How CLOBs on Celestia Blobs and ZK Proofs Are Transforming On-Chain Trading

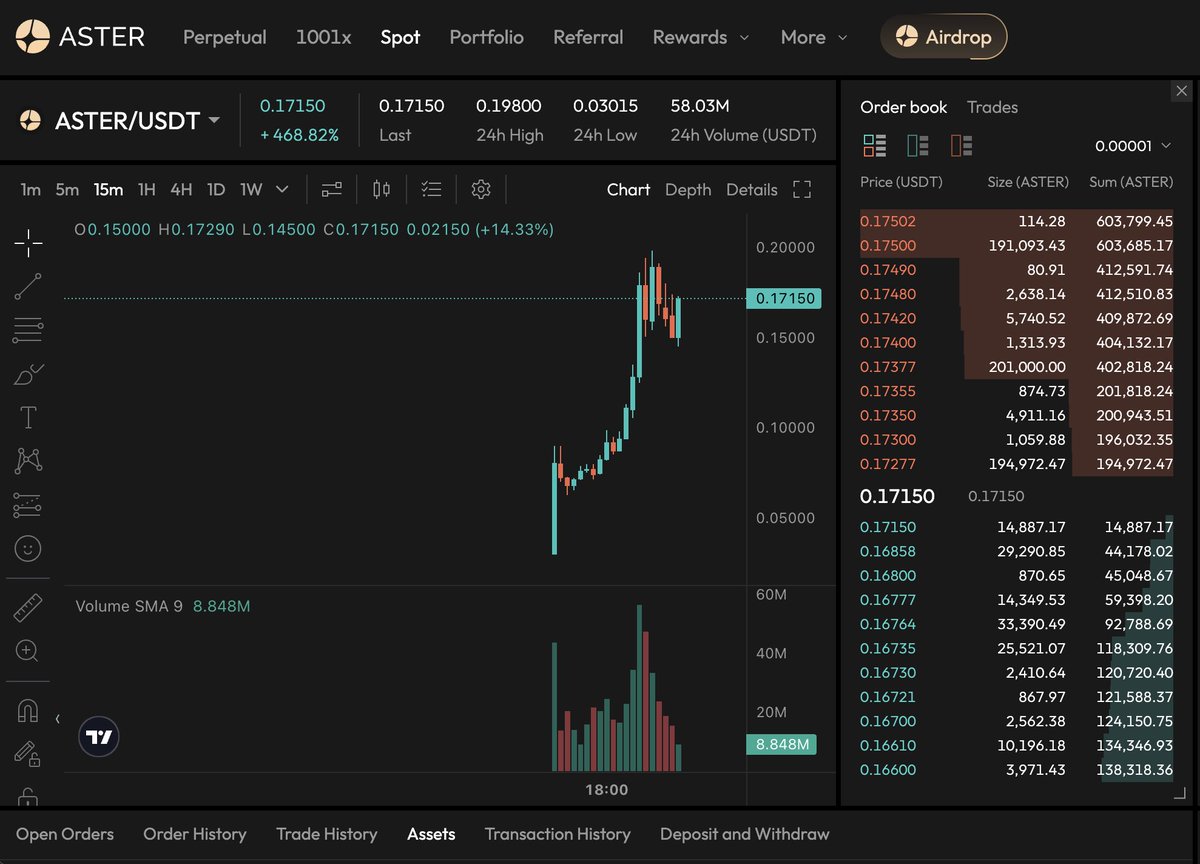

Central Limit Order Books (CLOBs) have long been the gold standard in traditional finance for matching buyers and sellers efficiently, but bringing this model on-chain has always been a technical headache. High gas fees, limited throughput, and privacy concerns have kept DeFi order books lagging behind their centralized counterparts. But the combination of Celestia’s modular data availability (DA) layer and zero-knowledge (ZK) proofs is rapidly changing the game, unlocking a new era for on-chain trading.

Celestia Blobs: The Backbone of Scalable On-Chain Order Books

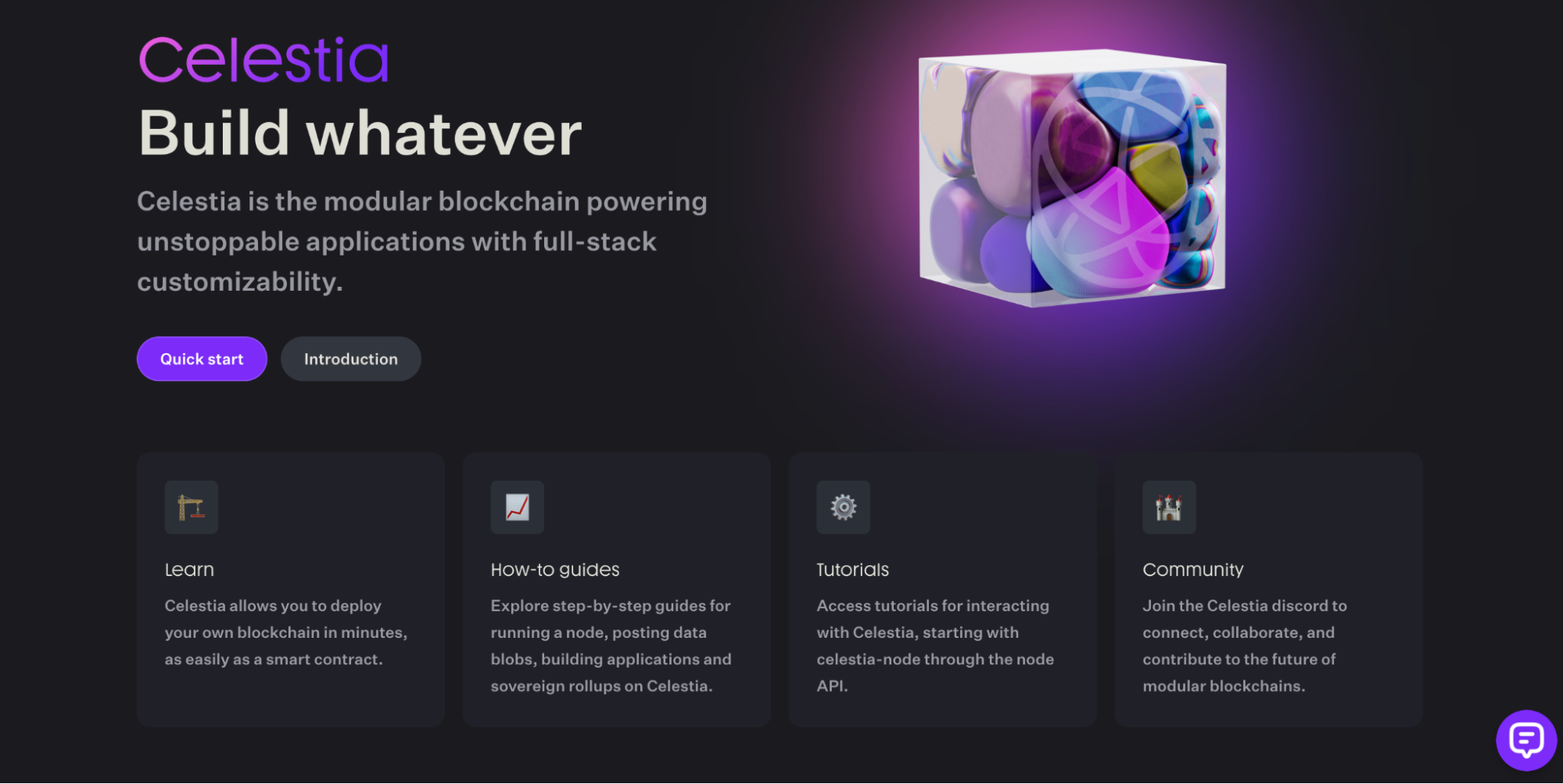

Celestia’s approach to blockchain architecture is simple yet radical: decouple consensus and data availability from execution. This separation allows for specialized layers that can scale independently. At the heart of this design are blobs: large, cheap data packets posted directly to Celestia’s DA layer. These blobs don’t need to be executed or interpreted by validators; they’re simply made available for anyone to download and verify.

This model is tailor-made for high-frequency trading systems like CLOBs. Instead of cramming every trade into expensive smart contract storage, exchanges can batch orders, trade history, and state deltas into blobs. The result? Dramatic reductions in on-chain costs and a massive boost in throughput, exactly what DeFi needs to compete with the speed of centralized exchanges.

Zero-Knowledge Proofs: Fast Matching Without Sacrificing Privacy

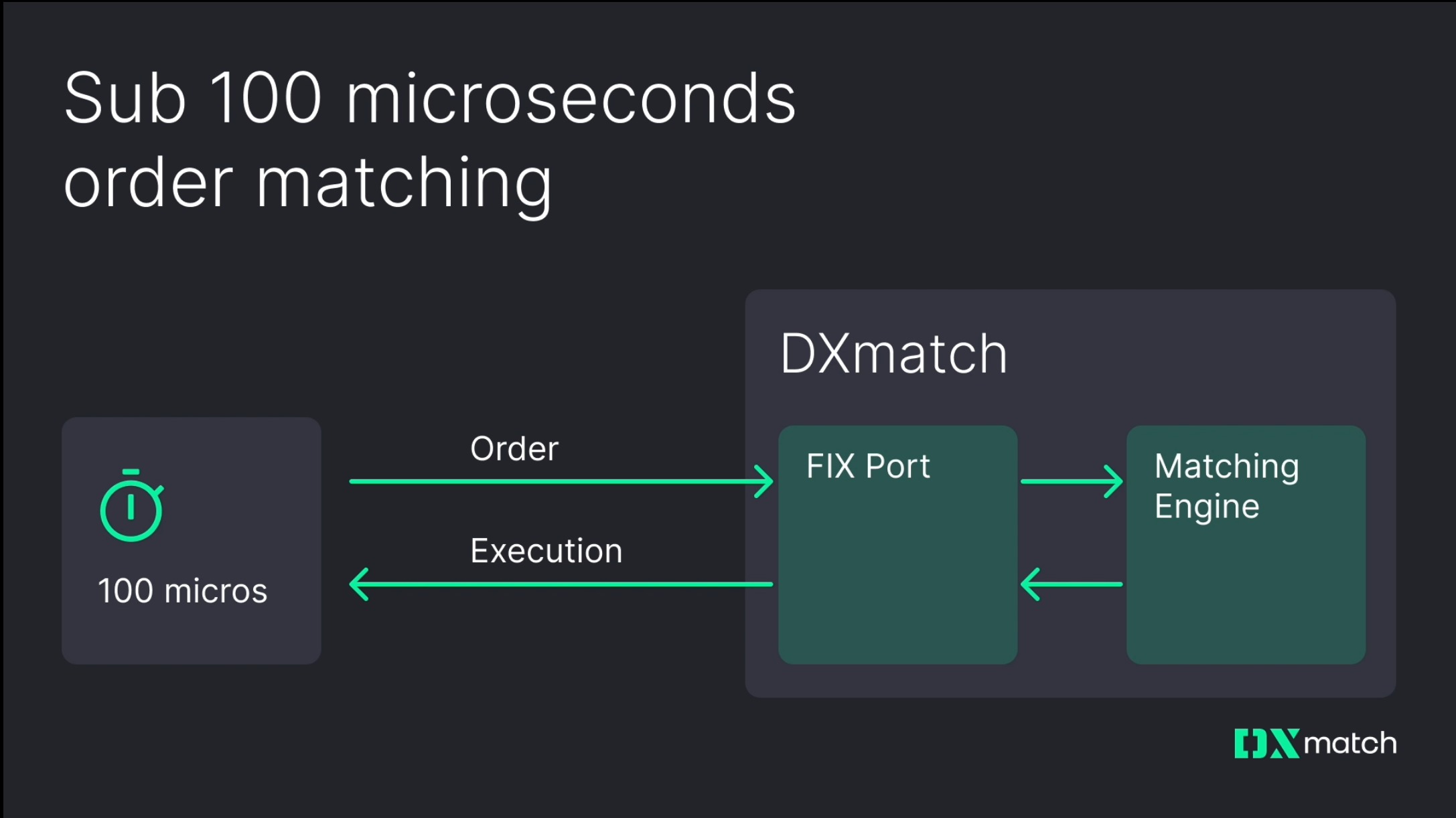

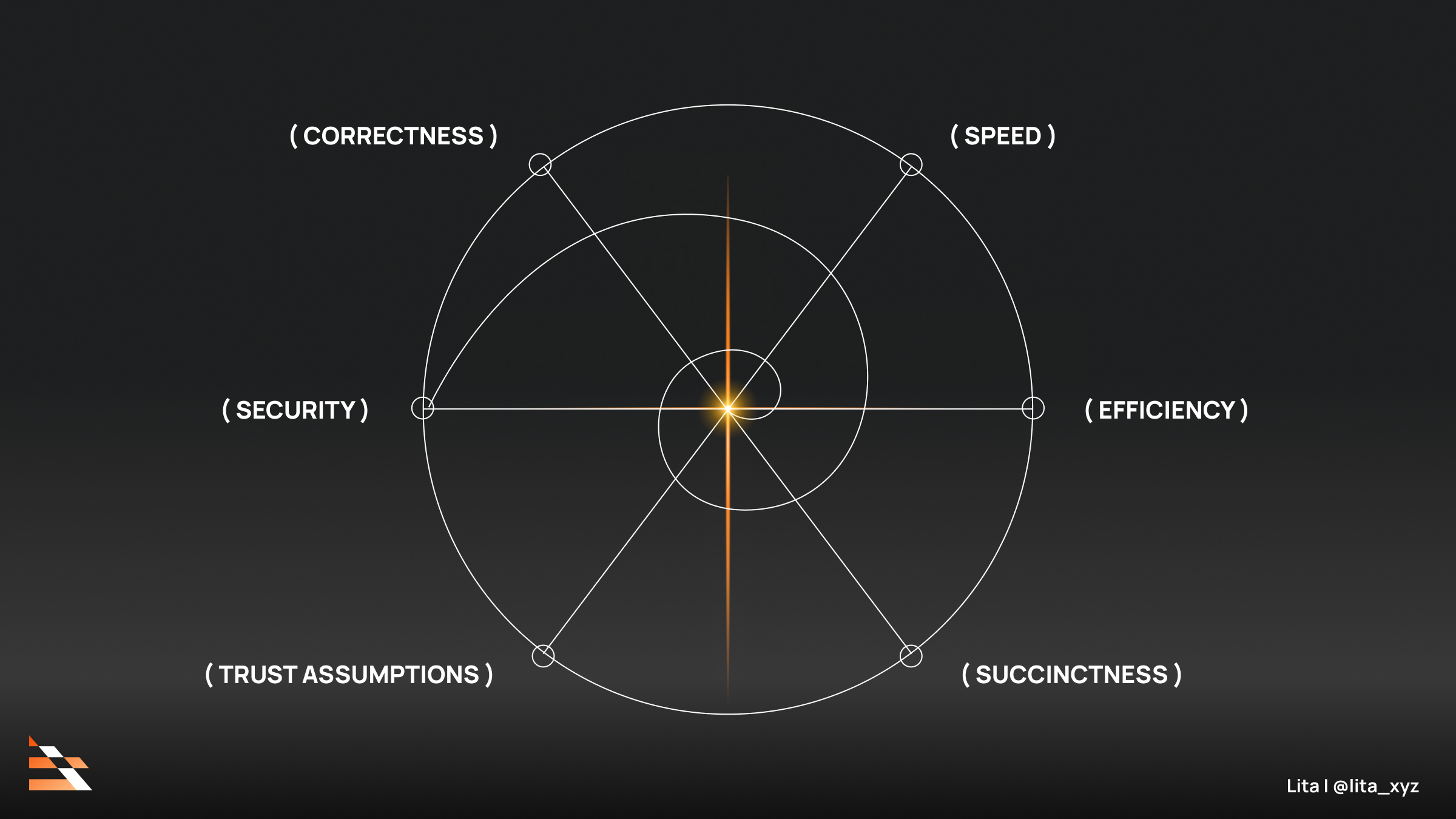

The next piece of the puzzle is off-chain computation verified by ZK proofs. Projects like Succinct’s zkVM are pioneering architectures where order matching happens off-chain at lightning speed, but every match is provably valid thanks to zero-knowledge circuits. Instead of trusting a centralized engine or exposing wallet addresses and positions, users get cryptographic guarantees that all trades followed the rules, without revealing sensitive details.

This isn’t just theory; it’s already live in protocols like Hibachi DEX. Here’s how it works:

How Hibachi Uses Off-Chain Matching with ZK Proofs on Celestia

-

Traders submit orders to Hibachi’s off-chain matching engine. Users place buy and sell orders, which are collected and managed by Hibachi’s off-chain central limit order book (CLOB) for fast and efficient matching.

-

Orders are matched off-chain for high-speed execution. The off-chain engine rapidly matches orders, ensuring deep liquidity and low latency similar to centralized exchanges, but without sacrificing decentralization.

-

A zero-knowledge (ZK) proof is generated for each batch of matched trades. Hibachi uses technologies like Succinct’s zkVM and SP1 to create compact proofs that all trades followed protocol rules, without revealing sensitive user data.

-

Encrypted trade data and ZK proofs are posted as blobs to Celestia’s data availability layer. The matched trade data and proofs are bundled into encrypted blobs, then submitted to Celestia, ensuring data is available and tamper-proof at low cost.

-

On-chain smart contracts verify ZK proofs and update user balances. Hibachi’s contracts on Ethereum or other supported chains validate the proofs posted on Celestia, then securely update trader balances and positions on-chain.

This approach ensures that even as orderbooks remain transparent and auditable, individual traders’ strategies and positions stay hidden from prying eyes, a critical upgrade over today’s traceable DeFi landscape.

The Synergy: CLOBs on Blobs with ZK = Next-Level DeFi Trading

The real magic happens when you combine these innovations:

- Scalability: Offloading trade data to Celestia blobs plus off-chain computation verified by ZK proofs means exchanges can process thousands of trades per second without clogging up mainnet blockspace.

- Cost Efficiency: Cheap blob storage lets high-frequency traders operate profitably at scale, no more death by gas fees.

- User Privacy: Zero-knowledge circuits keep wallet addresses and positions confidential while still proving trades are fair.

- Security: Trustless settlement with cryptographic guarantees replaces reliance on centralized intermediaries or opaque matching engines.

This isn’t just incremental progress, it’s a leap toward trustless exchanges matching the performance of their centralized peers without compromising security or decentralization. As more projects adopt this stack, expect to see an explosion in both liquidity and innovation across the Celestia blobspace trading ecosystem.

What’s especially compelling is how these advances address the persistent trade-off between transparency and privacy in DeFi. Traditional DEXs using on-chain CLOBs have been forced to expose wallet addresses and trade histories, making it trivial for adversaries to track positions or front-run strategies. With CLOBs on blobs and ZK proofs, the order book itself remains public and auditable, but the identities and positions of traders are cryptographically shielded. This is a game-changer for institutional participants and high-volume traders who’ve previously avoided DeFi due to privacy risks.

As these technologies mature, we’re seeing an emerging pattern: hybrid order matching. Here, trades are matched off-chain for speed, then settled on-chain via compact ZK proofs posted as encrypted blobs to Celestia. This hybrid model blends the best of both worlds – deep liquidity and instant execution with non-custodial settlement and verifiable fairness.

Real-World Adoption: Protocols Leading the Charge

Projects like Hibachi aren’t just theoretical showcases; they’re actively demonstrating what’s possible when modular data availability meets cutting-edge cryptography. Hibachi batches its state changes (balances, fills, cancels) into encrypted blobs posted to Celestia’s DA layer. It then uses SP1 to generate succinct ZK proofs that all trades obeyed protocol rules, proofs that can be verified by anyone without revealing sensitive information. For users, this means:

Key Benefits of CLOBs on Blobs with ZK Proofs for Traders

-

High-Speed, Low-Cost Trading: Leveraging Celestia’s blobs for data availability enables rapid order processing and settlement with minimal fees, making high-frequency trading economically feasible for everyone.

-

Enhanced Privacy and Security: Zero-knowledge proofs validate trades without exposing wallet addresses or trading strategies, protecting trader identities and sensitive positions on-chain.

-

Trustless, Verifiable Trade Execution: Off-chain order matching engines, such as those used by Hibachi, generate cryptographic proofs to ensure all trades follow protocol rules, removing the need to trust a centralized party.

-

Deep Liquidity and Efficient Price Discovery: Central Limit Order Books (CLOBs) allow traders to access aggregated liquidity and transparent orderbooks, leading to tighter spreads and more competitive pricing—now possible on-chain thanks to Celestia and ZK tech.

-

Scalability Without Compromising Decentralization: By separating execution and data availability, Celestia’s modular architecture lets DeFi platforms scale to handle thousands of trades per second while preserving the core principles of decentralization.

And it’s not just Hibachi. The broader Celestia ecosystem is rapidly expanding as more protocols recognize the efficiency gains of blobspace trading paired with zero-knowledge security. With Blobstream now streaming modular DA to Ethereum rollups as well, there’s a growing bridge between ecosystems, enabling even greater composability and liquidity flow.

What Comes Next?

Expect competition among DEX protocols to heat up as they race to capture new liquidity using these tools. We’ll likely see:

- More sophisticated privacy-preserving features built directly into trading UIs

- Automated market makers (AMMs) experimenting with blob-based state storage for efficiency

- Rollups leveraging Celestia blobs for ultra-cheap data posting, fueling new high-frequency markets

The bottom line? The fusion of modular data availability and zero-knowledge computation isn’t just an incremental upgrade, it’s a catalyst for a new generation of trust-minimized financial infrastructure. In this landscape, power users can finally enjoy deep liquidity, low fees, fast execution, and strong privacy, all at once.