How Ethereum Blobs Impact Celestia Blobspace Markets: Pricing, Demand, and Supply Dynamics

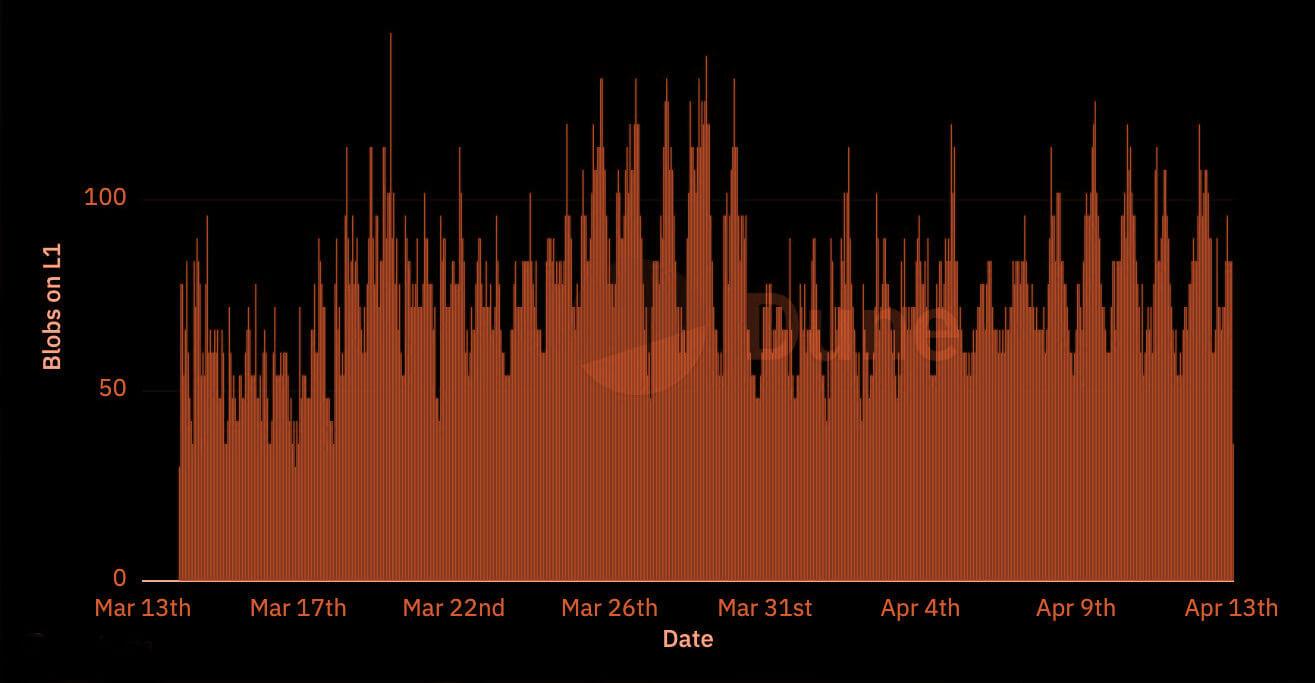

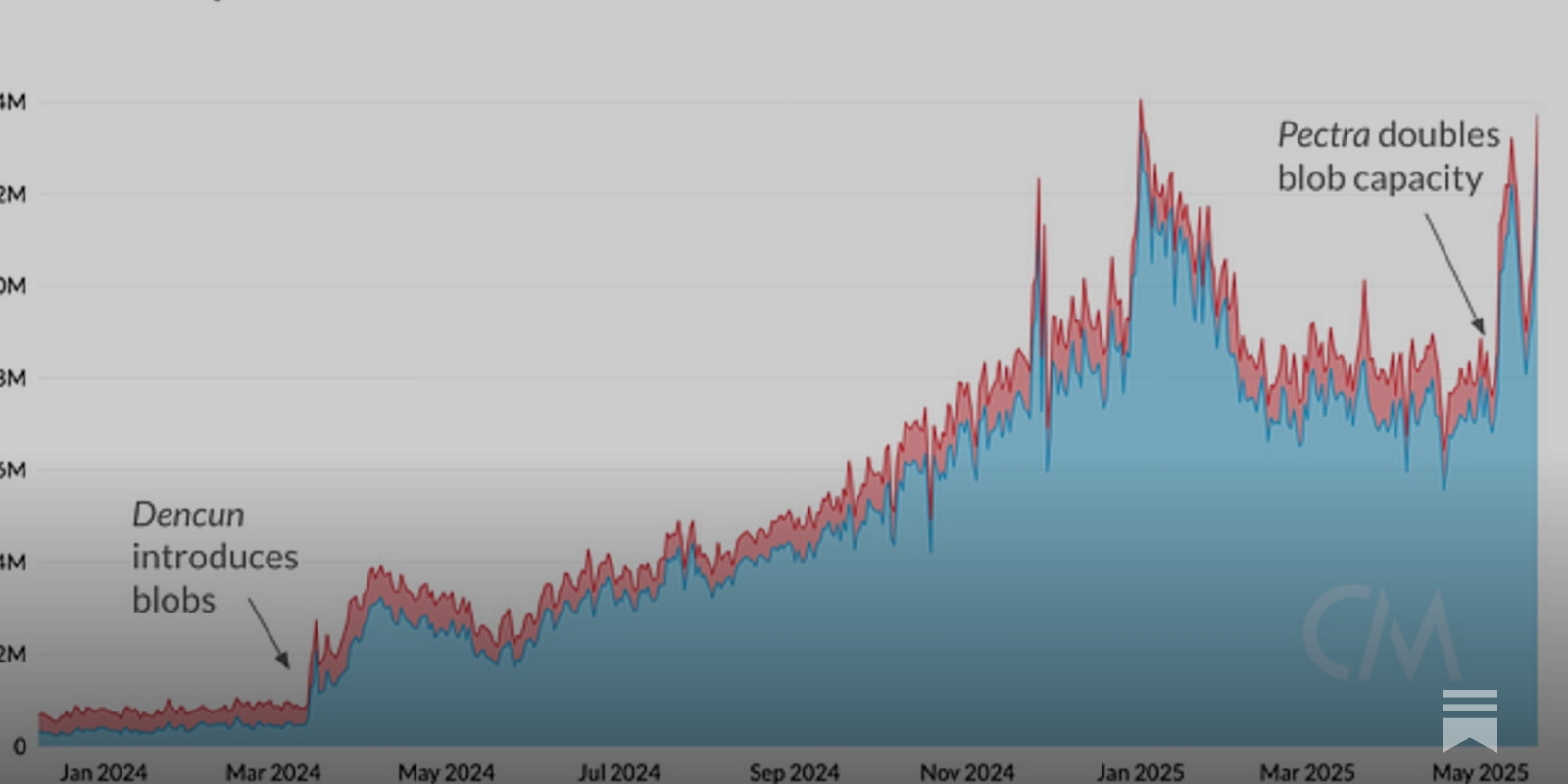

Ethereum’s recent Pectra upgrade has fundamentally shifted the competitive landscape between Ethereum blobs and Celestia in the data availability market. With the target and maximum blobs per block increased from 3/6 to 6/9, Ethereum now supports up to 8.15GB of blob data per day. This strategic move has triggered a 20.8% surge in rollup blob purchases, while simultaneously causing the average cost for rollups to plummet to less than $0.00001 per day. The implications for Celestia’s blobspace market are profound, as the pricing, demand, and supply dynamics are being rapidly recalibrated in response to Ethereum’s evolving capacity and fee structure.

Blob Pricing: Ethereum’s Cost Collapse vs. Celestia’s Value Proposition

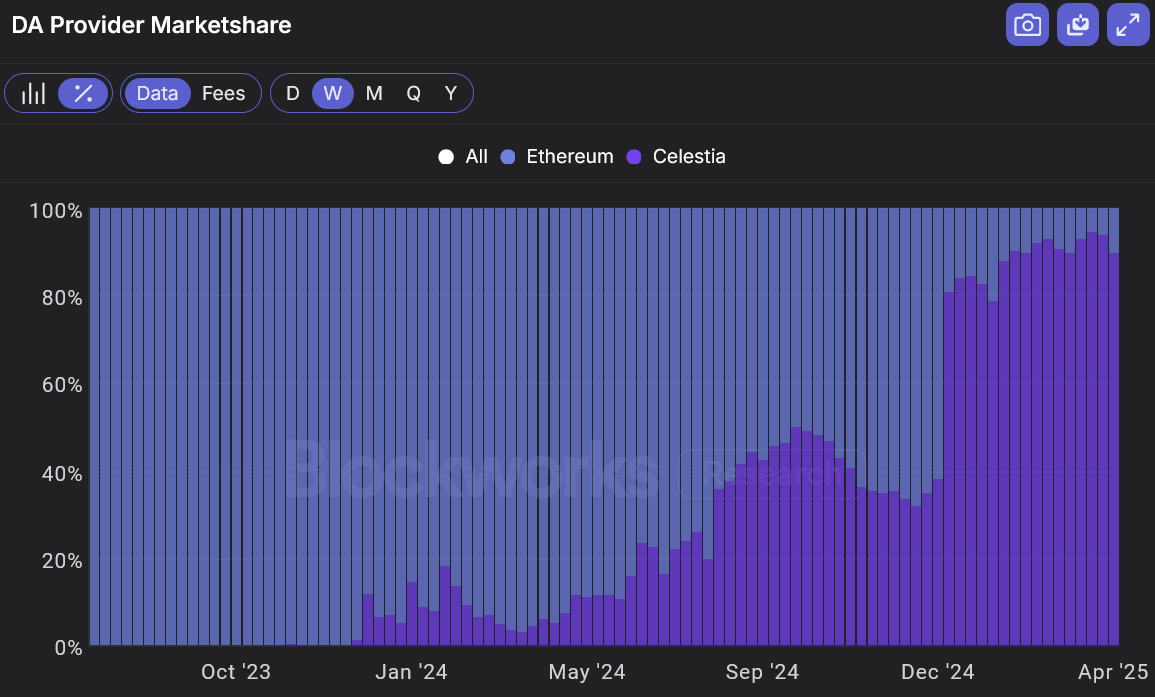

As of December 2024, Ethereum’s average blob fee revenue stood at $921,000 per week, dwarfing Celestia’s $6,000 per week. Year-to-date, Ethereum’s total blob fee revenue reached approximately $8.4 million, compared to Celestia’s $72,000. Despite this dominance, the Pectra upgrade has driven Ethereum’s per-MB blob cost to previously unseen lows. While Ethereum blobs averaged $20.56 per MB over the past year, Celestia maintained a significant cost advantage at just $7.31 per MB. On a rolling 7-day basis, Ethereum blobs recently cost $66.88 per MB, while Celestia’s cost remained at $0.10 per MB: an order-of-magnitude difference that continues to attract cost-sensitive projects.

Cryptocurrency 6-Month Price Comparison: Celestia, Ethereum, and Key Competitors

Real-time price performance of Celestia (TIA), Ethereum (ETH), and other major cryptocurrencies over the past 6 months, highlighting market trends relevant to blobspace and data availability sectors.

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Celestia (TIA) | $1.44 | $1.55 | -7.1% |

| Ethereum (ETH) | $4,340.01 | $3,500.00 | +24.0% |

| Bitcoin (BTC) | $121,837.00 | $60,000.00 | +103.1% |

| Arbitrum (ARB) | $0.4180 | $0.5000 | -16.4% |

| Optimism (OP) | $0.6980 | $0.8000 | -12.6% |

| Solana (SOL) | $221.95 | $150.00 | +48.0% |

| Avalanche (AVAX) | $28.12 | $25.00 | +12.5% |

| Polygon (MATIC) | $0.2363 | $0.3000 | -21.2% |

Analysis Summary

Over the past six months, Bitcoin and Solana have led the market with the highest price gains, while Celestia, Arbitrum, Optimism, and Polygon have experienced declines. Ethereum has posted a strong 24% gain, reflecting its ongoing innovation and market dominance in the data availability and blobspace sectors. Celestia, despite rapid growth in blob usage and transactions, has seen a modest 7.1% price decrease.

Key Insights

- Bitcoin more than doubled in value (+103.1%), showing the strongest growth among major assets.

- Ethereum’s price increased by 24.0%, coinciding with major upgrades (e.g., Pectra) and increased blob capacity.

- Celestia (TIA) saw a 7.1% decline, despite significant growth in blob usage and transaction volume.

- Rollup-focused assets like Arbitrum (-16.4%), Optimism (-12.6%), and Polygon (-21.2%) underperformed, reflecting sector-specific pressures.

- Solana (+48.0%) and Avalanche (+12.5%) outperformed Celestia and rollup tokens, indicating shifting market preferences.

This comparison uses real-time price data as of 2025-10-09, with 6-month historical prices sourced directly from CoinMarketCap and other referenced platforms. All figures are presented exactly as reported in the provided data, ensuring accuracy and consistency.

Data Sources:

- Main Asset: https://coinmarketcap.com/currencies/celestia/

- Ethereum: https://coinmarketcap.com/currencies/ethereum/

- Bitcoin: https://coinmarketcap.com/currencies/bitcoin/

- Arbitrum: https://coinmarketcap.com/currencies/arbitrum/

- Optimism: https://coinmarketcap.com/currencies/optimism/

- Solana: https://coinmarketcap.com/currencies/solana/

- Avalanche: https://coinmarketcap.com/currencies/avalanche/

- Polygon: https://coinmarketcap.com/currencies/polygon/

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

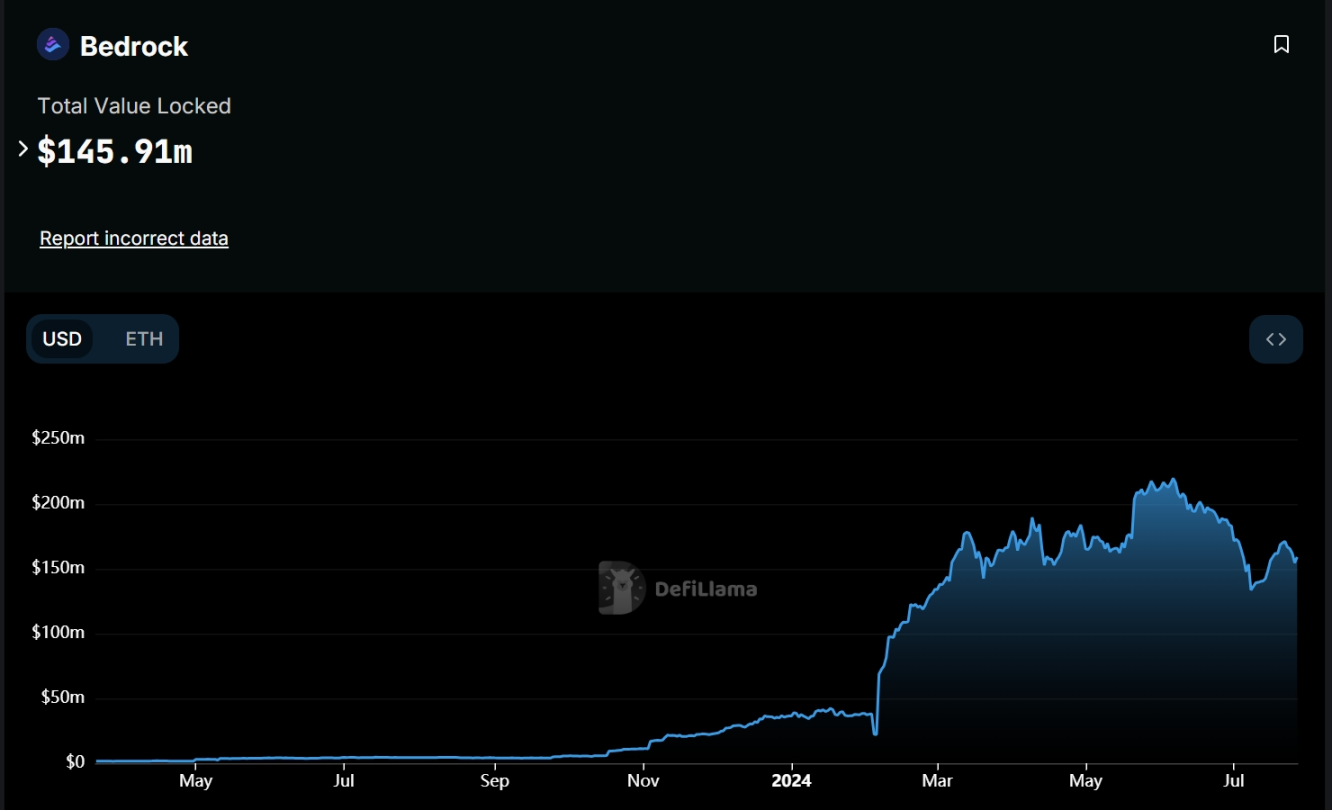

These price differentials are not merely academic; they directly impact developer and rollup decisions regarding data availability solutions. As Ethereum’s capacity increases and costs collapse, some rollups may consolidate activity on Ethereum to capitalize on near-zero fees. However, Celestia’s ultra-low costs and rapidly expanding blobspace, average daily blob size surged from 1.18GB to 11.4GB in just two weeks, position it as the preferred choice for high-throughput applications and NFT projects.

Demand Dynamics: Rollup Profitability and Blob Utilization

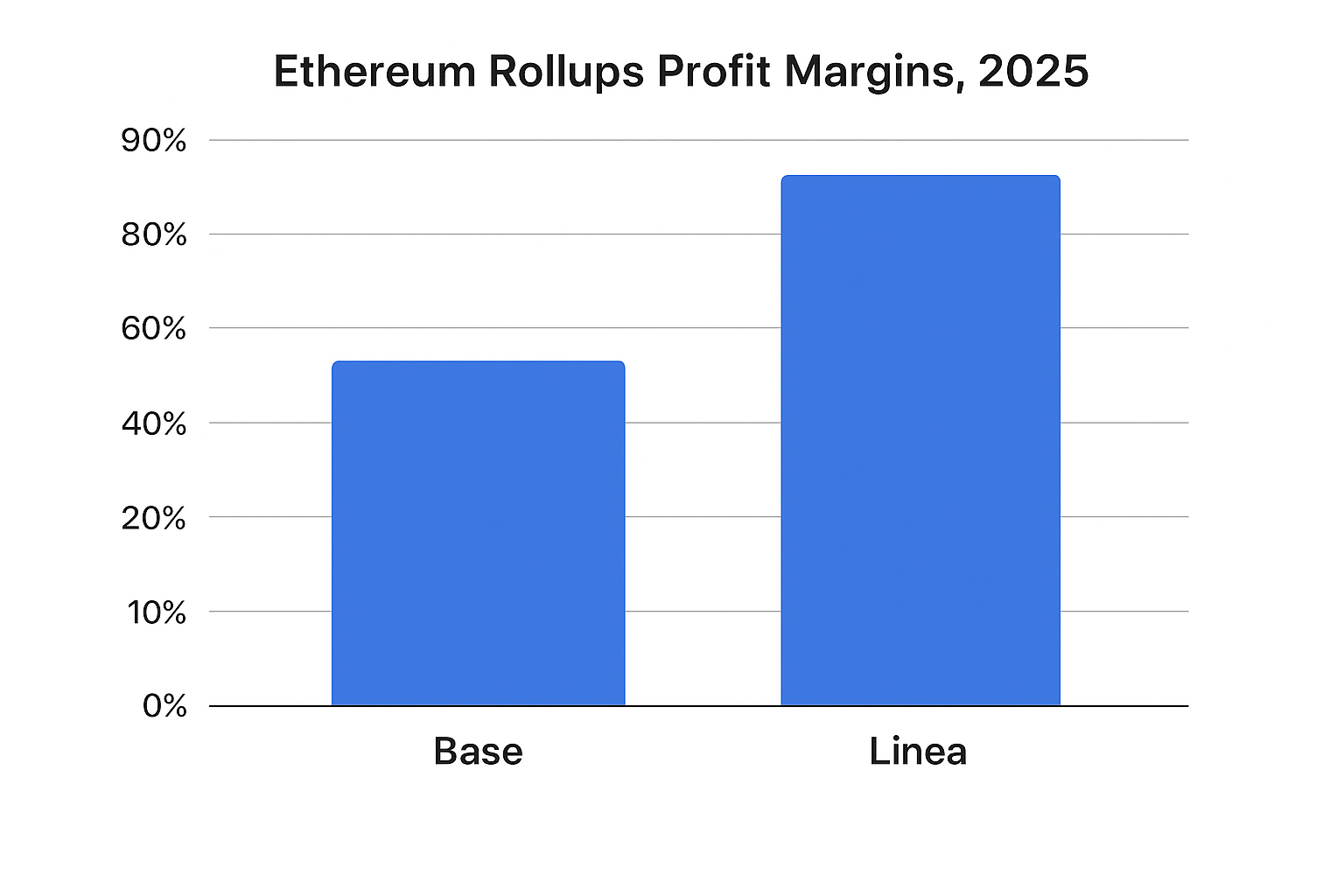

The economics of rollups have shifted dramatically post-Pectra. Platforms like Base and Linea now enjoy post-fee profit margins of approximately 98%, with Base achieving net revenues of $1.12 million after costs. Yet, Ethereum’s expanded blob capacity is currently underutilized, usage sits 33% below the new target, keeping fees at rock-bottom levels. This underutilization is a double-edged sword: it incentivizes further rollup migration to Ethereum, but also signals potential for fee volatility if demand spikes unexpectedly.

Meanwhile, Celestia has experienced a >60% jump in daily transactions (from 44,000 to 71,000) and a tenfold increase in average blob size, largely driven by NFT minting and new dApps leveraging its modular architecture. This surge demonstrates robust organic demand growth, independent of Ethereum’s fee fluctuations.

Key Drivers of Blobspace Demand on Celestia and Ethereum (2024-2025)

-

Rollup Activity and Profit Margins: The surge in rollup usage on Ethereum, especially post-Pectra upgrade, has driven significant blobspace demand. Rollups like Base and Linea now enjoy post-fee profit margins of approximately 98%, with Base leading in net revenue at $1.12 million after costs, incentivizing further blob purchases.

-

Blob Fee Reductions and Market Dynamics: Ethereum’s Pectra upgrade (May 2025) increased blob capacity, causing a 20.8% rise in daily rollup blob purchases (from 21,200 to 25,600) and rendering blobs nearly free for rollups (less than $0.00001 per day), thereby stimulating demand.

-

NFT Minting and High-Throughput Projects: On Celestia, a dramatic increase in NFT minting and adoption by new projects led to a 10x rise in average blob size (from 1.18GB to 11.4GB) and a 60% increase in daily transactions (from 44,000 to 71,000) between June and December 2024.

-

Relative Blobspace Costs: Celestia’s blob fees remain substantially lower than Ethereum’s. As of December 2024, Celestia generated $6,000 per week in blob fees versus Ethereum’s $921,000 per week, making Celestia attractive for cost-sensitive projects and driving demand from new entrants.

-

Blob Sharing and Efficiency Gains: The fixed 128KB blob size on Ethereum poses challenges for smaller rollups. Blob sharing—where multiple rollups share a single blob—has emerged as a key driver, with studies showing cost reductions exceeding 85% for participating rollups, increasing demand for shared blobspace solutions.

-

Node Storage Requirements: Increased blob usage on Ethereum post-Pectra has led to higher storage needs for consensus layer nodes (now up to 44.6GB), influencing infrastructure demand and long-term scalability considerations.

However, smaller rollups face unique challenges due to the fixed 128KB blob size on Ethereum. Inefficient utilization can erode cost savings unless blobs are shared among multiple rollups, a practice that has demonstrated cost reductions exceeding 85% in recent studies.

Supply Shocks and Market Tipping Points

The supply side of the blobspace market is equally dynamic. Ethereum’s increased blob limits have raised consensus layer node storage requirements to approximately 44.6GB, up from 40-44GB pre-Pectra. While this expansion supports greater throughput, it also raises concerns about long-term network sustainability and centralization risks.

Celestia, on the other hand, continues to scale horizontally, with its modular approach enabling rapid increases in both blob size and transaction count without significantly impacting node requirements. The market is watching closely: will Ethereum’s aggressive scaling strategy eventually saturate again, or will Celestia’s flexible model capture a greater share of L2 blockspace demand?

Industry voices are split on whether we are at a true blobspace tipping point. Some analysts argue that as Ethereum continues to raise blob limits in response to demand, short-term price collapses will be offset by eventual resaturation as more rollups seek to capture these fleeting margins (read more). Others believe Celestia’s lower-cost, high-throughput model offers a sustainable alternative as data needs outpace Ethereum’s upgrades.

For traders and developers, these evolving dynamics present both opportunities and risks. Celestia trading strategies increasingly hinge on anticipating cross-chain demand shifts and monitoring fee compression cycles on Ethereum. When Ethereum’s blobspace is underutilized, as it is now, the cost differential narrows, potentially slowing Celestia’s inflows. Yet, the moment Ethereum’s blob supply approaches saturation, fee volatility can surge, sending price-sensitive projects scrambling for alternatives. This cyclical pattern underscores the importance of real-time blob supply and demand analytics for optimizing Celestia positioning.

Strategic Considerations: Arbitrage, Diversification, and the Future of Blob Markets

Blobspace market participants must now weigh several critical factors:

Top Strategies for Navigating Ethereum & Celestia Blobspace in 2025

-

Leverage Blob Sharing for Cost Efficiency: Rollups with low data throughput can significantly reduce costs—by over 85%—by collaborating and sharing blobs, as demonstrated by recent studies (arxiv.org). This approach maximizes the utility of Ethereum’s fixed 128KB blobs, especially when blob fees are near zero.

-

Prioritize Ethereum for High-Value Data Availability: Despite cost reductions post-Pectra, Ethereum remains the dominant data availability platform, generating approximately $8.4 million in blob fee revenue year-to-date compared to Celestia’s $72,000 (bitgetapp.com). Projects requiring maximum security and market liquidity should continue to anchor on Ethereum.

-

Exploit Celestia for Large-Scale, Cost-Sensitive Deployments: With blob fees at just $6,000 per week and average blob sizes surging to 11.4GB, Celestia is ideal for NFT minting and projects with massive data needs (theblock.co). Its modular architecture supports rapid scaling at a fraction of Ethereum’s cost.

-

Monitor Blob Capacity Upgrades and Fee Dynamics: The May 2025 Pectra upgrade boosted Ethereum’s daily blob capacity from 5.5GB to 8.15GB, driving down costs to less than $0.00001 per day for rollups (galaxy.com). Staying informed on future upgrades and fee market changes is critical for optimizing deployment timing and cost.

-

Balance Storage Requirements With Network Participation: As blob usage increases, so do node storage demands—Ethereum consensus nodes now store approximately 44.6GB of data, up from 40-44GB pre-Pectra (panewslab.com). Teams should assess infrastructure capabilities before scaling up blob usage.

First, arbitrage opportunities arise when there is a temporary mispricing between Celestia data blob pricing and Ethereum blobs, especially during periods of fee volatility or network congestion. Traders with robust cross-chain monitoring infrastructure can capitalize on these windows, but latency and transaction finality risks remain non-trivial.

Second, diversification across data availability layers is becoming a standard risk management tactic. Projects are increasingly splitting their data commitments between Ethereum and Celestia, leveraging each network’s strengths: Ethereum’s deep liquidity and institutional trust, Celestia’s cost efficiency and scalability. This hybrid approach is especially relevant for emerging L2s and NFT platforms seeking both resilience and cost control.

Third, the prospect of further protocol upgrades looms large. Ethereum’s dynamic blob gas pricing research and Celestia’s roadmap for modular expansion will continue to reshape the competitive landscape. Market participants should remain alert to signals from core developer teams, as even minor parameter changes can cascade into significant price and demand shifts.

What’s Next for Blobspace Market Trends?

Looking ahead, several key trends warrant close attention:

- Blob sharing innovation: As research demonstrates >85% cost reductions for smaller rollups via blob sharing, expect rapid adoption and new middleware solutions facilitating efficient multi-rollup data packaging.

- Fee volatility triggers: Watch for sudden jumps in rollup activity or NFT mints that could push Ethereum’s usage closer to its new blob target, reigniting fee competition and rebalancing flows toward Celestia.

- Node storage constraints: Ethereum’s rising node requirements may eventually limit participation, while Celestia’s modular scaling could attract more developers prioritizing decentralization.

Ultimately, the interplay between L2 blockspace demand, protocol upgrades, and competitive pricing will continue to define the relative fortunes of Ethereum and Celestia in the data availability sector. As always, those armed with timely analytics and a nuanced understanding of market microstructure will be best positioned to capture emerging opportunities.

For a technical deep dive on how Ethereum’s blob space limit impacts Celestia blob trading and pricing, see our dedicated analysis here.