How CLOBs on Blobs and ZK Proofs Are Transforming On-Chain Trading for Celestia Developers

On-chain trading is undergoing a radical transformation, driven by the fusion of Central Limit Order Books (CLOBs), Celestia’s modular data availability, and the cryptographic assurance of Zero-Knowledge (ZK) proofs. For developers working within the Celestia ecosystem, this convergence is not just a technical upgrade – it’s a paradigm shift that redefines how decentralized exchanges (DEXs) can operate at scale without sacrificing transparency, privacy, or speed.

CLOBs on Blobs: Elevating On-Chain Trading Infrastructure

Historically, on-chain order book DEXs have struggled to match the performance and user experience of centralized exchanges. High gas costs and blockspace limitations forced most DeFi protocols to adopt Automated Market Makers (AMMs), which trade efficiency for simplicity. However, with CLOBs on blobs, we’re witnessing a new era where high-speed off-chain matching engines process trades while all order data and trade results are published as blobs on Celestia’s data availability layer. This architecture enables:

- Public verifiability: Every trade and order is accessible as a data blob, ensuring auditability without prohibitive costs.

- Scalability: Leveraging Celestia’s Data Availability Sampling (DAS), lightweight nodes can efficiently verify massive volumes of trade data.

- Economic efficiency: Storing full order books or snapshots in blobs slashes operational expenses compared to traditional on-chain settlement.

This model has quickly gained traction as a new DeFi standard. As noted by industry observers, “CLOBs on blobs isn’t just an idea anymore – it is becoming the new standard for on-chain trading. ” (

)

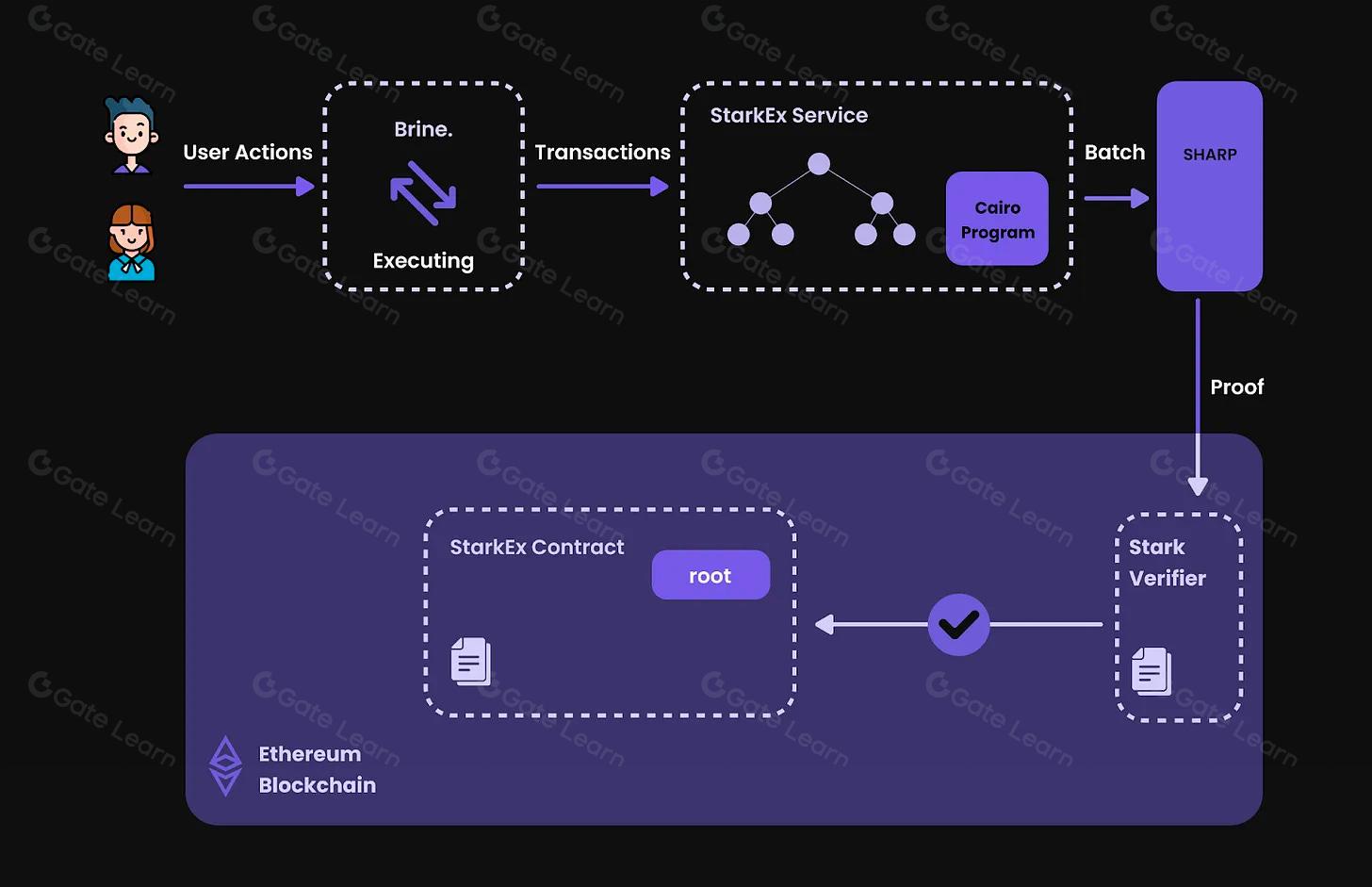

ZK Proofs: Privacy and Integrity Without Compromise

The integration of ZK proofs into this modular stack unlocks powerful guarantees for both users and developers. Projects like Hibachi demonstrate how ZK proofs can be used to cryptographically verify that off-chain order matching strictly follows protocol rules – all without exposing sensitive details about individual orders or trader behavior. This means:

- User privacy is preserved; only aggregate state changes are revealed.

- No trust assumptions; anyone can independently verify that trades were executed correctly using published proofs.

- CEX-level speed with DEX-level security; off-chain matching delivers instant execution while final settlement remains transparent and censorship-resistant.

This innovation addresses one of DeFi’s oldest dilemmas: how to combine fast execution with verifiable fairness. By posting ZK-proven batches of operations to Ethereum or other chains via Celestia blobs, platforms achieve both scalability and trust minimization. For deeper technical insight into this process, see detailed discussions at Succinct’s Hibachi blog post.

The Role of Celestia’s Modular Architecture in Blobspace Trading

The backbone of this movement is Celestia’s modular blockchain design. By decoupling data availability from consensus and execution layers, Celestia empowers developers to build custom trading applications optimized for their specific needs. The DAS protocol allows even resource-constrained nodes to verify large datasets efficiently – making it viable for anyone to participate in securing blobspace trading infrastructure.

This architecture eliminates the bottlenecks that have long plagued monolithic blockchains. Developers can deploy high-performance CLOB-based DEXs that rival centralized platforms in throughput while remaining open, permissionless, and resilient against censorship. As highlighted in recent research (cicada.ventures), this separation of concerns is foundational for supporting institutional-grade DeFi infrastructure at scale.

Celestia (TIA) Price Prediction 2026-2031

Professional outlook based on modular blockchain advancements, CLOB integration, and ZK proof adoption

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $1.10 | $1.80 | $2.60 | +29% | Market recovers from 2025 lows; CLOB/Blob adoption grows but macro headwinds persist |

| 2027 | $1.45 | $2.25 | $3.40 | +25% | Layer-2 and DeFi expansion on Celestia; growing institutional interest |

| 2028 | $1.80 | $2.80 | $4.10 | +24% | ZK proof rollouts and modular DEXs gain traction; regulatory clarity improves |

| 2029 | $2.20 | $3.45 | $5.30 | +23% | Mainstream DeFi and institutional adoption; Celestia powers several flagship dApps |

| 2030 | $2.60 | $4.10 | $6.20 | +19% | Celestia ecosystem matures, competition rises but network effect strong |

| 2031 | $2.95 | $4.70 | $7.10 | +15% | Sustained adoption, but growth moderates as market matures |

Price Prediction Summary

Celestia (TIA) is forecasted to experience steady growth from 2026 to 2031, driven by its leadership in modular blockchain technology, the adoption of CLOBs on Blobs, and the integration of ZK proofs for scalable and secure DeFi. The minimum and maximum ranges reflect both bearish and bullish scenarios, accounting for market cycles, competition, and regulatory factors. Average price predictions suggest a progressive uptrend, especially as institutional and developer adoption increases.

Key Factors Affecting Celestia Price

- Adoption of CLOBs on Blobs as a DeFi standard for high-speed, on-chain trading

- Widespread integration of ZK proofs enhancing privacy and security

- Expansion of Celestia’s modular ecosystem and rollup infrastructure

- Macro crypto market cycles and sentiment

- Regulatory environment and global DeFi policy shifts

- Competition from other modular data availability layers and Layer-2s

- Ability of Celestia-based dApps to attract users and liquidity

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As the modular blockchain thesis matures, Celestia’s blobspace is fast becoming the substrate of choice for advanced DeFi infrastructure. The ability to store and verify entire order books or periodic snapshots within data blobs creates a transparent yet cost-effective audit trail for all participants. This is not just theoretical: live deployments are already demonstrating how CLOBs on blobs can power sophisticated trading venues, including perpetual swaps and high-frequency spot markets, with near-instant settlement and open verifiability.

Emerging Use Cases and Developer Opportunities

For Celestia developers, this convergence unlocks a spectrum of new possibilities:

Top Use Cases for CLOBs on Blobs in DeFi

-

Institutional Trading Desks: CLOBs on blobs enable high-frequency, low-latency trading with on-chain settlement, making them ideal for institutional desks seeking transparency and auditability without sacrificing performance. Projects like Hibachi leverage Celestia and ZK proofs to deliver CEX-level execution speeds and verifiable order histories.

-

Privacy-Preserving Decentralized Exchanges (DEXs): By utilizing Zero-Knowledge proofs and encrypted data blobs, platforms can offer private order matching and settlement while ensuring the integrity of trades. This approach is exemplified by Hibachi and similar ZK-native DEXs, which allow users to trade without exposing sensitive strategies or order flow.

-

Cross-Chain Settlement Infrastructure: CLOBs on blobs, combined with Celestia’s Blobstream and ZK proofs, facilitate secure, transparent settlement across multiple blockchains. This modular approach enables seamless interoperability and data verification between ecosystems like Celestia and Ethereum, supporting advanced DeFi applications.

-

On-Chain Perpetuals and Derivatives Platforms: High-throughput order books stored as blobs allow for scalable, transparent trading of perpetual contracts and other derivatives. Projects such as Hibachi demonstrate how ZK proofs ensure fair matching and settlement in complex derivatives markets.

-

Transparent Audit Trails for Regulators and Users: Publishing order data and trade results as blobs on Celestia provides tamper-proof, publicly verifiable audit trails, supporting compliance and building trust among institutional and retail participants.

The rise of ZK proofs DeFi means that institutional-grade compliance checks can be performed on-chain without leaking sensitive trading data. Developers can implement features like encrypted order flow analytics or private balance updates while maintaining public proof of correctness. This opens the door to regulated trading environments and hybrid models that combine the best features of centralized and decentralized systems.

Real-World Performance at Today’s Market Prices

Celestia’s current price stands at $1.40, reflecting its growing role as a foundational layer for scalable DeFi applications. As more liquidity migrates to blobspace-powered DEXs, expect increasing demand for TIA as both a utility asset and a governance token within this emerging ecosystem. Price stability in the $1.39–$1.43 range highlights market confidence in Celestia’s technology stack and its ability to support high-throughput order book exchanges without sacrificing decentralization or transparency.

For developers evaluating where to build next-generation trading protocols, the combination of modular blockchain order books, ZK-proof verification, and efficient data blobs offers an unparalleled toolkit for innovation.

“This design unlocks a modular stack for verifiable trading: Blobspace = Off-chain Orderbook Layer. ”

The Road Ahead: Standardizing On-Chain Trading Infrastructure

The industry consensus is clear: CLOBs on blobs are rapidly becoming the new standard for on-chain trading. With modularity at its core, Celestia enables protocols to evolve independently, whether optimizing matching engines off-chain or experimenting with novel privacy-preserving primitives using ZK proofs. As more teams leverage these primitives, we anticipate:

- Lower entry barriers: Lightweight nodes can participate in verification thanks to DAS.

- Diversified liquidity venues: Specialized DEXs tailored to unique asset classes or compliance requirements.

- Sustained performance gains: Settlement times rivaling centralized platforms but with full auditability.

This paradigm shift is not just about speed or cost, it’s about rebuilding trust in financial infrastructure by making every trade provable and every ledger update transparent yet private where necessary. For those tracking macro trends in DeFi infrastructure, keep an eye on Celestia’s developer ecosystem as it sets new benchmarks for what’s possible with modular blockchains and data availability.