How Baselight and Walrus Protocol Transform Celestia Data Blobs into Queryable, Monetizable Datasets

Celestia’s modular architecture has made data blobs a core primitive for decentralized applications, but raw blobs alone are not enough. The real breakthrough comes when these blobs become structured, queryable, and monetizable datasets: and that’s where the Baselight and Walrus Protocol integration is changing the game. With Celestia’s current price at $1.53, interest in blobspace is surging as new tooling unlocks practical value for developers, data scientists, and enterprises seeking to activate onchain data.

From Blob Storage to Structured Datasets: How Baselight and Walrus Interact

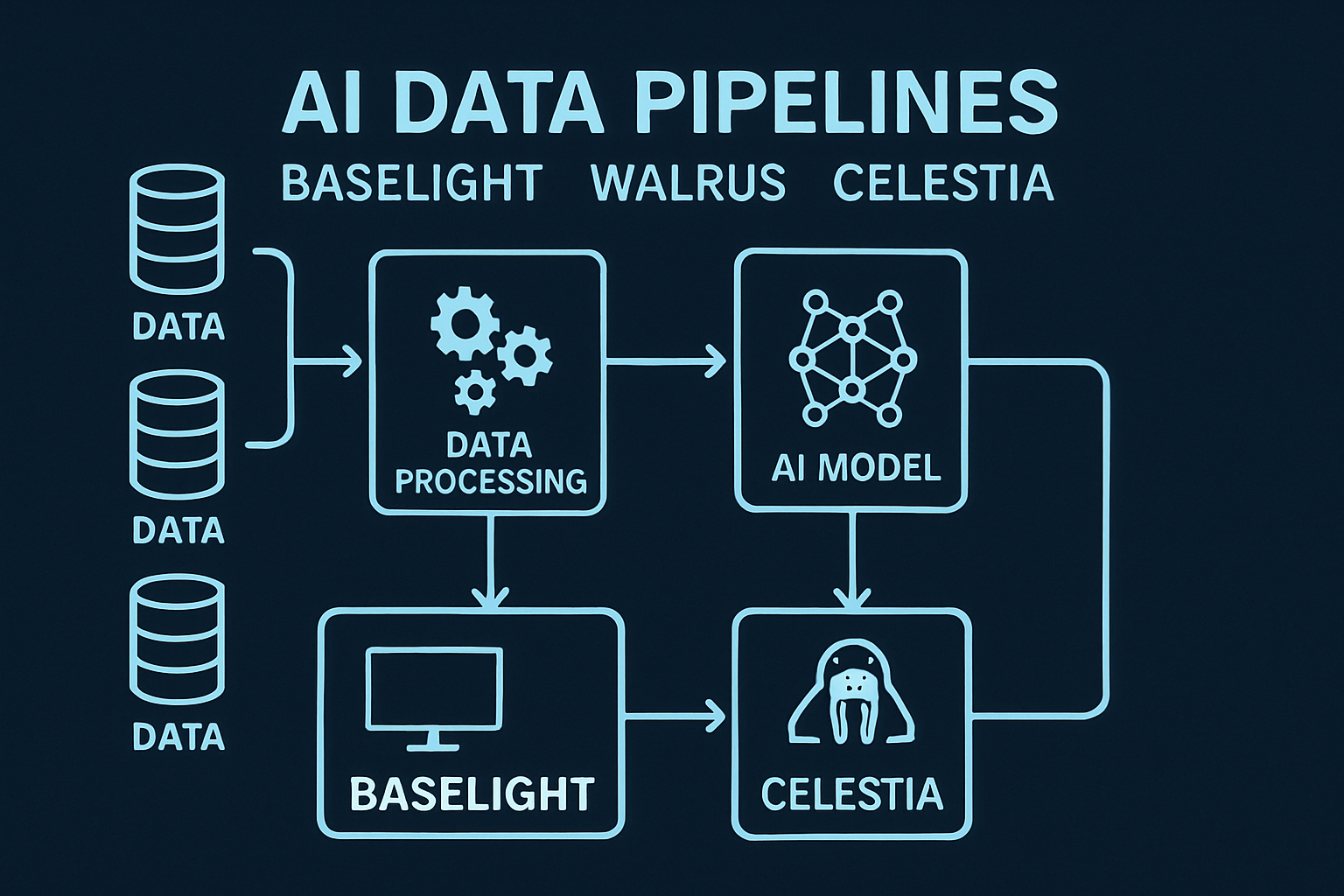

Let’s break down the technical flow. Walrus, developed by Mysten Labs, acts as a decentralized storage protocol purpose-built for cost-efficient blob handling on Celestia. It leverages Celestia’s scalable data availability layer to store large volumes of data, think gigabytes per batch, at minimal cost using its proprietary batching system, Quilt.

Baselight, from Finisterra Labs, then steps in as the permissionless analytics and discovery layer. It indexes blobs stored on Walrus and transforms them into SQL-ready tables with support for native AI agents and custom model integrations. The result: raw Celestia blobs become live datasets that can be queried in real time, integrated into autonomous workflows, or monetized via token-gated access.

Unlocking Queryable Blob Datasets: Technical Advantages

This integration solves two critical pain points:

- Data Discovery: Instead of hunting through raw blobspace or dealing with fragmented tools, users find structured datasets indexed by Baselight across 120 billion rows and 51,000 and datasets.

- Programmable Access: Dynamic models such as token-gated queries (where only holders of a specific token can access certain data), time-locked permissions (data becomes available after a set period), or DAO-governed licensing are now possible directly at the dataset level.

This approach enables new business models around Celestia data blobs, think paid APIs for DeFi analytics or DAO-controlled research archives, and gives both builders and researchers fine-grained control over how their datasets are shared or sold.

The Data Monetization Flywheel: Why This Matters Now

The ability to monetize Celestia data is not theoretical, it’s already attracting institutional capital. Walrus has raised $140 million from investors including Standard Crypto and a16z, signaling confidence in decentralized blob markets becoming a key pillar of the AI era. As more apps deploy on Celestia and blob transaction volume grows (with each PayForBlobs transaction supporting up to just under 2 MiB of data), demand for tools that make this data actionable will only accelerate.

The big picture: With Baselight and Walrus Protocol integration live, anyone can turn passive blob storage into an active revenue stream or research asset. You’re no longer limited to storing bytes, you can build products powered by structured insights from live blockchain activity.

Celestia (TIA) Price Prediction 2026-2031

Professional forecast based on Baselight & Walrus integration, modular blockchain adoption, and current (2025) market conditions ($1.53)

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Year-over-Year Change (%) |

|---|---|---|---|---|

| 2026 | $1.20 | $1.65 | $2.40 | +8% |

| 2027 | $1.35 | $2.10 | $3.10 | +27% |

| 2028 | $1.70 | $2.75 | $4.25 | +31% |

| 2029 | $2.10 | $3.40 | $5.60 | +24% |

| 2030 | $2.30 | $4.05 | $6.90 | +19% |

| 2031 | $2.60 | $4.60 | $8.00 | +14% |

Price Prediction Summary

Celestia (TIA) is positioned for steady long-term growth, leveraging its core role in the modular blockchain stack and the transformative Baselight/Walrus integration. The forecast anticipates moderate but consistent price appreciation as onchain data monetization and decentralized analytics mature. Bearish scenarios reflect broader crypto volatility and possible regulatory headwinds, while bullish cases price in increased adoption, data market expansion, and successful ecosystem scaling.

Key Factors Affecting Celestia Price

- Baselight and Walrus integration: Unlocks monetizable, queryable datasets, driving new utility and demand for Celestia’s data availability.

- Modular blockchain trend: Growing adoption of modular architectures supports Celestia’s relevance as a foundational protocol.

- Institutional interest: Backing from major funds (a16z, Franklin Templeton) signals long-term confidence and potential for ecosystem growth.

- Data economy growth: Expansion of AI, analytics, and decentralized data markets increases demand for scalable data availability solutions.

- Technical improvements: Upgrades improving throughput, cost efficiency, and programmability can enhance TIA’s utility and value.

- Regulatory environment: Changes in data privacy, crypto, and onchain data regulations could impact adoption rates and price potential.

- Competition: Emergence of rival data availability protocols or new technologies could limit upside or introduce volatility.

- Market cycles: Broader crypto bull/bear cycles will influence short-term price swings.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Key Use Cases Emerging Right Now

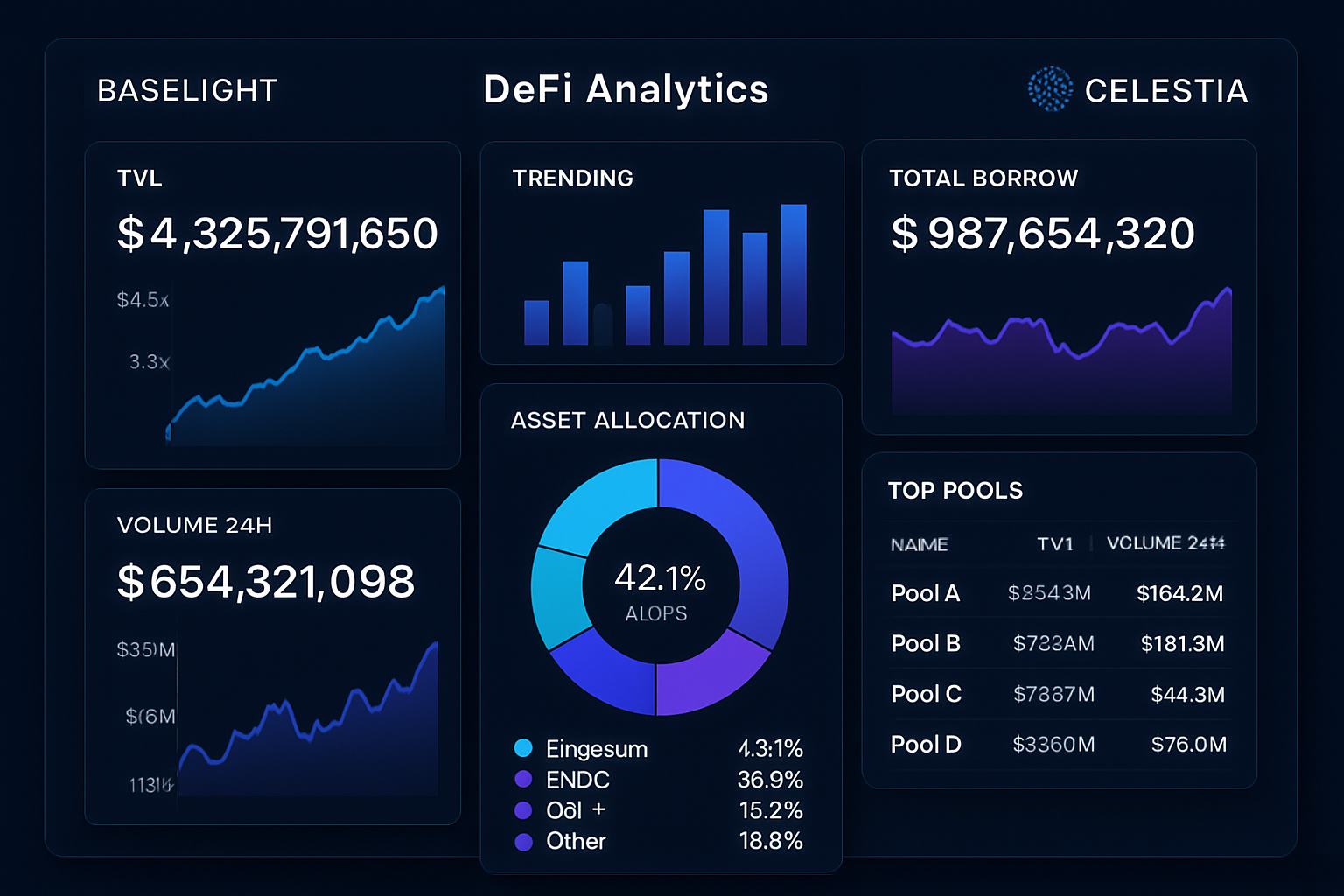

- DeFi Market Analytics: Real-time monitoring of rollup activity or liquidity spikes using queryable transaction datasets indexed from Celestia blobs.

- AI and ML Training Data: Builders can offer curated training sets extracted from onchain activity via Baselight’s SQL engine, monetized with token-gated APIs.

- DAO-Controlled Research Vaults: Communities use programmable licensing to monetize access to proprietary analytics harvested from their own blob submissions.

For developers and data scientists, this means a step change in how onchain data is sourced and operationalized. Instead of building brittle ETL pipelines or scraping explorer APIs, teams can now access production-grade datasets directly from blobspace, with Baselight’s SQL interface enabling sub-second queries across hundreds of billions of rows. This is especially powerful for AI agents or automated trading systems that need both speed and data integrity.

Baselight’s support for custom models also allows users to run analytics or even inference on live data, unlocking advanced use cases such as predictive analytics for DeFi risk, anomaly detection in rollup activity, or real-time sports betting feeds. Combined with Walrus’s granular access controls, dataset owners can fine-tune who accesses what and when, creating a permissionless yet programmable data market.

Blob Market Analytics: Where the Value Flows

As Celestia’s blobspace matures, blob market analytics become a critical edge. Platforms like Baselight are already surfacing insights into transaction spikes, revert errors, and app-level engagement by analyzing raw blob flows. For example, monitoring PayForBlobs transaction volumes can reveal which rollups are gaining traction or when new protocols launch.

Top 5 Practical Uses for Queryable Celestia Data Blobs

-

DeFi Analytics and Risk Assessment: Baselight transforms Celestia data blobs into structured datasets, enabling real-time analysis of DeFi protocols for transaction volumes, liquidity trends, and risk metrics. This empowers traders, auditors, and analysts to make data-driven decisions directly from onchain activity.

-

AI and Machine Learning Data Pipelines: With Walrus and Baselight, developers can store large, permissionless datasets on Celestia and query them efficiently for AI model training, inference, and autonomous agent workflows, all while maintaining data provenance and access controls.

-

Decentralized Data Marketplaces: The integration allows creators to monetize datasets by offering token-gated or time-locked access, enabling new business models for data sharing and licensing within decentralized marketplaces.

-

Onchain Research and Analytics: Researchers can access and query historical and real-time blockchain data for academic, financial, or market research, leveraging Baselight’s SQL engine and Walrus’s decentralized storage for transparent, reproducible results.

-

DAO Governance and Transparency: DAOs can store proposals, votes, and governance actions as Celestia blobs, then use Baselight to structure and query this data for transparent reporting, compliance, and community insights.

With Celestia (TIA) holding at $1.53, the economics of blob storage and retrieval are increasingly relevant to both traders and builders. Low-cost storage via Walrus means that even high-frequency datasets remain affordable to maintain and monetize. As more protocols adopt token-gated queries or DAO licensing models for their datasets, expect secondary markets for blob-derived insights to emerge, potentially with their own pricing curves tied to demand for specific types of onchain intelligence.

Looking Ahead: Data as a Liquid Asset Class

The convergence of Baselight and Walrus Protocol signals a new era where data itself becomes a liquid asset. Monetizing Celestia blobs is no longer limited to speculative trading; it now includes recurring revenue from dataset subscriptions, pay-per-query APIs, and community-driven licensing deals. This model not only aligns incentives between data creators and consumers but also unlocks sustainable business models for open-source projects that historically struggled to monetize raw blockchain data.

For those building in the Celestia ecosystem, the message is clear: structured blobspace is here, it’s programmable by default, and it’s already generating real-world value streams at scale. Whether you’re looking to deploy an AI agent that needs up-to-the-minute DeFi feeds or launch a DAO-governed research vault powered by token-gated queries, the infrastructure stack is ready, and demand is only accelerating as institutional capital flows into decentralized data markets.