity and Ethereum Scaling

Ethereum’s highly anticipated Fusaka Upgrade is set to reshape the landscape of blockchain data scaling, with ripple effects across the Celestia blobspace ecosystem and Layer 2 (L2) rollups. As the market watches Ethereum (ETH) currently trading at $4,036.45, the focus has shifted from price action alone to the underlying technical upgrades driving future growth. Let’s break down what makes Fusaka a pivotal moment for blob capacity, L2 economics, and Celestia’s role in this new paradigm.

What Is the Celestia Fusaka Upgrade and Why Does It Matter?

The Fusaka Upgrade, scheduled for December 3,2025, isn’t just another protocol tweak. It’s a coordinated release that aims to double Ethereum’s blob capacity while introducing PeerDAS (Peer Data Availability Sampling), a game-changing technology for data verification. In concrete terms:

- BPO1 Fork (December 17,2025): Raises per-block blob limits from 6/9 (target/max) to 10/15.

- BPO2 Fork (January 7,2026): Further increases limits to 14/21 blobs per block.

Blobs are large data packets that L2 solutions use to batch transactions off-chain. By expanding this capacity, Fusaka directly addresses congestion and cost issues that have held back L2 adoption. VanEck analysts have highlighted how these changes let Ethereum nodes verify blocks using probabilistic sampling instead of full downloads – a critical step toward elastic scaling (source).

PeerDAS: Unleashing Efficient Blob Verification

At the heart of the Fusaka Upgrade is PeerDAS (EIP-7594), which allows validator nodes to check data availability by sampling small portions of blobs rather than downloading entire datasets. This leap in efficiency means:

- Lower bandwidth and storage requirements for nodes

- Higher throughput without compromising security

- Greater scalability for L2 rollups like those leveraging Celestia data blobs

For developers and traders tracking Celestia blob capacity, this is more than an incremental improvement. Projections suggest Ethereum could process up to 12,000 transactions per second by 2026, compared to today’s much lower throughput (source). This scalability is crucial for supporting everything from DeFi protocols to NFT marketplaces relying on fast, affordable transactions.

Ethereum (ETH) Price Prediction Post-Fusaka Upgrade (2026-2031)

Professional ETH price outlook factoring in Fusaka’s scalability impact, L2 adoption, and evolving crypto market trends.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,600 | $4,800 | $6,200 | +18.9% | Initial post-upgrade adoption drives L2 growth; volatility from regulatory clarity and macro trends. |

| 2027 | $4,200 | $5,650 | $7,500 | +17.7% | Sustained L2 expansion and DeFi/NFT rebound; competitive L1 chains increase pressure. |

| 2028 | $4,800 | $6,300 | $8,900 | +11.5% | Broader institutional adoption; ETH as core Web3 infrastructure, but potential for market corrections. |

| 2029 | $5,200 | $7,000 | $10,500 | +11.1% | Ethereum solidifies role in global finance; regulatory headwinds and tech advancements shape ceiling. |

| 2030 | $5,700 | $7,850 | $12,800 | +12.1% | Next wave of blockchain applications, improved scalability; market cycles and competition influence sentiment. |

| 2031 | $6,200 | $8,900 | $15,000 | +13.4% | Mature L2 ecosystem, ETH as settlement layer; bullish case: mainstream finance integration, bearish: global regulation. |

Price Prediction Summary

Ethereum’s price outlook post-Fusaka upgrade is optimistic, with strong scalability improvements supporting L2 growth and mainstream adoption. While ETH benefits from technological leadership and network effects, price action remains sensitive to broader crypto cycles, regulatory shifts, and competition from alternative blockchains. The average price trend shows steady annual growth, with upside potential if Ethereum captures more of the global financial infrastructure.

Key Factors Affecting Ethereum Price

- Fusaka and PeerDAS upgrades enabling higher throughput and cheaper L2 transactions.

- Global regulatory environment for crypto assets and DeFi protocols.

- Adoption of Ethereum by institutions and traditional finance.

- Emergence of competitive L1 and L2 blockchains (e.g., Solana, Avalanche, zkSync).

- Macro-economic conditions impacting risk assets and investor appetite.

- Ongoing developer activity and ecosystem innovation (DePIN, AI, RWAs, etc.).

- Market cycles and speculative activity typical to the crypto sector.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Blobspace Market Impact: What This Means for Celestia Data Blobs and Traders

The expansion of blob capacity is poised to have a direct impact on blob trading dynamics. With more room for blobs per block and more efficient verification methods, we’re likely to see:

- Reduced transaction fees: Lower data costs make L2 rollups more attractive.

- Greater demand for Celestia data blobs: As Ethereum scales up, so does demand for off-chain data solutions.

- A surge in developer activity: New tools and tighter defenses lower the barrier to entry for building on both Ethereum and Celestia.

This shift is already being tracked by analysts at Stakely and Crypto. com, who note that Fusaka lays the foundation for future upgrades like Danksharding while making Ethereum more competitive with high-performance blockchains (source). Blob markets are expected to become more liquid as supply constraints ease and new trading strategies emerge around dynamic blob pricing.

For the Celestia community and data blob traders, these changes are more than just technical milestones. They represent a fundamental shift in how value is created and captured within the blobspace market. The ability to process more blobs per block, combined with PeerDAS’s sampling efficiency, means that Celestia data blobs can be integrated into a wider range of L2 solutions, driving both utility and speculation.

As Ethereum’s blob capacity scales up in two phases, first to 10/15 blobs per block on December 17,2025, then to 14/21 on January 7,2026, the economics of data availability will evolve rapidly. Traders should watch for:

Opportunities and Risks for Blob Traders After Fusaka

-

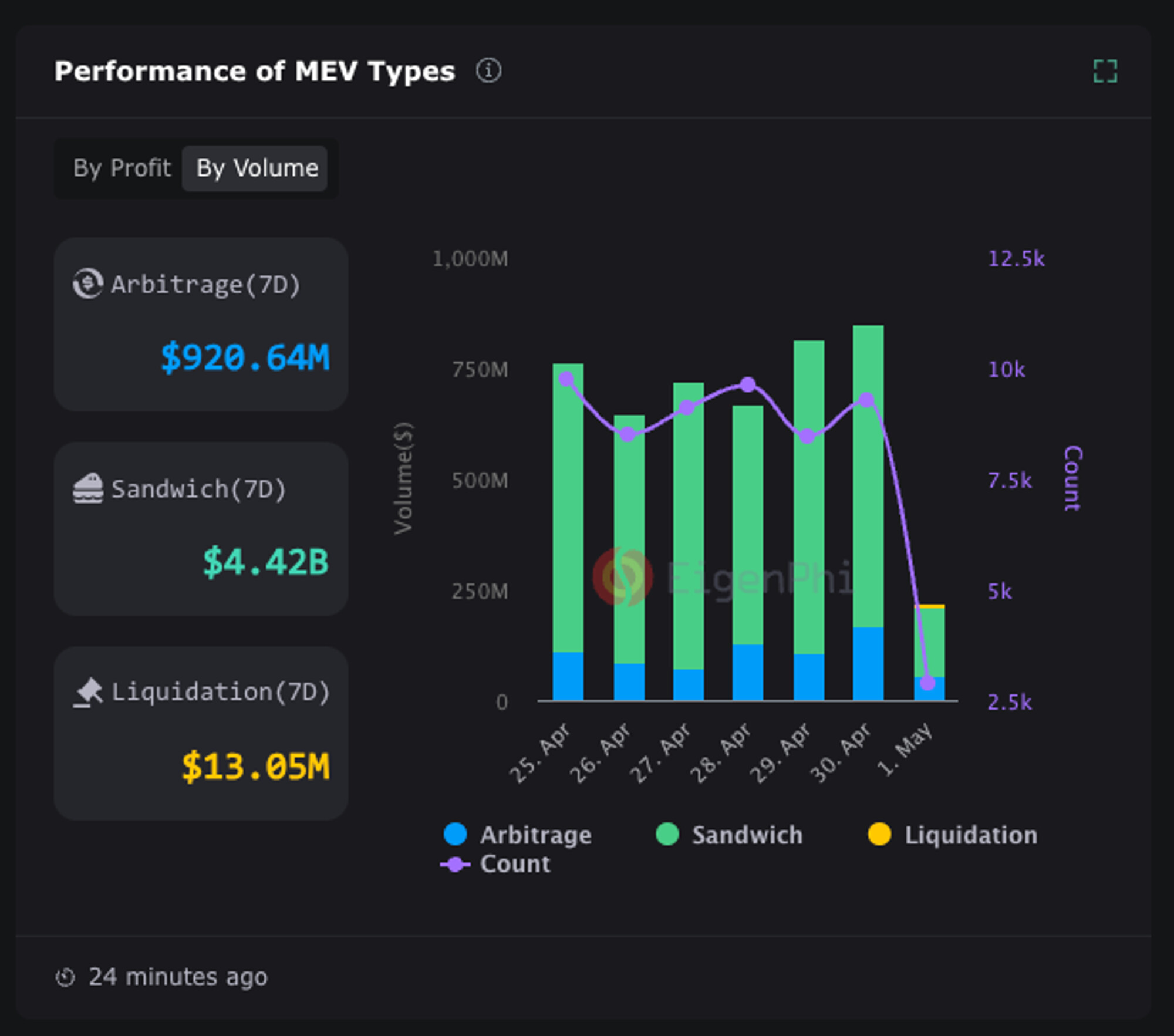

Increased Arbitrage Opportunities Across L2s: With the Fusaka upgrade doubling blob capacity, Layer 2 rollups like Arbitrum, Optimism, and zkSync can post more transaction data per block. This is likely to create more price discrepancies and arbitrage windows for blob traders as L2 throughput and liquidity increase.

-

Lower Transaction Fees, Higher Volatility: As PeerDAS and higher blob limits drive L2 transaction fees down, traders may see increased market activity and volatility on rollups, opening new trading strategies but also amplifying risk.

-

Potential for Blob Price Compression: As supply of blobs rises from 6/9 to 14/21 per block by January 2026, blob prices may fall due to increased availability, impacting profitability for traders relying on scarcity.

-

Network Congestion and MEV Risks: Higher blob capacity could attract more MEV (Maximal Extractable Value) strategies and sophisticated trading bots, leading to network congestion spikes and unpredictable execution risks for blob traders.

-

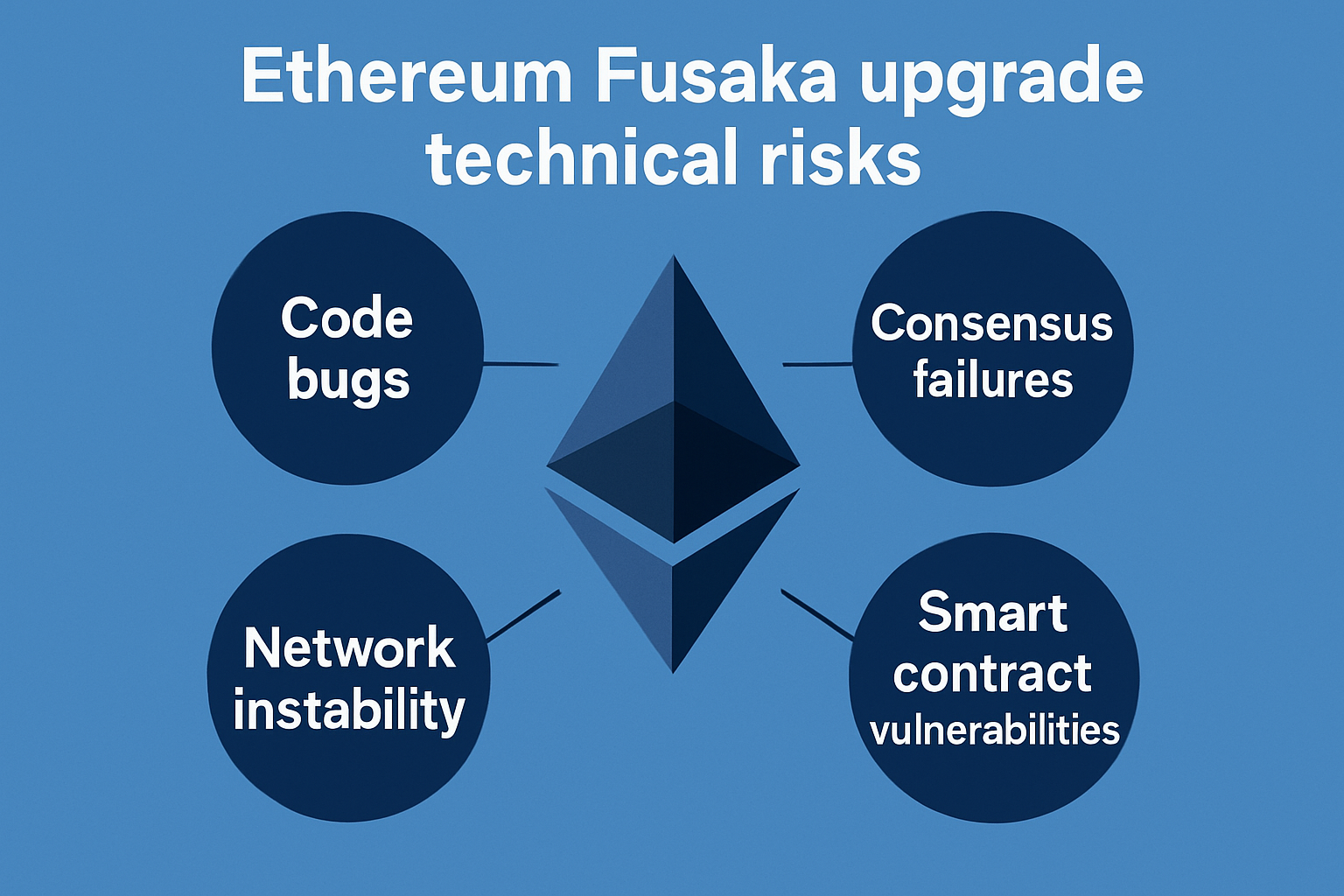

Uncertainty Around Protocol Upgrades: The phased rollout (BPO1 and BPO2) and new PeerDAS mechanism introduce technical and operational risks. Unexpected bugs or delays could impact blob market dynamics and trader positions.

While reduced fees and improved throughput are bullish signals for L2 adoption, they also introduce new competitive pressures. With the Fusaka Upgrade, Ethereum is positioning itself to rival purpose-built high-throughput blockchains, making it more attractive for developers who might otherwise have migrated to alternative ecosystems. This is especially relevant as ETH holds steady at $4,036.45, reflecting confidence in Ethereum’s long-term scaling roadmap.

What to Watch: Blobspace Market Trends and Celestia’s Next Moves

Looking ahead, the interplay between Ethereum’s on-chain upgrades and Celestia’s modular data availability layer will be a focal point for both investors and builders. As blobspace becomes less scarce, expect to see:

- Increased blob trading volumes: More blobs per block means more opportunities for arbitrage and market making.

- Dynamic blob pricing: As supply constraints ease, price discovery will become more nuanced and responsive to real-time demand.

- Innovation in L2 design: Developers will experiment with new rollup architectures that leverage expanded blobspace and PeerDAS.

For those active on Blobspace Markets, staying ahead means monitoring not just ETH price action but also the evolving liquidity and volatility in blob markets. The next six months will be pivotal as infrastructure upgrades go live and new trading patterns emerge.

If you’re building or trading in the Celestia ecosystem, now is the time to revisit your strategies. The Fusaka Upgrade’s impact on Celestia blob capacity and Ethereum scaling blobs could redefine market dynamics and open up opportunities that simply didn’t exist before.

For a deeper dive into the protocol changes and their market implications, check out the official Ethereum protocol update (source) or review the latest projections for throughput and transaction costs (source).

As always, keep your eyes on the signal, not just the noise. The Celestia Fusaka Upgrade is more than a technical update; it’s a catalyst for the next wave of blobspace innovation and trading.