How Ethereum’s Blob Space Limit Impacts Celestia Blob Trading and Pricing

Ethereum’s recent Pectra upgrade has sent ripples through the Celestia blobspace ecosystem, shaking up the dynamics of data availability and blob trading. With Ethereum (ETH) currently priced at $4,545.12, and its gas and blob parameters freshly tuned, developers and traders are asking: What does this mean for Celestia’s rapidly expanding blob market?

Ethereum Blob Limits: The Pectra/Fusaka Effect

The Pectra upgrade, rolled out on May 7,2025, increased Ethereum’s maximum blobs per block from 6 to 9 (target: 6). This was a direct response to surging Layer 2 (L2) activity and growing demand for affordable data posting. Almost overnight, daily blobs purchased by rollups jumped by 20.8%, rising from 21,200 to 25,600. That’s a daily data capacity leap from 2.7GB to 3.3GB. Yet even with this expanded limit, only about two-thirds of the new target blobs per block are being used.

The result? A dramatic drop in blob costs. The median price per blob has tumbled to just $0.00000000035. For L2s relying on Ethereum for data availability, this means their daily spend on blobs is now less than one-thousandth of a cent, a negligible cost for protocols moving millions in value.

“Blobs today are priced dynamically based on congestion. When usage hits 50% of the target limit, a base fee kicks in. “ (bnbstatic.com)

Celestia Blobspace: Surging Demand Amid Ethereum Shifts

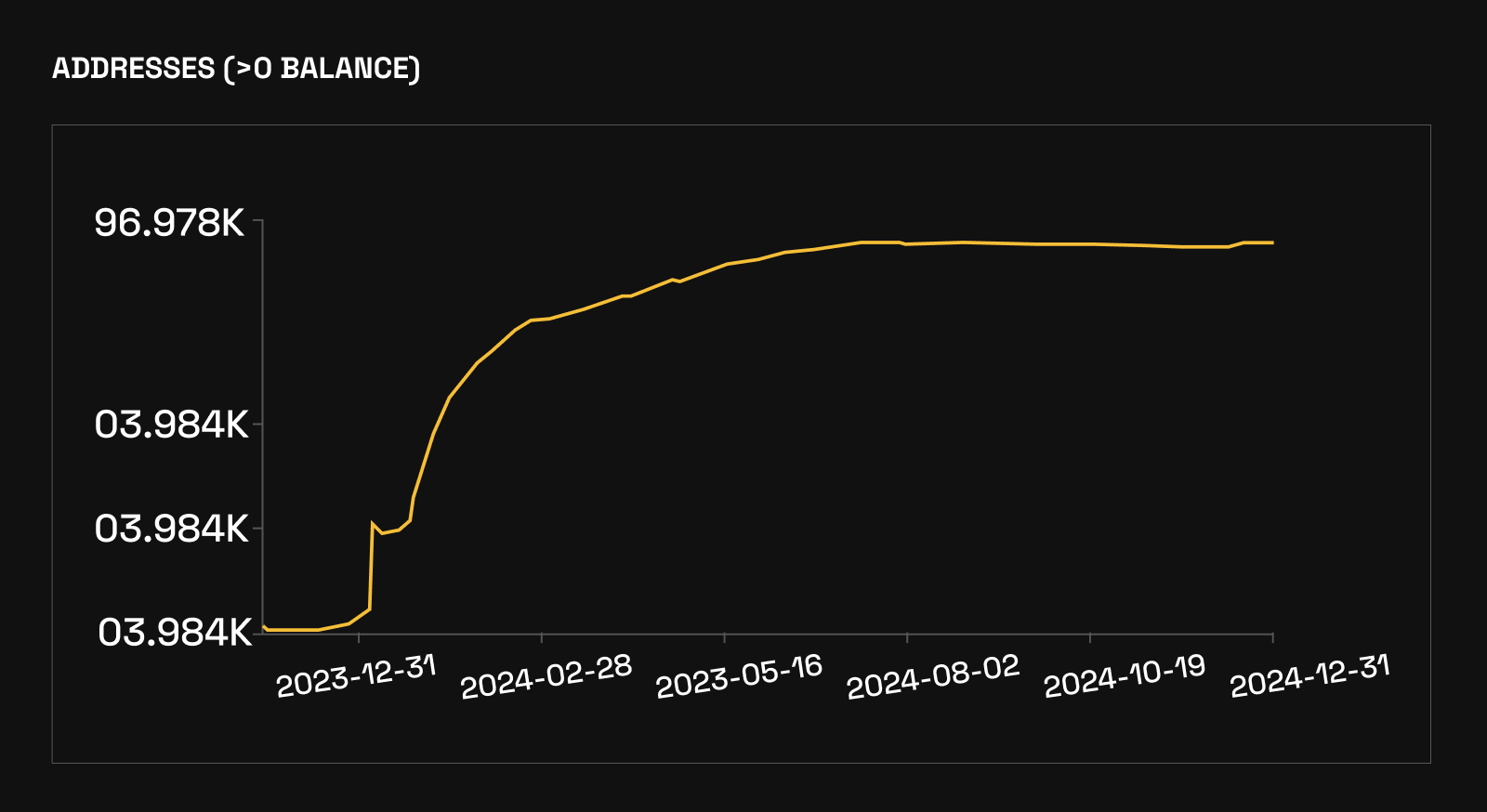

While Ethereum’s upgrades have made its native blobs cheaper and more abundant for L2s, Celestia is seeing explosive growth in both blob size and transaction volume. Between June and December 2024, the average Celestia blob size ballooned from roughly 1.18GB to an eye-popping 11.4GB. Daily transactions soared by over 60%, climbing from 44,000 to 71,000, driven largely by NFT launches and new projects prioritizing scalable data availability.

This divergence highlights a critical point: Even as Ethereum slashes costs for L2s with its new blob limits, there remains robust demand for Celestia’s specialized infrastructure, especially among projects requiring high throughput or large-scale data storage.

The Blob Market Pricing Feedback Loop

The interplay between Ethereum’s blob space limits and Celestia’s market is creating a feedback loop that savvy traders can exploit:

- Lower ETH Blob Prices: As more blobs fit into each block at minimal cost (source), some L2s may shift back toward using Ethereum exclusively for DA (data availability).

- Bigger Blobs on Celestia: Projects needing larger or more flexible DA solutions continue migrating to Celestia, even as ETH becomes cheaper, fueling higher throughput and bigger average blobs.

- Divergent Fee Structures: Data shows that over time, Celestia remains about 64% cheaper per MB than ETH blobs ($7.31 vs $20.56), according to Conduit (source). This pricing spread may widen if ETH fees climb again under congestion.

Comparison of Average Blob Sizes and Prices: Ethereum vs. Celestia (Post-Pectra Upgrade)

| Blockchain | Average Blob Size | Average Daily Blobs/Transactions | Median Blob Price (per blob) | Total Daily Data Capacity | Notes |

|---|---|---|---|---|---|

| Ethereum (Post-Pectra) | 128 KB | 25,600 blobs/day | $0.00000000035 | 3.3 GB | Blob price dropped sharply after upgrade; less than one-thousandth of a cent per day for rollups |

| Celestia (Dec 2024) | 11.4 GB | 71,000 transactions/day | $7.31 per MB | ~810 GB | Blob sizes surged nearly 10x in two weeks; strong demand from NFT and data-heavy projects |

What Traders Need to Watch Next

The next phase of upgrades, like Fusaka’s staged increase up to potentially 15 or even 21 blobs per block, will keep shifting the balance between these two ecosystems. For now, though, both chains are carving out distinct niches in the evolving world of data availability.

Celestia (TIA) Price Prediction 2026-2031

Outlook based on Ethereum’s blob space upgrades, Celestia’s growth, and evolving data availability market dynamics.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $6.20 | $8.50 | $13.00 | +13% | Continued growth in NFT and rollup adoption; competition from Ethereum blob upgrades keeps upside in check. |

| 2027 | $7.40 | $10.00 | $17.00 | +18% | Celestia expands partnerships and L2 integrations; regulatory clarity for DA chains improves investor confidence. |

| 2028 | $8.10 | $12.00 | $21.00 | +20% | Sustained DePIN and modular blockchain demand; new L2s launch on Celestia, but ETH upgrades slow migration. |

| 2029 | $9.00 | $14.50 | $27.00 | +21% | Celestia secures major enterprise clients; Ethereum blob limits increase further but DA cost advantage persists. |

| 2030 | $10.50 | $17.00 | $35.00 | +17% | Wider adoption in gaming/social dApps; market volatility increases with global regulation debates. |

| 2031 | $12.00 | $19.50 | $42.00 | +15% | Celestia cements position as leading DA layer; possible rollup supercycle drives demand, but saturation risk emerges. |

Price Prediction Summary

Celestia (TIA) is positioned for steady growth through 2031, driven by surging data demands from NFTs, rollups, and modular blockchain projects. While Ethereum’s ongoing upgrades will gradually reduce Celestia’s cost advantage, the platform’s scalability and ecosystem momentum are expected to support higher valuations, especially if enterprise and DePIN use cases materialize. Price volatility will remain, with wider min/max ranges reflecting both bullish adoption scenarios and bearish risks from competition or regulatory shifts.

Key Factors Affecting Celestia Price

- Ethereum’s blob space and data availability upgrades (Fusaka, Pectra, BPO forks)

- Celestia’s transaction volume and blob size growth

- Adoption by Layer 2s, DePIN, NFTs, and enterprise projects

- Relative data availability costs vs. Ethereum and other competitors

- Overall crypto market cycles and macroeconomic conditions

- Potential for regulatory clarity or new restrictions impacting DA chains

- Technological improvements (throughput, security, integrations)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For active traders and data analysts, the shifting landscape means opportunity, if you know where to look. As Ethereum’s blob space expands, the immediate effect is a compression of blob prices and a temporary migration of some L2s back to Ethereum for their data needs. But Celestia’s appeal isn’t just about cost per MB; it’s about flexibility, scale, and the ability to handle massive blobs and high transaction throughput that Ethereum’s design can’t currently match.

Market participants should pay close attention to the utilization rates on both chains. On Ethereum, only two-thirds of available blobs are being used post-Pectra. If usage surges due to new L2 launches or NFT booms, expect blob prices to rebound quickly, potentially narrowing the price gap with Celestia or even flipping it during peak congestion.

Celestia Analytics: Reading the Signals in Blobspace Markets

The real alpha lies in Celestia analytics. By tracking metrics like average blob size, daily transaction count, and fee volatility, traders can anticipate liquidity shifts before they hit headlines. For instance, the recent tenfold surge in average Celestia blob size, from 1.18GB to 11.4GB, signals not just technical demand but also a growing appetite for complex applications (think modular rollups and high-volume NFT drops) that outstrip what Ethereum’s current limits can support.

Key Indicators for Celestia Blobspace Health & Trading

-

Blob Utilization Rate: Tracking the percentage of Celestia’s available blobspace that is actively used helps gauge network demand and potential congestion. Sustained high utilization may signal rising transaction fees or trading opportunities.

-

Average Blob Size: Monitoring changes in average blob size—recently surging from 1.18GB to 11.4GB—can reveal increased on-chain activity, especially from NFT projects and data-intensive applications.

-

Daily Blob Transaction Volume: A spike in daily transactions (e.g., from 44,000 to 71,000) often points to heightened demand for data availability, which can influence blob pricing and trading strategies.

-

Blob Price Trends: Keeping an eye on the median price per blob and its fluctuations—especially compared to Ethereum’s blob costs (e.g., Celestia at $7.31/MB vs. Ethereum at $20.56/MB)—helps identify arbitrage and trading opportunities.

-

Rollup Activity on Celestia: Tracking the number and volume of Layer 2 rollups and NFT projects posting data to Celestia provides insight into ecosystem growth and blobspace demand.

-

Ethereum Blobspace Upgrades: Monitoring Ethereum upgrades (like Pectra and Fusaka) and their impact on blob limits, utilization, and fees can affect Celestia’s competitive positioning and blob trading dynamics.

Don’t overlook the impact of upcoming protocol changes either. The Fusaka upgrade on Ethereum will gradually raise maximum blobs per block from today’s 9 up toward 15 or even 21 in future forks (bnbstatic.com). Each step could temporarily depress ETH blob fees further, but as history shows, usage tends to catch up fast with increased capacity.

For those trading blobs or speculating on TIA (Celestia’s native token), keep your eyes glued to:

- Blob utilization rates on both chains

- Fee spikes during market volatility

- NFT project launches or major rollup migrations

- Protocol upgrade timelines (Pectra/Fusaka/BPO forks)

The Future of Data Availability: Beyond Limits

The bottom line? Ethereum’s Pectra and Fusaka upgrades have made data posting cheaper than ever for L2s, with current ETH at $4,545.12, it’s an attractive proposition for cost-sensitive protocols. Yet as projects demand ever-larger blobs and more flexible DA solutions, Celestia is capturing outsized market share by catering to these emerging needs.

This evolving landscape means that blob trading impact, Celestia analytics, and blob market trends will remain top-of-mind for anyone serious about DeFi infrastructure or blockchain scalability plays. The interplay between these ecosystems is less a zero-sum game than a dynamic dance, one where informed actors can spot signals early and move ahead of the crowd.

What will drive the next big shift in blob pricing?

Ethereum’s Pectra upgrade has expanded blob capacity and lowered costs, while Celestia is seeing surging demand and larger blobs. Which do you think will have a bigger impact on future blob prices?