How CLOBs on Celestia Blobs and ZK Proofs Are Transforming On-Chain Trading

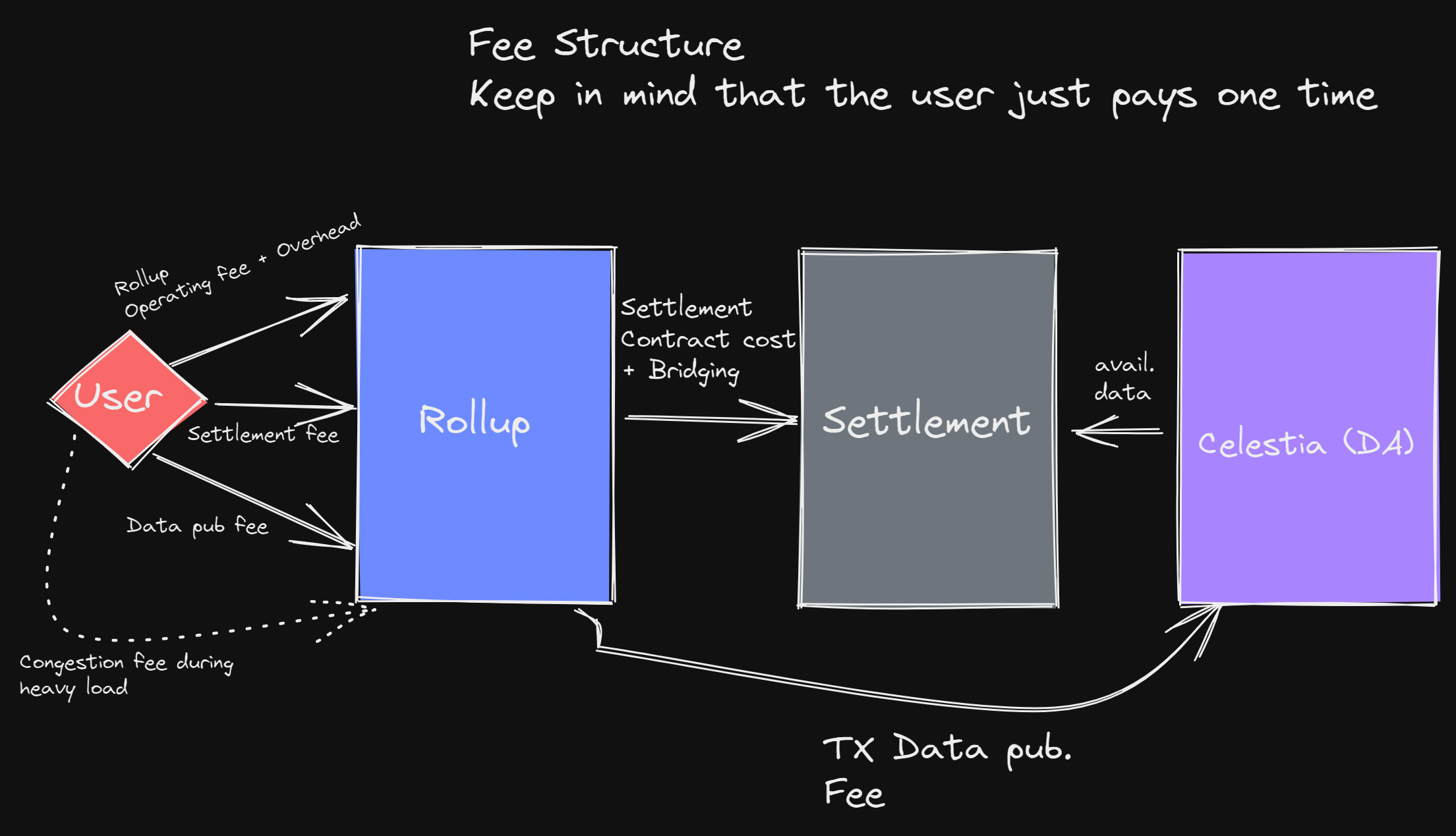

Central Limit Order Books (CLOBs) have long been the backbone of traditional finance, powering the transparent and efficient matching of buy and sell orders. In crypto, however, on-chain CLOBs have struggled to achieve similar speed and cost-effectiveness due to blockchain limitations. But thanks to Celestia’s modular data availability and the advent of zero-knowledge proofs (ZKPs) from projects like Succinct Labs, that paradigm is shifting rapidly. Today, CLOBs on Celestia blobs are redefining what’s possible for decentralized trading infrastructure, delivering scalability, privacy, and trustless security that rival centralized exchanges.

Why Traditional On-Chain Order Books Fell Short

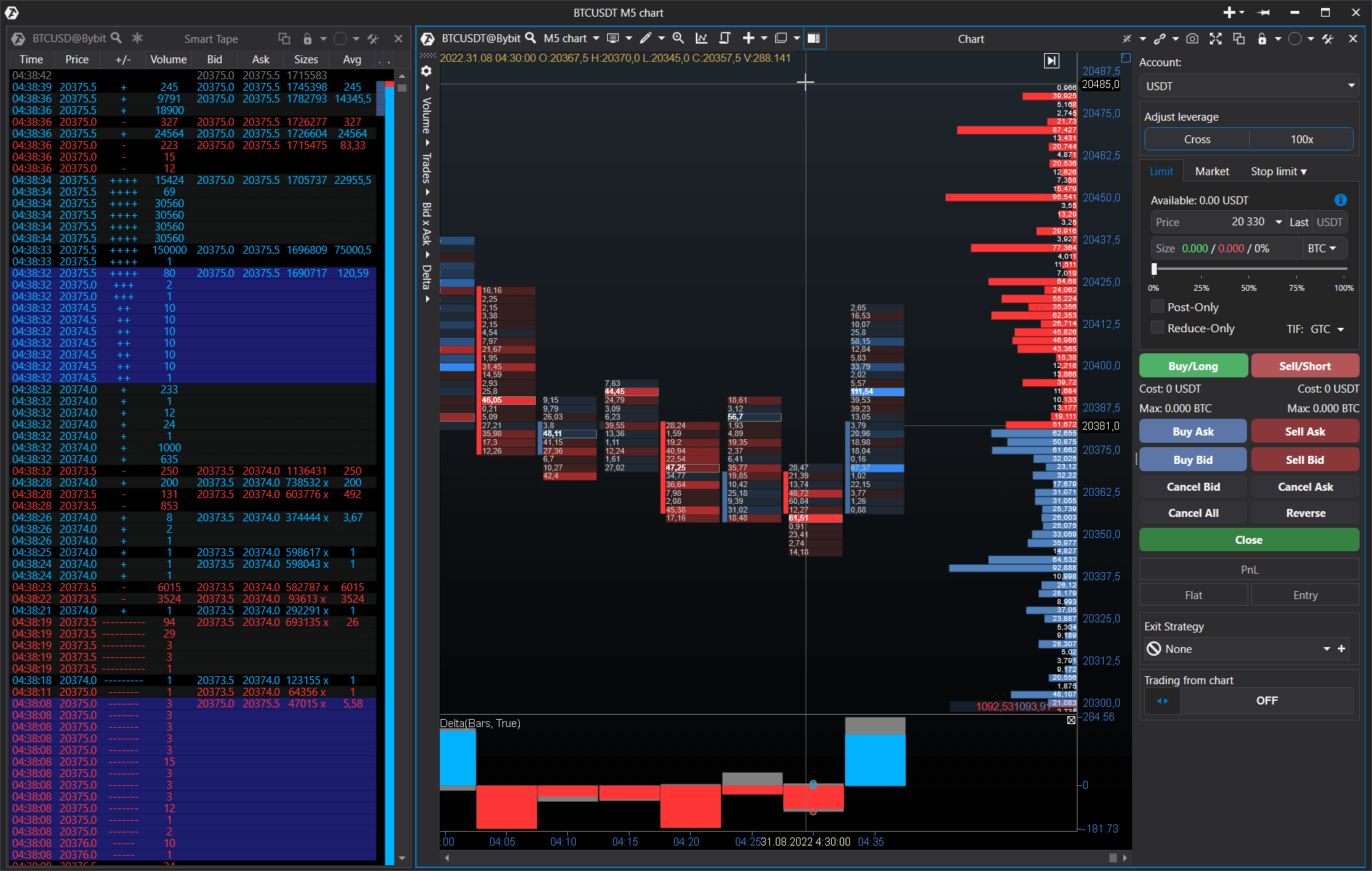

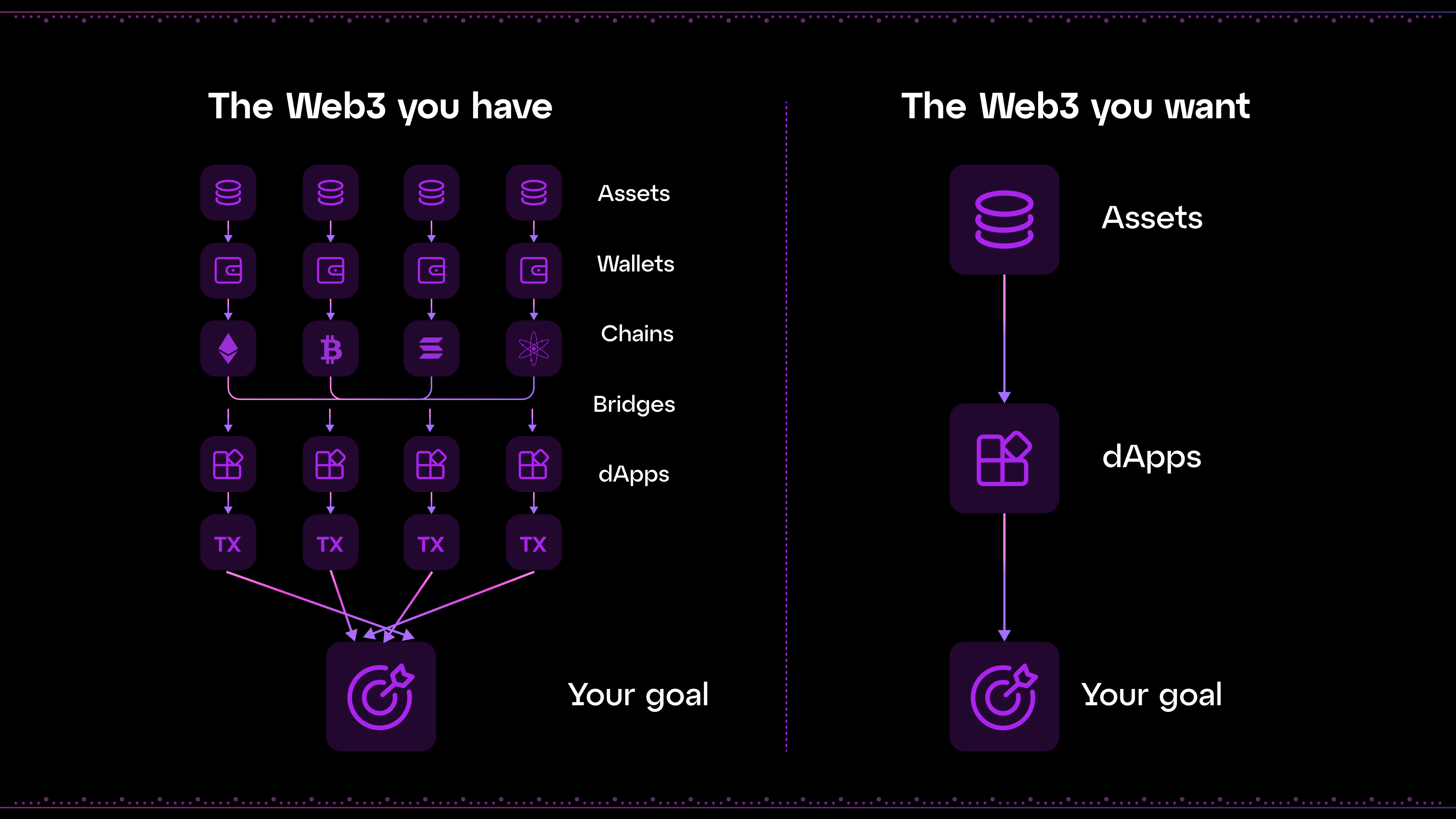

Historically, attempts to build CLOBs directly on general-purpose blockchains like Ethereum ran into significant bottlenecks. High gas fees, network congestion, and limited throughput made real-time order matching impractical. As a result, most DeFi trading gravitated toward Automated Market Makers (AMMs), which offer simplicity but sacrifice price discovery and advanced order types.

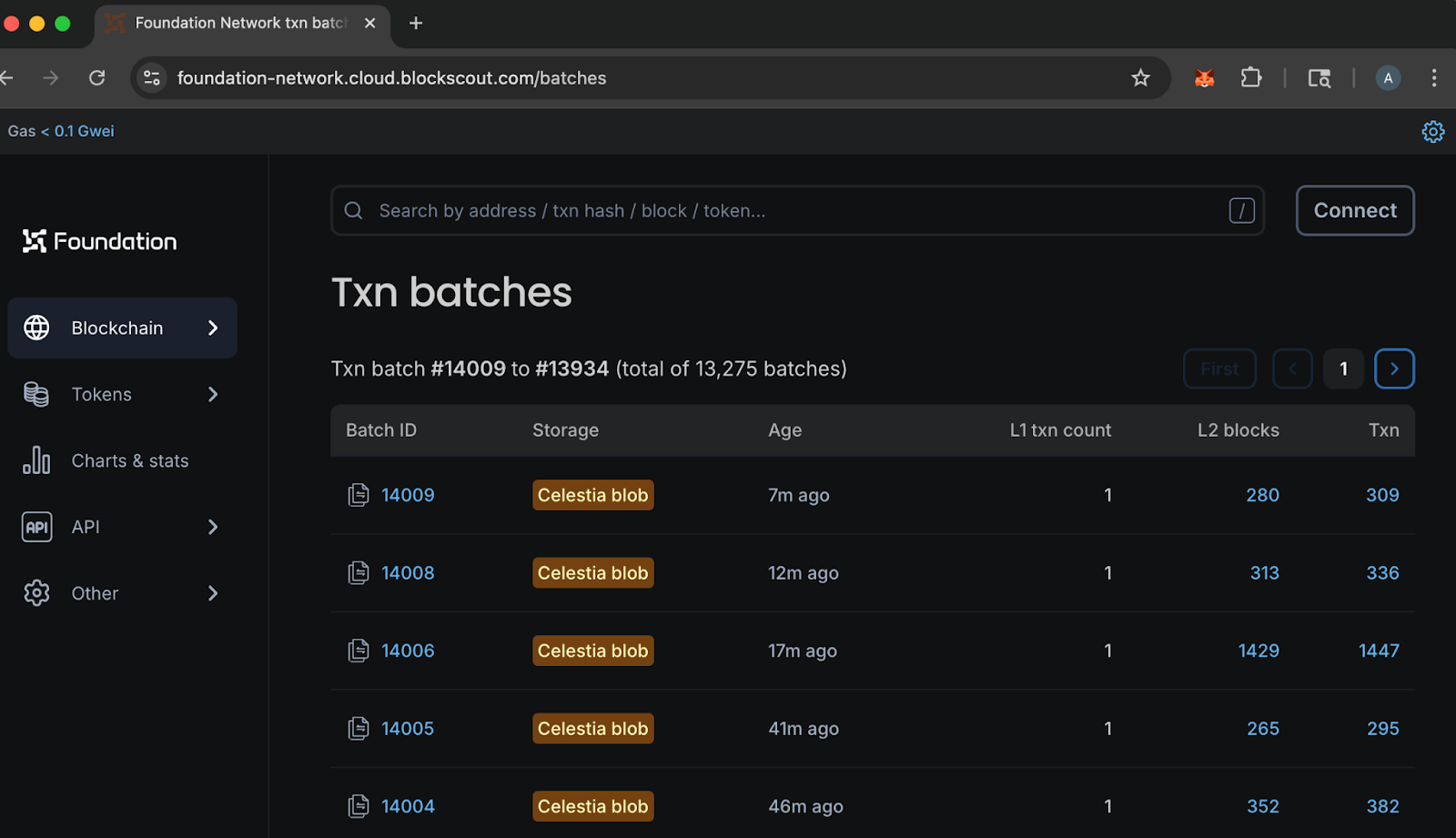

The landscape began to change with the emergence of Celestia blobs: a new form of high-capacity, low-cost data storage enabled by modular data availability layers such as Celestia. By decoupling consensus from execution, Celestia’s architecture lets developers publish vast amounts of order book data without clogging the main chain or escalating costs. This breakthrough is at the core of why “CLOBs on blobs” are gaining traction as a next-generation solution for on-chain trading.

CLOBs on Blobs: The Modular Advantage

Celestia’s Data Availability Sampling (DAS) allows nodes to efficiently verify that all transaction data, including order books and trade history, are published and available without requiring every node to store every byte. This dramatically increases throughput while preserving decentralization.

The current market reflects growing confidence in this approach: as of now, Celestia (TIA) trades at $1.42, up $0.0400 ( and 0.0290%) over 24 hours (24h high: $1.43; 24h low: $1.36). This steady performance underscores how innovations in blobspace markets are supporting real-world adoption and liquidity for new DeFi primitives built atop Celestia blobs.

Read more about how CLOBs meet Celestia in Cicada Ventures’ deep dive.

The Zero-Knowledge Proof Revolution in DeFi Trading

The other half of this transformation comes from advances in zero-knowledge proofs DeFi, particularly with solutions like Succinct Labs’ SP1 zkVM. ZKPs enable cryptographic verification that off-chain computations, such as order matching or balance updates, have been executed correctly without revealing sensitive user data or requiring every detail to be replicated on-chain.

This innovation is already powering next-generation exchanges like Hibachi, which combine encrypted trading logic with public auditability via ZKPs anchored in Celestia’s blobspace layer. The result? Blazing-fast decentralized order books where user balances stay private but all operations remain provably fair.

- Scalability: High transaction throughput without compromising security or decentralization.

- Efficiency: Lower latency and transaction costs compared to legacy blockchains.

- Privacy: Enhanced confidentiality for traders while maintaining public verifiability.

- Security: Trustless validation of off-chain computations using cryptographic proofs.

This unique synergy is what puts “CLOBs on blobs” at the forefront of modern DeFi infrastructure, and why established players and new protocols alike are racing to integrate these technologies into their platforms.

Celestia (TIA) Price Prediction 2026-2031

Forecast based on current price of $1.42 and evolving modular blockchain & ZK tech adoption

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Key Scenario |

|---|---|---|---|---|---|

| 2026 | $1.10 | $1.65 | $2.40 | +16% | Early DEX adoption, moderate DeFi growth |

| 2027 | $1.25 | $2.05 | $3.00 | +24% | Broader CLOB & ZK exchange traction |

| 2028 | $1.40 | $2.60 | $3.80 | +27% | Privacy DEXes rival CEXes, modular DA surge |

| 2029 | $1.60 | $3.30 | $5.00 | +27% | Mainstream DeFi migration, regulatory clarity |

| 2030 | $1.85 | $4.10 | $6.50 | +24% | Widespread modular blockchain adoption |

| 2031 | $2.20 | $5.00 | $8.00 | +22% | Celestia ecosystem matures, cross-chain growth |

Price Prediction Summary

Celestia (TIA) is positioned for steady growth as modular blockchains and ZK-powered CLOBs disrupt on-chain trading. The price outlook anticipates gradual adoption in the mid-term, with potential for strong upside as privacy, scalability, and data availability drive institutional and retail DeFi migration. While volatility and regulatory risks persist, Celestia’s unique architecture and growing ecosystem could see TIA outperform legacy Layer-1s if adoption trends accelerate.

Key Factors Affecting Celestia Price

- Adoption of modular blockchains and Celestia’s DA layer by DEXs and DeFi apps

- Growth in ZK proof technology and privacy-preserving trading

- Regulatory clarity around DeFi and privacy protocols

- Competition from other DA solutions (EigenDA, Avail, etc.)

- Market cycles and macroeconomic trends affecting crypto

- Sustained developer activity and ecosystem funding

- Potential for major partnerships or CEX listings

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As more projects adopt modular data availability and ZK-powered execution, the boundaries between centralized and decentralized trading experiences are quickly dissolving. The days of sluggish, costly on-chain order books are fading, replaced by platforms that offer both the transparency of DeFi and the speed of traditional finance.

SP1 zkVM and Succinct Labs: The Engine Behind Trustless On-Chain Trading

The SP1 zkVM from Succinct Labs is a general-purpose zero-knowledge virtual machine designed to make ZK proofs accessible for complex trading logic. Developers can write order matching engines or settlement algorithms in familiar languages like Rust, compile them to run in SP1, and automatically generate ZK proofs attesting to correct execution. This not only slashes the cost and complexity of verifying trades but also enables features like encrypted order flow, private balances, and customizable compliance rules, all backed by cryptographic integrity.

The impact is already visible in protocols like Hibachi, which use Celestia blobs for scalable data publication while leveraging SP1 zkVM for provable computation. By separating data availability from execution and proof generation, these systems achieve a level of modularity that was unattainable with monolithic blockchains or legacy DEX architectures.

The Competitive Edge: Blobspace Markets vs. Legacy DEXs

This new paradigm has profound implications for both users and builders:

Key Advantages of CLOBs on Celestia Blobs

-

Massive Scalability with Celestia’s Data Availability: Celestia’s modular architecture and Data Availability Sampling (DAS) enable high-throughput order book trading without congesting the main blockchain, supporting thousands of transactions per second.

-

Significantly Lower Transaction Costs: By storing order book data in Celestia blobs, exchanges benefit from drastically reduced fees compared to traditional on-chain order books on Ethereum.

-

Lightning-Fast Trade Execution: Off-chain order matching, combined with Celestia’s efficient data layer, delivers low-latency trading that rivals centralized exchanges, eliminating the slowdowns of legacy DeFi order books.

-

Enhanced Privacy with Zero-Knowledge Proofs: Integrating Succinct’s zkVM and ZK proofs allows exchanges to verify trades and balances without exposing sensitive user data, ensuring privacy while maintaining transparency.

-

Trustless Security and Verifiability: ZK proofs guarantee that off-chain computations and order matching are provably correct, removing the need for centralized trust and reducing the risk of manipulation.

-

Composable and Modular Infrastructure: Celestia’s separation of execution and data availability lets developers build customizable, interoperable DeFi platforms that can evolve rapidly without being limited by monolithic blockchain constraints.

For traders: You get advanced order types (limit, stop-loss), near-instant settlement, privacy-preserving trades, and transparent audit trails, all without surrendering custody or relying on opaque intermediaries.

For developers: Modular DA layers like Celestia mean you can scale your exchange horizontally without worrying about mainnet congestion or escalating gas fees. ZK-powered computation ensures compliance and fairness while preserving user anonymity.

Explore how Hibachi leverages Succinct’s ZK proofs with Celestia blobs

What Comes Next for On-Chain Trading Infrastructure?

The momentum behind “CLOBs on blobs” is only accelerating as more teams recognize the benefits of this modular approach. With Ethereum EIP-4844 introducing native blob support, expect to see even tighter integration between rollups, DA layers, and advanced trading engines. Projects like Succinct are already partnering across ecosystems, such as their collaboration with Offchain Labs’ Tandem, to bring zero-knowledge proving to a wider array of chains (source).

The current price action provides $1.42 for Celestia (TIA), with a daily range between $1.36 and $1.43: reflects steady growth and increasing confidence in blobspace-based infrastructure as a foundation for next-generation DeFi markets.

Celestia Technical Analysis Chart

Analysis by Ethan Carmichael | Symbol: BINANCE:TIAUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

Draw a primary downtrend line connecting the series of lower highs from the price peak in early 2025 through to the most recent price action as of late September 2025. Mark horizontal support at $1.36 (recent low) and $1.00 (psychological round number below). Place horizontal resistance lines near $1.80 (recent failed bounce) and $2.00 (prior support now resistance). Use a rectangle to highlight the consolidation range between $1.36 and $1.80 since July 2025. Add a callout on the significant volume dropoff (if visible) in the latter half of the year. Annotate a potential accumulation zone between $1.36-$1.50. Mark arrow_mark_downs at failed breakout attempts near $2.00 and arrow_mark_ups at the most recent support test near $1.36.

Risk Assessment:high

Analysis: The technical structure is deeply bearish, with no confirmed reversal.

While there are some signs of potential accumulation, downside risk remains pronounced,

especially if $136 fails.

Fundamentals are promising but will take time to translate into market confidence.

Ethan Carmichael’s Recommendation: Remain on the sidelines unless you have a long-term fundamental thesis and are comfortable with elevated volatility and drawdown risk.

Any entries at current levels should be small,

tightly risk-managed,

and only for investors with a multi-year horizon.

Key Support & Resistance Levels

📈 Support Levels:

$136 – Recent local low and current support zone.

moderate

$1 – Psychological round number,

possible ultimate support if current level fails.

strong

📉 Resistance Levels:

$18 – Resistance from recent failed bounces.

moderate

$2 – Major breakdown level and prior support,

now resistance.

strong

Trading Zones (low risk tolerance)

h five

style=

c o l o r:

hash two five six three e b

;m argin-b ottom:

five-tenths-rem;”>🎯 Entry Zones:

ul s t y l e=

l i s t-s t y l e:

n o n e;

padding:

z e r o;

m argin:

z e r o;”>

only suitable for low-risk,

l ong-term entries.

s pan s t y l e=

b ackground-c olor:

hash f five nine e zero b;

c o l o r:w hite;p adding:

one eighth-rem three eighths-rem;b order-r adius:t w enty-five-hundredths-rem;font-size:s eventy-five-hundredths-rem;m argin-l eft:f ive-tenths-rem;’>medium risk

ul s t y l e=l ist-s tyle:n one;p adding:z ero;m argin:z ero;’>

How to Get Involved in Blobspace Markets Today

If you’re interested in participating in this new era of decentralized trading infrastructure:

- Dive into developer docs: Start building with Celestia blobs or integrate SP1 zkVM into your protocol stack.

- Experiment on live DEXs: Platforms like Hibachi offer hands-on experience with high-speed CLOB trading powered by modular DA.

- Monitor blobspace analytics: Use tools from Blobspace Markets to track market trends, liquidity shifts, and pricing anomalies unique to blob-enabled exchanges.

- Join the conversation: Engage with communities driving innovation at the intersection of modular blockchain design and privacy-preserving computation.

The convergence of Celestia’s scalable data layer with Succinct’s ZK proof systems signals a fundamental shift in how we build trustless financial markets. As these technologies mature, and as prices like TIA’s current $1.42 reflect growing adoption, the future of DeFi looks faster, fairer, and more secure than ever before.