How Blobspace Markets Enable Hedging Data Availability Fees with Blob Perpetuals

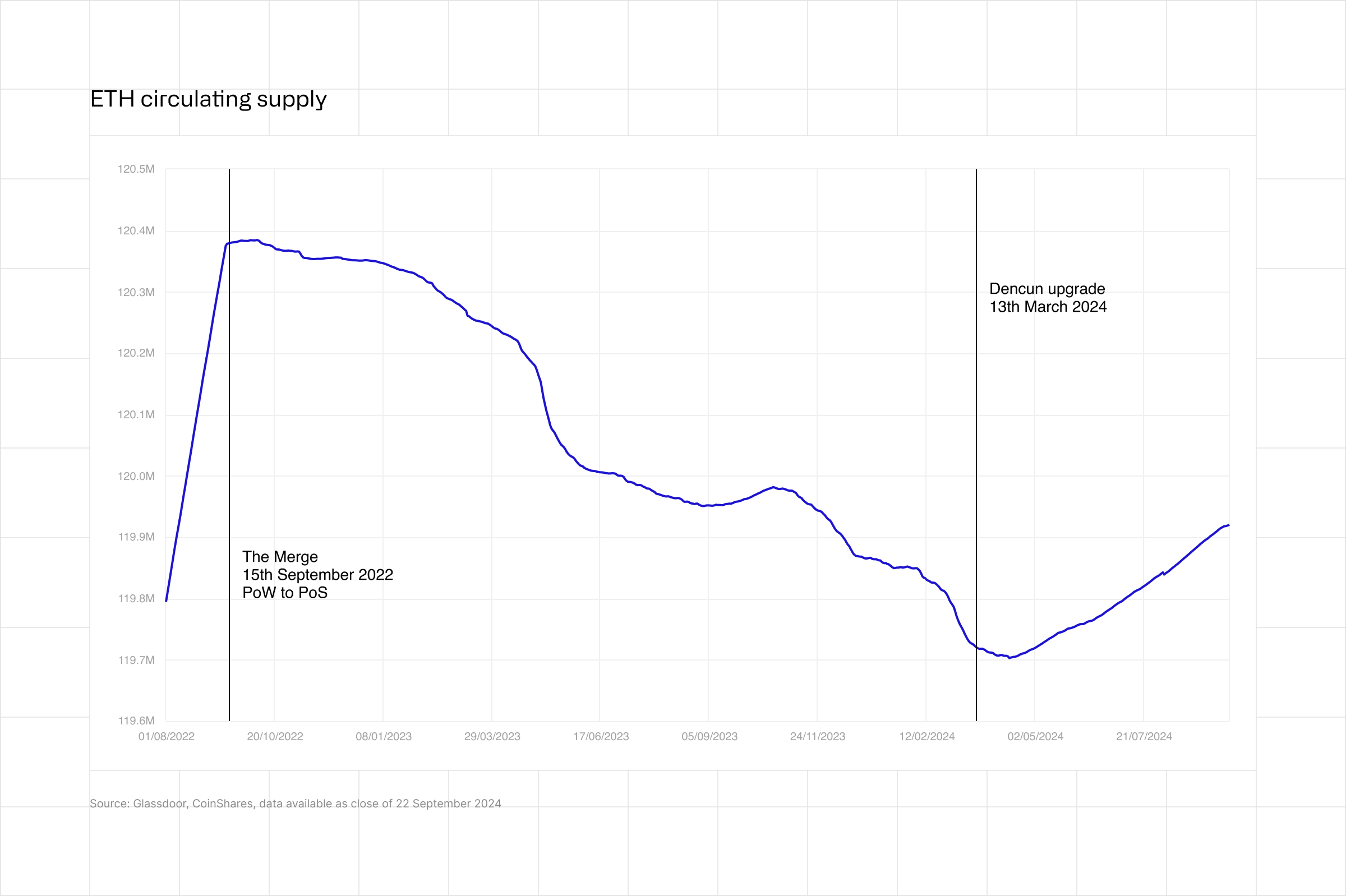

As the modular blockchain ecosystem matures, efficient management of data availability (DA) costs is becoming a top priority for rollups and decentralized applications. Ethereum’s introduction of blob transactions via EIP-4844 has already slashed DA costs for Layer 2s, but as activity increases and blobspace fees fluctuate, unpredictable expenses threaten to erode these savings. Enter blob perpetuals: innovative financial instruments designed to help projects hedge against blobspace fee volatility and lock in predictable operational costs.

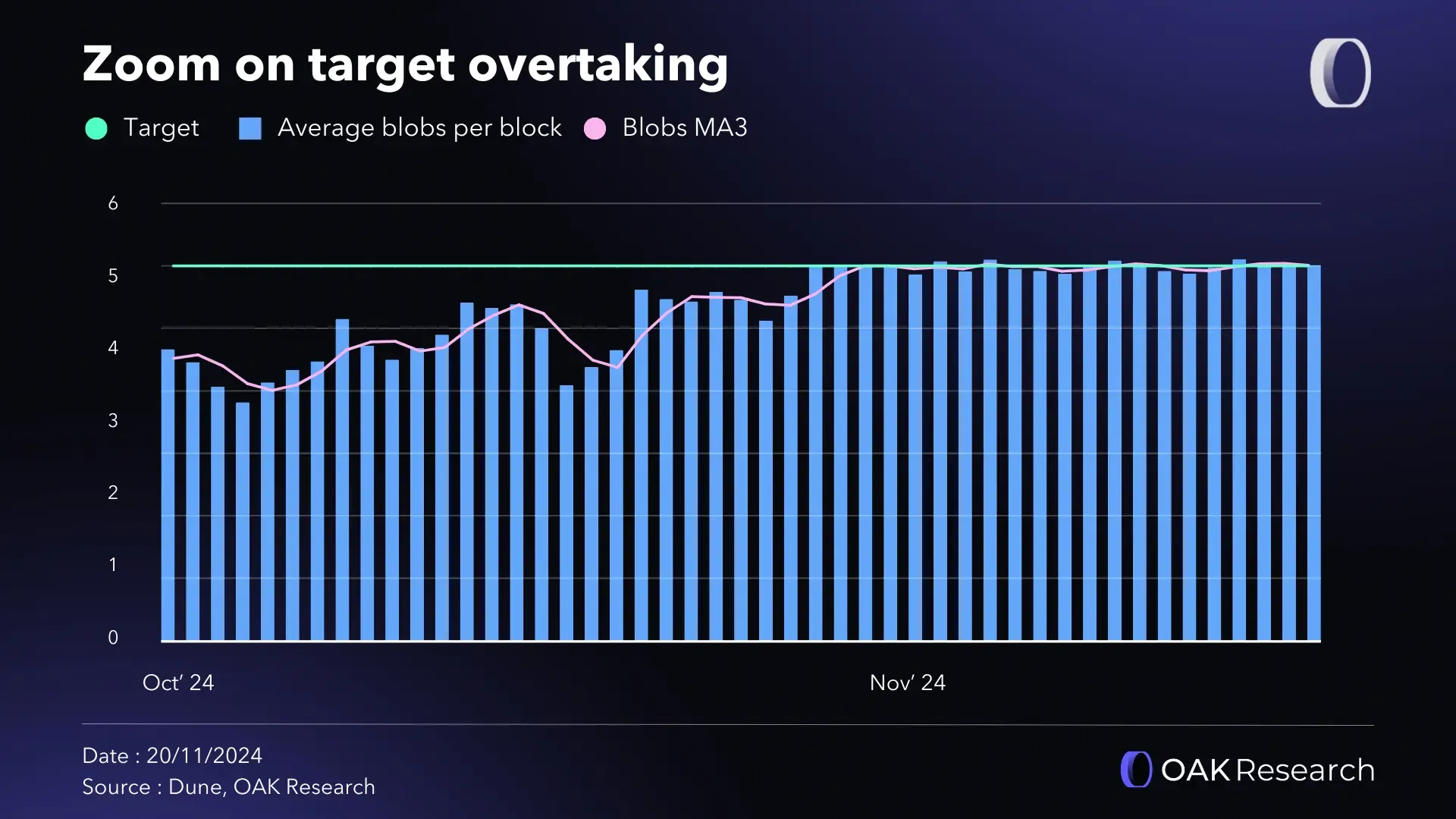

Understanding Blobspace Fee Volatility

Blobspace is the digital real estate where rollups post their transaction data for validators to verify. On Ethereum, the debut of blobs has led to remarkable cost reductions for L2s – Base’s DA expenses, for example, plummeted from $9.34 million in Q1 2024 to just $42,000 in Q3 2024 (blockworks.co). However, this new fee market is dynamic: as demand grows, so do prices. Recent months have seen a resurgence in blobspace fees as on-chain activity accelerates.

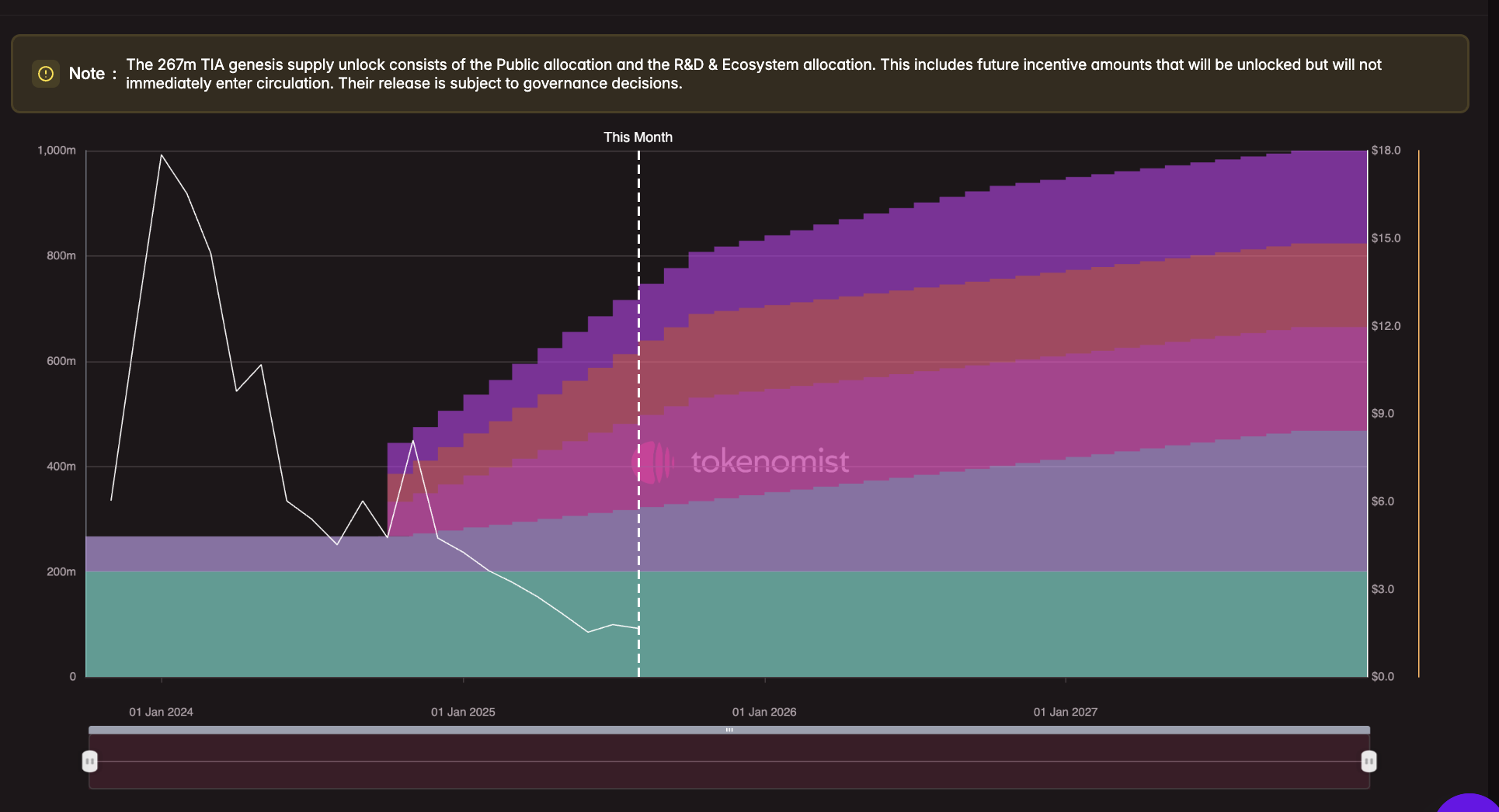

Celestia offers an alternative with even lower DA costs: $7.31 per MB versus Ethereum’s $20.56 per MB over comparable periods (conduit.xyz). Yet even Celestia’s modular architecture can’t fully shield users from market-driven price swings as usage surges and blob sizes ballooned by 10x in 2025 (theblock.co).

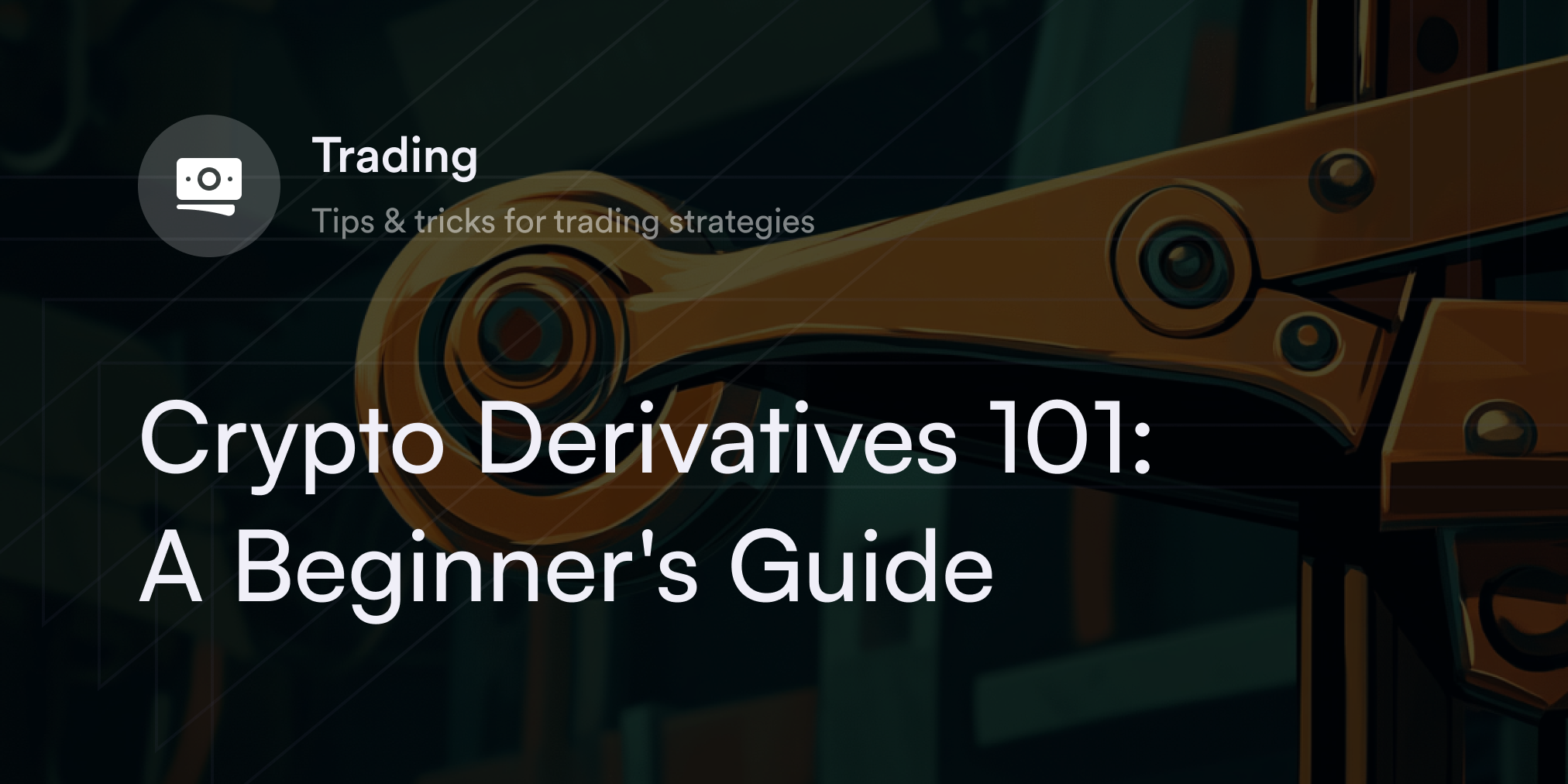

What Are Blob Perpetuals?

Blob perpetuals are derivatives that allow users – especially rollup operators – to hedge against unpredictable DA expenses by locking in a fixed price for future blobspace usage. Think of them as insurance contracts: when you enter a blob perpetual agreement, you agree to pay (or receive) a set fee per MB regardless of future spot prices.

Key Benefits of Blob Perpetuals for L2 Operators

-

Hedge Against Blobspace Fee Volatility: Blob perpetuals allow L2 operators to lock in blobspace costs, providing protection from unpredictable fee spikes as on-chain activity increases. This helps maintain financial stability even when Ethereum blob fees fluctuate.

-

Enable Predictable Operational Expenses: By utilizing blob perpetuals, L2s can secure a fixed rate for data availability, making it easier to forecast and manage ongoing expenses. This predictability is crucial for budgeting and long-term planning.

-

Support Stable User Pricing: With hedged data availability costs, L2s can offer more consistent transaction fees to their users, enhancing user experience and trust in the platform.

-

Facilitate Scalable Growth: As demand for blobspace grows and fees rise, blob perpetuals help L2s scale confidently without sudden increases in costs undermining their business models.

-

Promote Advanced Risk Management: The emergence of blob perpetuals and similar derivatives gives L2s access to sophisticated financial tools, aligning blockchain operations with best practices in traditional finance for risk mitigation.

This approach brings much-needed predictability to budgeting and helps maintain stable transaction fees for end-users. As data availability hedging becomes more sophisticated, we’re witnessing the emergence of entire blob markets trading, where speculators and infrastructure providers alike can take positions on the future price of data blobs.

The Mechanics: How Hedging Works in Practice

The core idea behind DA hedging with blob perpetuals is simple but powerful: mitigate risk by transferring exposure to those more willing or able to bear it. For example, if a rollup expects higher blobspace fees due to upcoming protocol upgrades or increased user activity, it can purchase blob perpetuals at today’s rate ($7.31 per MB on Celestia) and safeguard its margins should prices spike.

The other side of these contracts might be taken by speculators betting on lower future fees or infrastructure providers seeking steady income streams. This dynamic creates a robust marketplace that absorbs shocks and smoothes out the wild swings characteristic of nascent crypto sectors.

The Rise of Blobspace Derivatives Markets

The development of Celestia blobspace futures, capacity auctions, and other advanced derivatives promises even greater flexibility for risk management going forward (mirror.xyz). Researchers are actively exploring mechanisms that will let L2s dynamically size their hedges based on transaction volume forecasts or network congestion signals – all while maintaining security through innovations like data availability sampling (DAS).

As the landscape evolves, blob perpetuals are set to become a cornerstone of operational strategy for both established and emerging rollups. The ability to lock in blobspace costs at $7.31 per MB on Celestia, compared to Ethereum’s $20.56 per MB, is not just an efficiency gain, it’s a competitive advantage (conduit.xyz). This pricing certainty empowers projects to plan for growth, absorb user surges, and avoid passing unpredictable fees onto their communities.

Beyond cost control, these markets foster a new class of participants, speculators, liquidity providers, and DA risk managers, who help deepen liquidity and improve price discovery. As more L2s adopt blob perpetuals and similar instruments, we’re likely to see increased sophistication in hedging strategies. For example, some may layer blobspace futures with spot purchases or participate in rollup DA capacity futures auctions to optimize for both cost and flexibility.

What’s Next? Opportunities and Considerations

The rapid expansion of Celestia’s blobspace market, driven by 10x increases in blob sizes and a 60% rise in transactions (theblock.co): signals growing demand for robust hedging tools. As these instruments mature, several key opportunities and considerations emerge:

Emerging Trends in Celestia Blobspace Derivatives

-

Growth of Blob Perpetuals for Fee Hedging: Platforms like Celestia are seeing increased interest in blob perpetuals, enabling Layer 2s to lock in blobspace costs and manage fee volatility. This helps maintain predictable expenses as blobspace fees fluctuate with network demand.

-

Integration of Blobspace Derivatives on Decentralized Derivatives Exchanges: Leading DeFi protocols such as dYdX and Perpetual Protocol are exploring or have launched blobspace fee markets, allowing users to speculate or hedge on data availability costs.

-

Cross-Chain Data Availability Derivatives: With Blobstream bridging Celestia’s data availability to Ethereum, new derivatives are emerging that let users hedge or arbitrage between Celestia and Ethereum blobspace fees, leveraging Celestia’s current cost advantage ($7.31 per MB vs. Ethereum’s $20.56 per MB).

-

Institutional Adoption of Blobspace Risk Management Tools: As data availability becomes a core infrastructure cost, institutional players and large rollups are adopting blobspace futures and options to stabilize operational costs and offer predictable pricing to their users.

-

Development of Data Availability Indexes: Analytics providers like Dune Analytics are creating indexes tracking blobspace prices across networks, giving traders and L2 operators new benchmarks for derivative products and fee forecasting.

Security remains paramount: The underlying safety of these financial products depends on the integrity of Celestia’s data availability sampling (DAS) mechanism. Innovations like Blobstream are making it possible to scale DA securely as the network grows (eclipselabs.io). Still, participants must stay vigilant about smart contract risks and evolving market dynamics.

Transparency is crucial: Open access to real-time pricing data and analytics will be essential for healthy markets. Platforms like Blobspace Markets can play a pivotal role by offering dashboards that track spot prices, perpetual rates, open interest, and settlement history, empowering users with actionable insights rather than just raw numbers.

Getting Involved: Navigating Blob Perpetuals as an L2 or Trader

If you’re a rollup operator or DeFi builder considering participation in these markets, start by assessing your historical data usage patterns and fee sensitivity. Use this information to size your hedge appropriately, over-hedging can be costly if prices fall while under-hedging leaves you exposed to spikes.

For independent traders or liquidity providers eyeing blob markets trading, focus on understanding the drivers behind blobspace demand: upcoming protocol upgrades, L2 migration waves, or even macro-level crypto sentiment shifts can all impact pricing. Staying ahead of these trends gives you an edge when taking positions or providing liquidity.

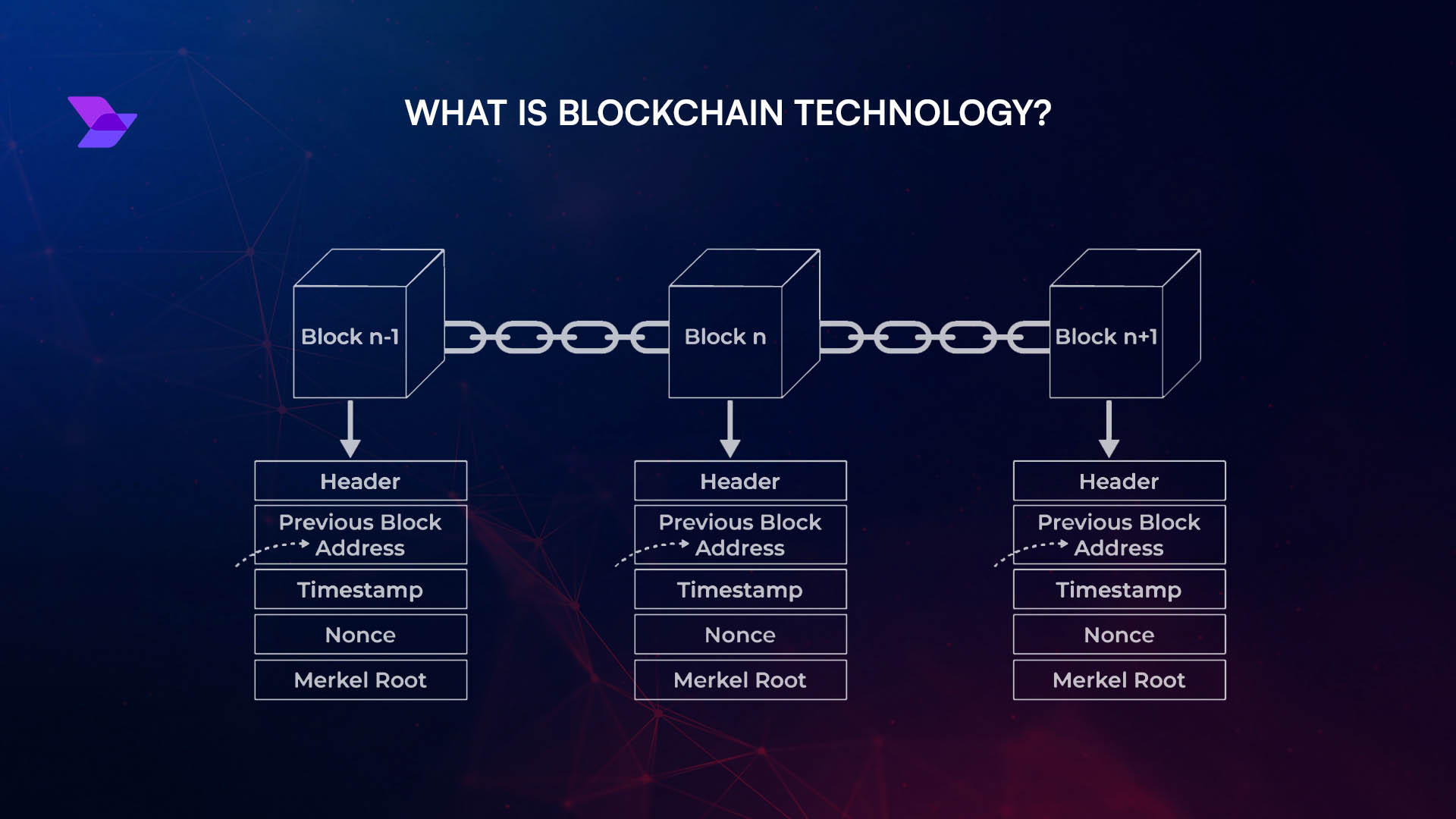

The Big Picture: Modular Blockchains Meet Modern Risk Management

The convergence of modular blockchain architecture with advanced financial engineering is opening up new frontiers for scalability, and sustainability, in Web3 infrastructure. By leveraging tools like blob perpetuals and capacity futures, projects can transform volatile DA expenses into manageable line items while unlocking deeper market participation.

This is only the beginning. As research accelerates and adoption widens across Ethereum rollups and Celestia-based ecosystems alike, expect even more creative hedging products tailored to diverse needs, from dynamic fee ceilings to cross-chain DA insurance pools.