How the Fusaka Upgrade Impacts Celestia Blobspace Capacity and Pricing

Ethereum’s Fusaka upgrade, scheduled for December 3,2025, has become a focal point in blockchain circles for its ambitious improvements to data availability and Layer 2 scalability. While Fusaka’s direct technical changes are isolated to Ethereum, the upgrade’s broader implications for modular blockchains, especially Celestia, are worth close examination. With Celestia (TIA) currently trading at $0.9943, and a 24-hour range between $0.4640 and $1.39, the market is watching closely for any ripple effects on blobspace capacity and pricing.

Fusaka Upgrade: What Changes for Data Availability?

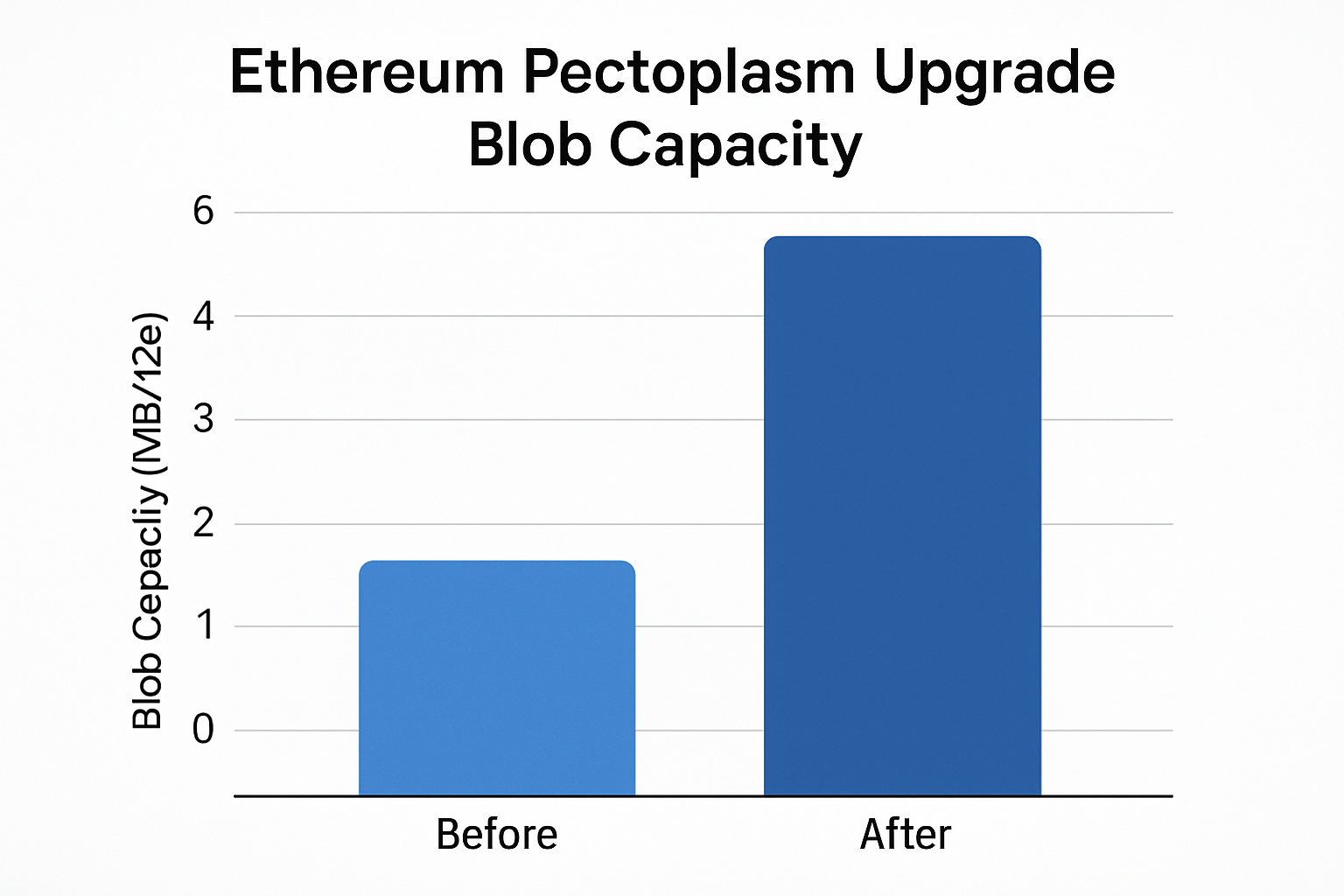

Fusaka introduces Peer Data Availability Sampling (PeerDAS) and a suite of 12 Ethereum Improvement Proposals (EIPs), each designed to increase the network’s data throughput and reduce costs for Layer 2 rollups. By raising the blob target and maximum count, Fusaka is poised to make it cheaper and more efficient for rollups to post data to Ethereum. This is expected to translate into lower transaction fees and greater throughput across the ecosystem. For context, even after the Pectra upgrade, blob fees were already low; Fusaka pushes them further down by strategically increasing available capacity.

Ethereum’s move is widely seen as a competitive response to high-performance modular blockchains like Celestia. However, it’s important to note that Celestia operates its own independent data availability layer, blobspace, where protocol parameters and market dynamics set the rules of engagement. While Fusaka sets a new benchmark for L2 efficiency on Ethereum, Celestia’s blobspace remains governed by its native consensus and pricing mechanisms.

Celestia Blobspace Capacity: Independent but Not Immune

Celestia’s blobspace capacity and pricing are not directly altered by changes on Ethereum. Instead, they are determined by Celestia’s protocol upgrades and community governance. As of today, there is no protocol-level connection that would cause Fusaka’s changes to immediately affect Celestia’s blob market. However, the competitive landscape is dynamic. Should Fusaka succeed in driving down L2 costs and boosting throughput significantly, developers may weigh the relative cost-efficiency of posting data to Ethereum versus Celestia.

The current price of Celestia (TIA) at $0.9943 reflects ongoing market speculation about its role as a leading data availability platform. Any future changes to Celestia’s blobspace capacity or pricing will stem from internal protocol decisions, not from external upgrades like Fusaka. Still, the psychological impact of Ethereum’s scaling advances could influence sentiment in the Celestia blob market.

For a snapshot of how analysts view near-term pricing dynamics:

Celestia (TIA) Price Prediction 2026-2031

Professional forecast considering latest market trends, Ethereum’s Fusaka upgrade context, and Celestia-specific fundamentals.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg. YoY) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.80 | $1.10 | $1.55 | +11% | Recovery after 2025 lows; cautious optimism as modular blockchains gain traction |

| 2027 | $0.95 | $1.38 | $2.05 | +25% | Growth accelerates with industry adoption; competition from Ethereum rollups persists |

| 2028 | $1.20 | $1.70 | $2.60 | +23% | Ecosystem matures, more dApps leverage Celestia’s blobspace; regulatory clarity improves |

| 2029 | $1.05 | $1.95 | $3.15 | +15% | Market consolidation phase; new scaling tech may pressure fees and margins |

| 2030 | $1.30 | $2.25 | $3.85 | +15% | Mainstream adoption of modular data layers; integration with cross-chain protocols |

| 2031 | $1.60 | $2.60 | $4.50 | +16% | Celestia positions as leading DA layer, but faces stiff competition and evolving tech standards |

Price Prediction Summary

Celestia (TIA) is projected to see gradual price appreciation from 2026 through 2031, with average yearly growth driven by adoption of modular blockchain architectures and increasing demand for scalable data availability layers. While the Ethereum Fusaka upgrade does not directly impact Celestia, it sets a competitive benchmark for data availability, influencing Celestia’s market positioning. The price outlook remains cautiously optimistic, with potential for significant upside if Celestia secures key partnerships and maintains technological leadership. However, competition from Ethereum and other DA solutions, as well as regulatory shifts, could introduce volatility and cap upside in bearish scenarios.

Key Factors Affecting Celestia Price

- Adoption rate of modular blockchains and demand for data availability solutions

- Impact of Ethereum upgrades (Fusaka, Danksharding) on industry standards and competition

- Regulatory developments affecting interoperability and data storage networks

- Celestia’s ecosystem growth, partnerships, and protocol upgrades

- Market sentiment and broader crypto cycles

- Technological innovation in data availability and rollup infrastructure

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Blob Pricing on Celestia: Market Forces Remain Decoupled

Blob pricing on Celestia is shaped by supply-demand dynamics within its own ecosystem. While Ethereum’s Fusaka upgrade may set new expectations for data availability costs across the industry, it does not directly modify how blobs are priced or allocated on Celestia. The protocol’s unique consensus design ensures that data blobs are priced based on network usage and validator incentives, parameters untouched by outside upgrades.

Still, cross-chain developers and projects evaluating where to post their data will be watching both ecosystems closely. If Fusaka delivers sustained lower costs on Ethereum L2s, some projects may shift their strategies, potentially impacting demand in Celestia’s blobspace over time.

Market participants should continue to monitor the evolving competitive interplay between Ethereum’s L2 rollup ecosystem and Celestia’s modular infrastructure. While the Fusaka upgrade may not directly shift Celestia’s blobspace capacity or pricing, it does set a new industry benchmark for data throughput and cost efficiency that could influence developer preferences and capital allocation in the medium term.

For Celestia, the key differentiator remains its protocol-level independence and the flexibility it offers to projects seeking scalable, decentralized data availability. The current Celestia (TIA) price of $0.9943 underscores the market’s recognition of this value proposition, even as Ethereum’s upgrades draw mainstream attention. Any significant adjustments to Celestia’s blobspace, whether in capacity, fee structure, or validator economics, will be the result of deliberate governance processes rather than external technical events.

How Developers and Analysts Are Reacting

Across forums and social channels, developers and analysts are debating whether Fusaka’s improvements will spark a migration of new projects back to Ethereum L2s or if Celestia’s modular approach will maintain its appeal. The consensus: both ecosystems are likely to coexist, with projects optimizing for their specific throughput, cost, and trust assumptions.

Celestia Blobspace vs. Ethereum Fusaka Data Availability

-

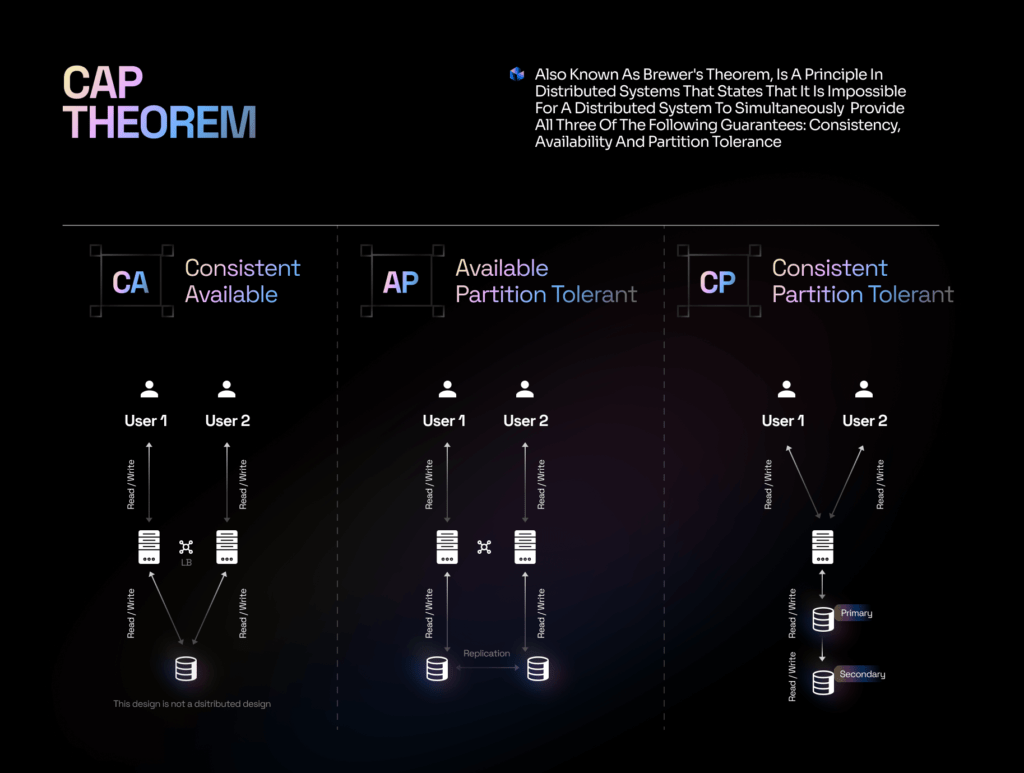

Underlying Architecture: Celestia operates as a modular blockchain with a dedicated data availability layer (blobspace), whereas Ethereum’s Fusaka upgrade enhances data availability within its monolithic Layer 1 by introducing PeerDAS and increasing blob capacity.

-

Blob Capacity and Scaling: After Fusaka, Ethereum will increase its blob target and maximum count, directly expanding data capacity for Layer 2 rollups. Celestia’s blobspace capacity, however, is set by its own protocol and is currently unaffected by Ethereum upgrades.

-

Pricing Mechanisms: Celestia’s blobspace pricing is determined by network-specific supply and demand dynamics and protocol parameters. In contrast, Ethereum’s Fusaka upgrade aims to reduce blob fees for Layer 2s, lowering transaction costs through protocol-level changes.

-

Upgrade Independence: Changes to Celestia’s blobspace (capacity or pricing) are independent of Ethereum’s roadmap. Fusaka’s impact is limited to Ethereum and does not directly alter Celestia’s protocol or economics.

-

Market Impact and Ecosystem Influence: While Fusaka’s improvements may influence industry standards for data availability, Celestia’s pricing and capacity remain determined by its own governance and technical evolution, not by Ethereum’s upgrades.

From a quantitative perspective, any impact on blob pricing on Celestia will ultimately depend on real shifts in demand, not just perceived cost competition. As of now, on-chain data shows steady utilization of Celestia’s blobspace, with no dramatic price volatility following Ethereum’s recent upgrade announcements. That said, large-scale protocol changes, such as a future Celestia upgrade or a surge in cross-chain deployments, could quickly alter this equilibrium.

For those tracking Celestia blob market impact, it’s crucial to watch not only headline protocol upgrades but also the subtle shifts in developer tooling, cross-chain integrations, and validator participation rates. These factors will shape the next phase of blob pricing and capacity trends.

Celestia Data Blobs Analytics: What to Watch Next

As the modular blockchain landscape matures, analytics around data blobs are becoming more sophisticated. Metrics such as blobspace utilization rates, average blob size, and validator participation provide real-time signals on network health and pricing pressure. With TIA at $0.9943, current analytics suggest a stable environment, but any uptick in demand from new rollup deployments or cross-chain data bridges could test existing capacity limits.

Looking ahead, market watchers should focus on:

- Upcoming Celestia governance proposals around blobspace parameters

- Trends in cross-chain data posting between Ethereum L2s and Celestia

- On-chain analytics for sudden shifts in blobspace utilization

Ultimately, while Fusaka is a milestone for Ethereum, it serves as a catalyst for innovation across all modular data availability platforms. Celestia’s independent protocol ensures that its blobspace capacity and pricing remain responsive to its own network dynamics and user demand. For now, the blob market on Celestia remains steady, but as competition heats up, both ecosystems will need to adapt to maintain their edge.