How Blob Fee Spikes Impact On-Chain Trading: Mitigating Volatility in Celestia Blob Markets

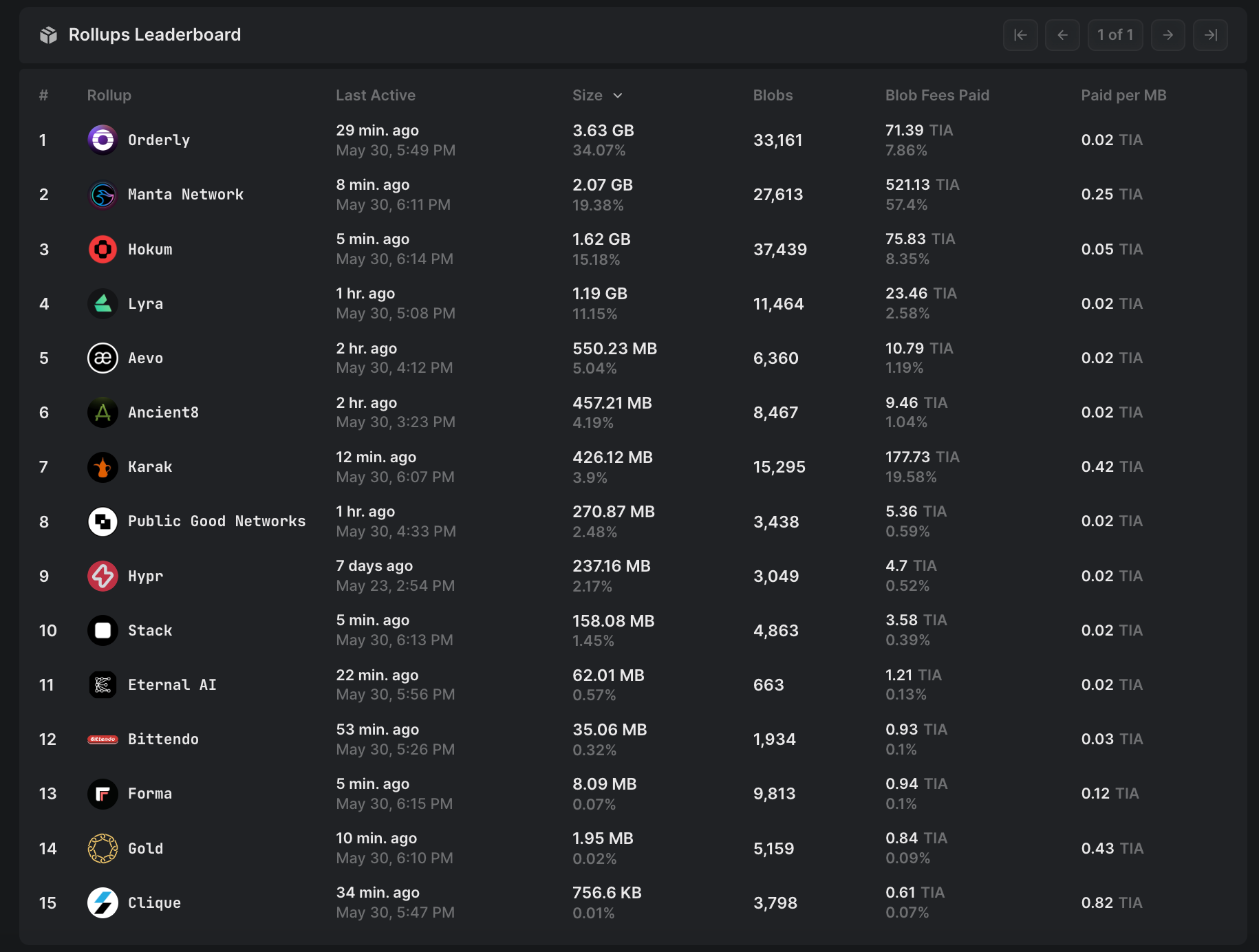

Celestia’s modular approach to data availability has rapidly reshaped the economics of on-chain trading. As NFT minting and rollup activity surge, the network’s ability to handle massive blob sizes, now averaging 11.4 GB daily, up from just 1.18 GB six months ago, has been tested in real time. The critical question for traders and developers alike: how do blob fee spikes ripple through the Celestia ecosystem, and what tools exist to mitigate volatility?

Blob Fee Spikes: Why They Matter for On-Chain Trading

Unlike legacy L1s, where transaction fees can skyrocket during periods of high demand, Celestia decouples execution from data storage via its data availability sampling (DAS) architecture. This design is engineered to absorb usage shocks, yet even here, abrupt increases in blob submissions can threaten market stability if not properly managed.

The latest data is instructive: despite a tenfold increase in average blob size and a jump in daily transactions to 71,000, Celestia’s average blob fee held steady at $0.19 per MB. In contrast, Ethereum’s corresponding cost averaged $11.14 per MB during the same period (source). This remarkable fee stability underpins efficient on-chain trading, but it also creates new dynamics for margin management, hedging strategies, and protocol design.

Mechanics Behind Blob Market Volatility

Blob market volatility is driven by several factors:

- NFT Minting Booms: Projects like Mammoth Overlord NFTs on Forma have spiked demand for data blobs, pushing total throughput higher.

- L2 Rollup Adoption: New chains such as RARI are integrating with Celestia as their DA layer, compounding network load.

- DAS Architecture: While this enables scalable sampling and lowers costs per user, extreme demand can still create temporary congestion or revert errors if not actively monitored (source).

This environment shapes both the risks and opportunities for on-chain traders. Sudden spikes in Celestia blob fee spikes, while rare so far thanks to DAS optimizations, could squeeze margins or disrupt settlement timing for protocols relying on predictable DA costs.

Mitigation Strategies: Margin Vaults and Fee Optimization

The emerging toolkit for managing blob market volatility centers around proactive monitoring and hedging:

- Blob Margin Vaults: These mechanisms allow protocols or power users to pre-fund DA costs at set thresholds, buffering against sudden fee surges.

- DAS Sampling Alerts: Real-time analytics dashboards flag usage spikes or revert errors before they impact downstream rollups (source). Early detection enables dynamic rebalancing of trading strategies.

- L2 Fee Arbitrage: As alternative DA providers like Celestia consistently undercut Ethereum’s costs by orders of magnitude, arbitrageurs can route transactions for optimal pricing, so long as they track live fee markets closely.

This multi-layered approach is critical as more DeFi derivatives and high-frequency trading strategies migrate onto modular DA networks. The goal: maintain predictable on-chain trading fees, even as underlying data volumes spike unpredictably.

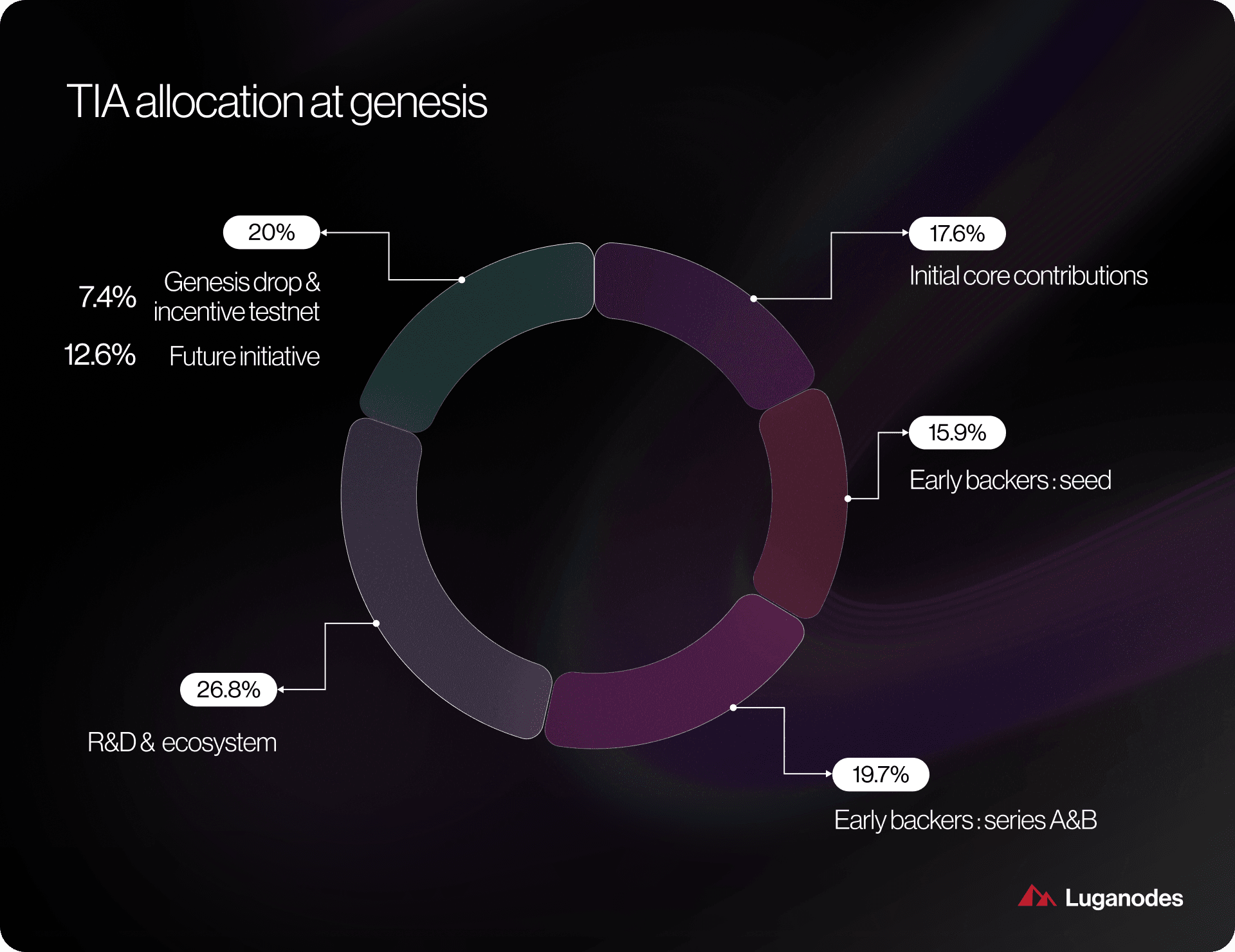

Celestia (TIA) Price Prediction 2026-2031

Professional TIA price projections based on blob market trends, tech adoption, and on-chain fee stability.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insight |

|---|---|---|---|---|---|

| 2026 | $0.95 | $1.32 | $1.80 | +25% | Adoption by major L2 rollups grows, but volatile macro environment limits upside. |

| 2027 | $1.10 | $1.58 | $2.30 | +20% | Blob market stabilization; NFT and gaming growth boost demand for Celestia DA layer. |

| 2028 | $1.30 | $1.85 | $2.95 | +17% | Broader DeFi and enterprise adoption; potential regulatory clarity begins to favor modular chains. |

| 2029 | $1.55 | $2.28 | $3.80 | +23% | Celestia solidifies as a top alternative DA provider; increased integration with zk-rollups. |

| 2030 | $1.80 | $2.70 | $4.60 | +19% | Mainstream rollup adoption and scaling, but competition from other DA solutions (EigenDA, Avail) heats up. |

| 2031 | $2.00 | $3.10 | $5.50 | +15% | Celestia reaches maturity in the modular blockchain stack; long-term fee stability and ecosystem growth. |

Price Prediction Summary

Celestia (TIA) is projected to experience steady growth through 2031, driven by rising adoption as a data availability layer for rollups, NFTs, and DeFi. While volatility will persist due to broader crypto market cycles and competition, Celestia’s robust technology and stable blob fee structure position it for gradual appreciation. By 2031, TIA could trade between $2.00 and $5.50, reflecting both conservative and bullish scenarios as the modular blockchain narrative matures.

Key Factors Affecting Celestia Price

- Growth in demand for modular data availability from L2s and new blockchain projects.

- Blob fee stability and low costs relative to Ethereum and competitors.

- Adoption in NFT, gaming, and DeFi sectors driving on-chain transaction volume.

- Potential regulatory developments impacting modular blockchains and DA providers.

- Competition from other data availability solutions (EigenDA, Avail, etc.).

- Overall crypto market cycles and macroeconomic trends influencing risk appetite.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Current State of Blob Fee Volatility (2025)

The most recent reports show that blocks are now accommodating 4, 6 blobs regularly without significant price spikes, a testament to Celestia’s maturing infrastructure (see Half-Year Report 2025). Still, vigilance is required; as more projects tap into cheap DA space for everything from NFTs to DeFi margin engines, the risk of sudden congestion events remains present.

For traders and protocol architects, the playbook is evolving. The rapid expansion in blob sizes, now averaging 11.4 GB daily, demands active fee management and robust risk controls. As Celestia’s average blob fee holds at $0.19 per MB (with TIA currently priced at $1.06), the economics favor those who can anticipate and adapt to usage surges.

Key Risk Factors and Practical Mitigation

The main risk for on-chain trading desks is unanticipated fee spikes during high-impact events like NFT launches or major rollup integrations. Here’s how leading teams are staying ahead:

Practical Steps to Mitigate Celestia Blob Fee Volatility

-

Monitor Real-Time Blob Usage and Fee Analytics: Use analytics dashboards such as Blockworks and L2BEAT to track blob transaction volumes, average blob sizes, and fee trends. Staying informed helps users and rollup operators anticipate potential fee spikes and adjust strategies accordingly.

-

Leverage Data Availability Sampling (DAS) Architecture: Celestia’s DAS enables scalable and cost-efficient data verification, helping to keep blob fees stable even during periods of high network activity. Rollups and dApps should ensure they are fully integrated with DAS to benefit from these efficiencies.

-

Adopt Dynamic Fee Adjustment Mechanisms: Implement or support rollup protocols that use base fee adjustment algorithms (as discussed in Ethereum Research) to promote more predictable and balanced blob usage, discouraging extreme utilization patterns that can drive up fees.

-

Utilize Alternative Data Availability (DA) Providers: In periods of high congestion, consider posting data to alternative DA networks, such as EigenLayer or Avail, to reduce reliance on a single provider and avoid fee bottlenecks.

-

Implement Hedging Strategies for TIA Exposure: Use DeFi derivatives platforms (e.g., dYdX, Perpetual Protocol) to hedge against volatility in Celestia (TIA) prices, which can indirectly impact operational costs for on-chain trading and data posting.

1. Real-Time Monitoring: Teams are leveraging analytics dashboards to track blob submission rates, revert errors, and block utilization in real time. Early warning systems can trigger protocol-level responses before costs spiral.

2. Dynamic Fee Adjustment: Many protocols now incorporate adaptive fee logic that recalibrates DA budget allocations based on live market data, reducing the risk of margin erosion from sudden spikes in Celestia blob fee spikes.

3. Cross-DA Routing: With alternative DA layers emerging, sophisticated trading engines can reroute high-volume transactions to whichever network offers optimal pricing at that moment, a move that requires both technical flexibility and continuous market surveillance.

Hedging Blob Volatility: Options for Advanced Users

For power users, hedging blob volatility goes beyond simple monitoring:

- Blob Margin Vaults: By locking in DA costs ahead of time, users can insulate themselves from unpredictable price movements during periods of heavy network activity.

- Batched Settlement Strategies: Grouping multiple trades or data submissions into larger blobs can amortize fixed costs across more transactions, smoothing out per-trade volatility.

- L2 Rollup Coordination: Coordinating with rollup operators allows for strategic timing of data posting to avoid known congestion windows.

What’s Next for Blobspace Fee Management?

The next phase in Celestia’s evolution will likely see further innovations in automated risk controls, potentially including on-chain insurance pools or new derivatives tied directly to Celestia data blob pricing. As modular blockchain adoption accelerates, expect new primitives designed specifically for managing data availability exposure at scale.

The bottom line: as long as demand for decentralized blockspace continues its upward trajectory, proactive blobspace fee management, robust analytics, and flexible hedging tools will separate winners from the rest in this fast-evolving market.