Celestia Blobs vs. Ethereum Blobs: Key Differences for Data Traders

For data traders and blockchain developers, the arrival of “blobs” on both Celestia and Ethereum has redefined how we think about data availability, scalability, and cost efficiency. But beneath the shared terminology, these two ecosystems have taken radically different approaches – and the implications for trading, storing, and analyzing blockchain data are huge. Today we’ll break down Celestia blobs vs Ethereum blobs with a focus on what matters most to market participants: price, permanence, throughput, and integration flexibility.

Data Availability: Permanent vs. Ephemeral Blobs

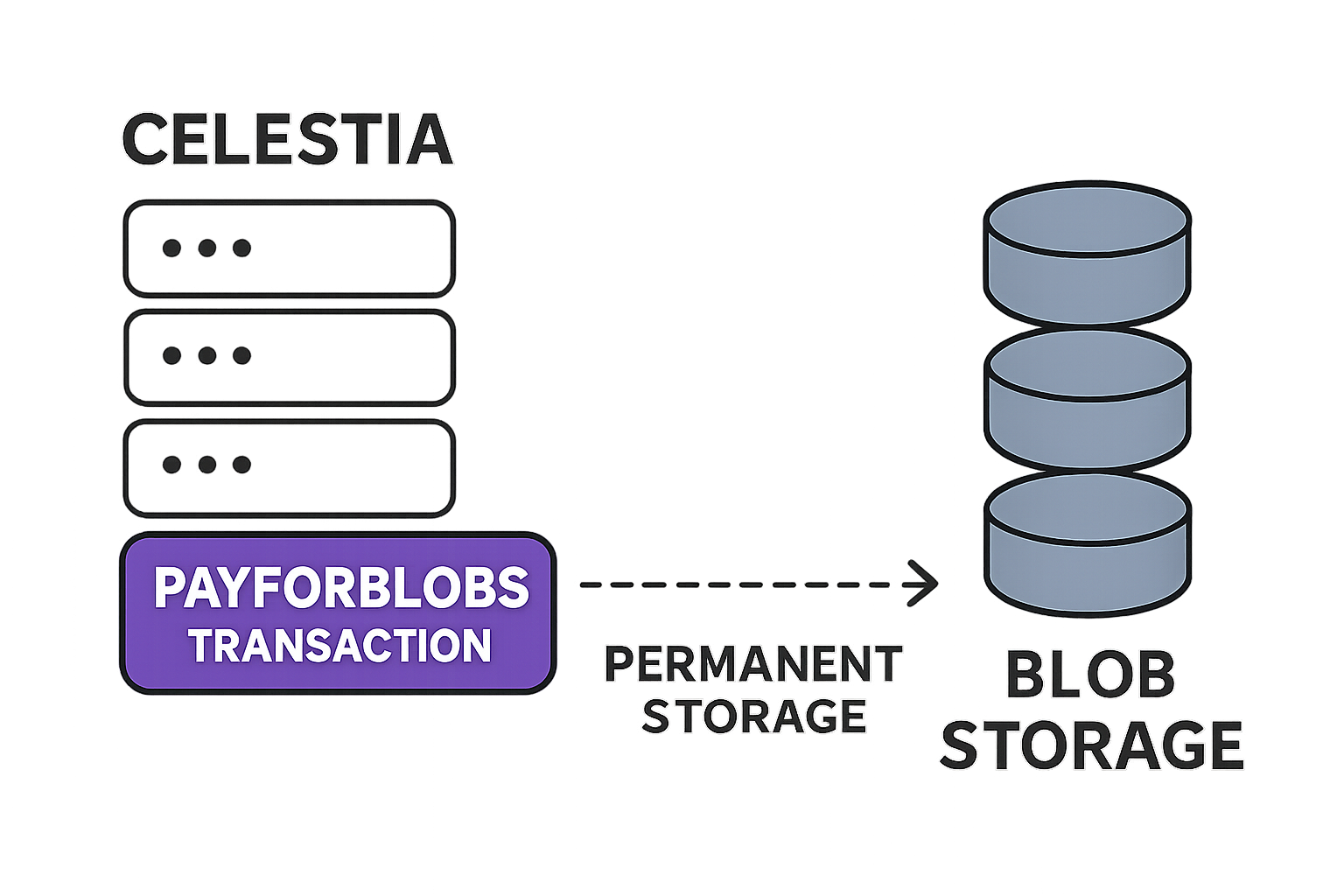

The most fundamental difference between Celestia’s and Ethereum’s blob architectures is how long your data actually sticks around. On Celestia, blobs are permanent residents. Once a blob is published via a PayForBlobs transaction, it gets encoded for redundancy (using erasure coding) and is secured through Merkleization – meaning its data root commitment becomes part of the block header itself. This makes every Celestia blob indefinitely available for verification or retrieval.

Ethereum’s EIP-4844 blobs take a different approach. To keep storage demands manageable on Ethereum nodes, these blobs are only accessible for a limited window (typically 14 days) before being pruned from the network. While this ephemeral model helps with scalability in the short run, it means traders or protocols needing to reference old data will need to look elsewhere.

Cost Comparison: The Real-Time Price Gap

If you’re trading or deploying rollups at scale, costs add up fast. Here’s where current market data paints a striking picture:

Celestia vs. Ethereum: Blob Posting Price Differences

-

Celestia blobs cost $7.31 per MB—64% cheaper than Ethereum. Across the full time period analyzed, posting data to Celestia’s modular data availability layer averages $7.31 per megabyte, while Ethereum blobs average $20.56 per megabyte for the same period. This substantial cost difference is a key factor for data traders and rollup developers choosing a DA solution.

-

SuperBlobs on Celestia drive costs even lower—to $0.81 per MB. Celestia’s SuperBlobs feature enables bulk data posting at a fraction of the standard rate, with fees dropping to just $0.81 per megabyte. This innovation makes large-scale data posting dramatically more affordable for high-throughput rollups and applications.

-

Ethereum blob prices fluctuate—recently averaging $66.88 per MB. On a 7-day rolling average, Ethereum blobs have cost $66.88 per megabyte, reflecting higher demand and competition for block space. In contrast, Celestia blobs have averaged just $0.10 per megabyte over the same period, highlighting Celestia’s cost advantage for data availability.

-

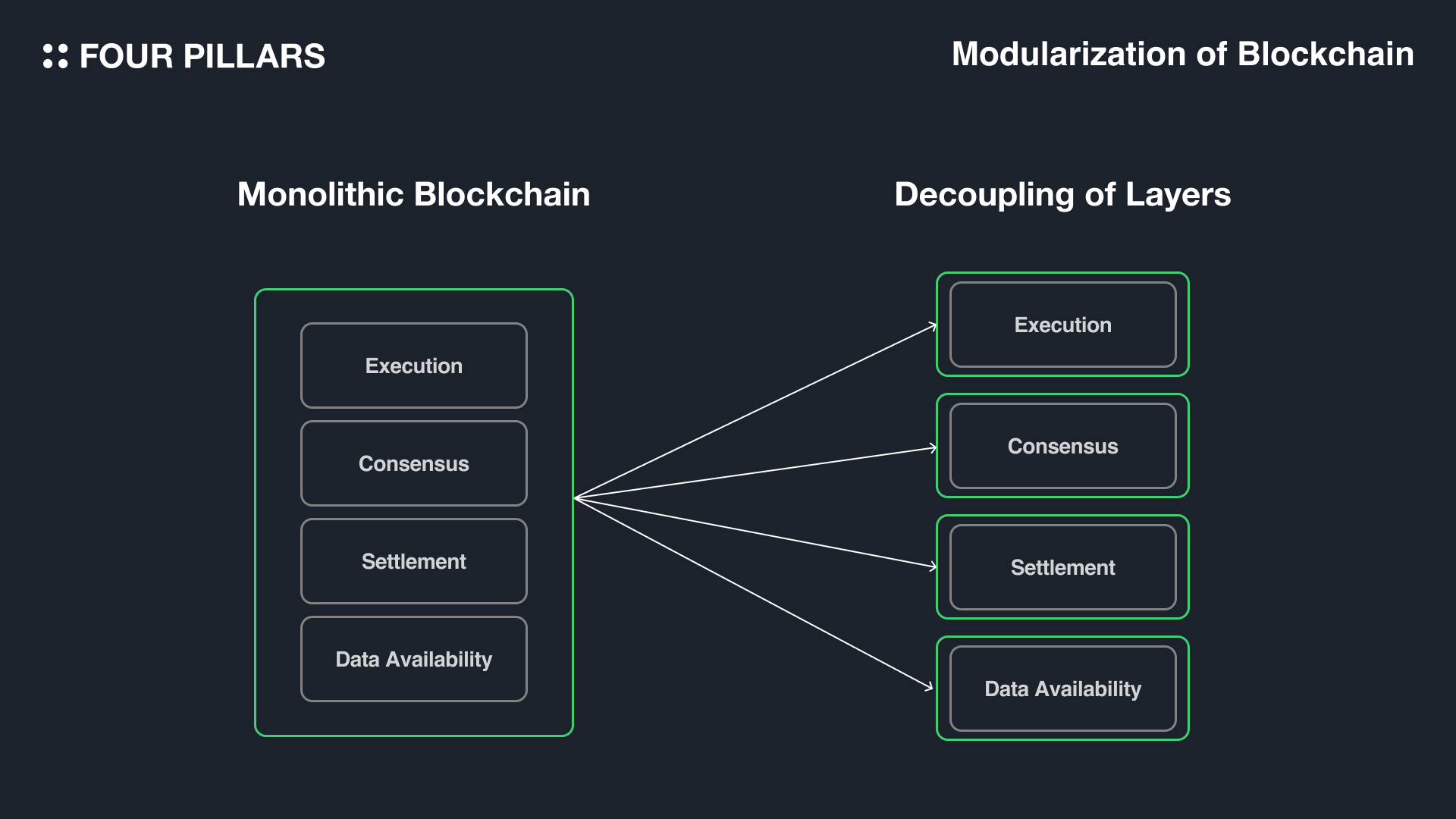

Celestia’s modular design enables consistently lower fees. By separating data availability from execution, Celestia optimizes resource allocation, keeping blob posting costs low and predictable—unlike Ethereum, where fees are impacted by network congestion and competition from other applications.

-

Ethereum’s monolithic structure keeps blob fees higher. Despite EIP-4844’s introduction of blobs, Ethereum’s monolithic design and persistent demand for block space mean that blob posting remains significantly more expensive than on Celestia, especially during periods of high network activity.

- Celestia: $7.31 per MB (average), with SuperBlobs reducing this further to $0.81 per MB in some cases.

- Ethereum: $20.56 per MB (average), but recent rolling averages show spikes up to $66.88 per MB.

- Latest snapshot: Some sources cite Celestia as low as $0.10 per MB – an order of magnitude below even its own average.

This massive gap isn’t just theoretical; it’s reshaping where new rollups choose to post their data.

If you want to dive deeper into these numbers, check out this breakdown from Conduit: Data Availability Costs: Ethereum Blobs Vs. Celestia – Conduit.

The Scalability Equation: Modular vs Monolithic Design

The architectural roots of each chain explain much of this divergence in cost and capability:

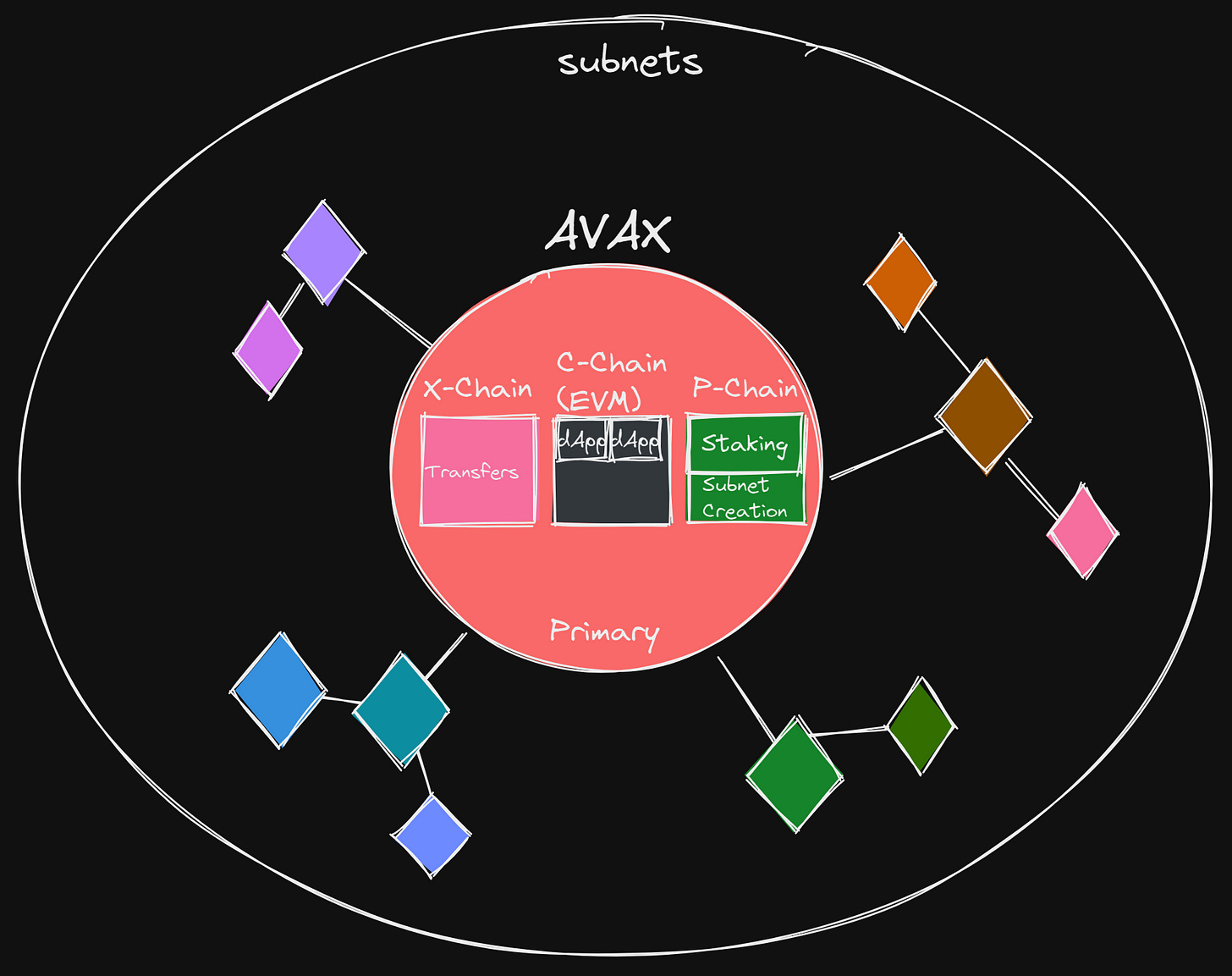

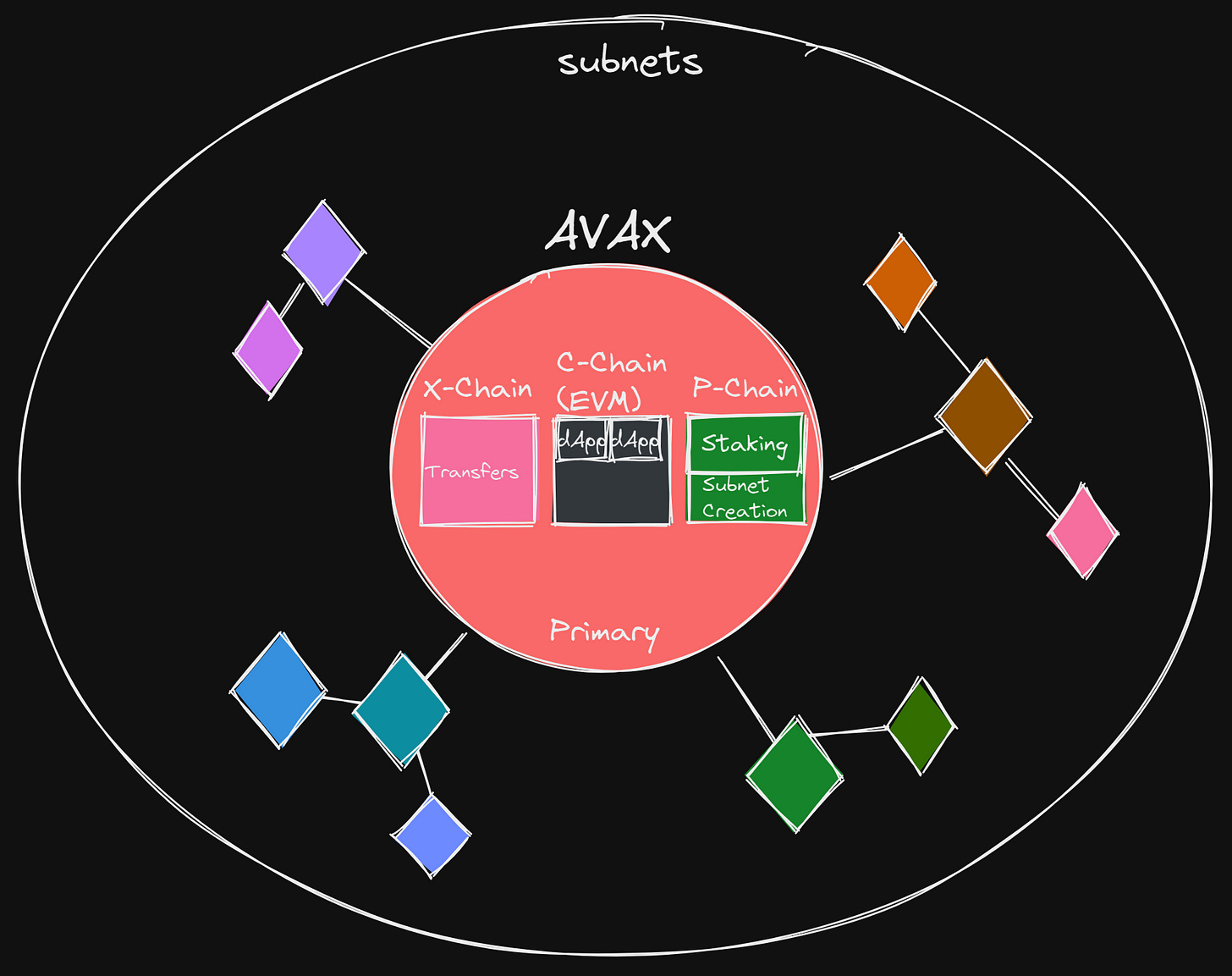

- Celestia: Built modular from day one, separating consensus/data availability from execution layers. This allows block sizes to scale up dramatically (with a roadmap targeting 1 gigabyte blocks) without bogging down the network.

- Ethereum: Still fundamentally monolithic despite upgrades like EIP-4844. Blobs help relieve pressure on mainnet block space but don’t fully solve throughput bottlenecks or enable custom execution environments like those possible on Celestia.

The result? If your application needs high throughput or custom execution logic, Celestia offers more room to grow at lower cost.

Let’s zoom in on what these differences mean for real-world blob trading strategies. For traders and protocols relying on data permanence, Celestia’s approach is a game-changer. The ability to access and verify blobs indefinitely opens up opportunities for secondary blob markets, long-term analytics, and novel DeFi primitives that simply aren’t possible with Ethereum’s 14-day expiry window. Imagine building indexes or derivatives on historical blob data, Celestia makes this feasible, while Ethereum’s ephemeral model introduces friction and risk.

Integration and Flexibility: Modular Ecosystem Advantage

Celestia’s modularity doesn’t just impact cost and scale, it also empowers developers to plug in their own execution environments, rollups, or even custom consensus layers. This flexibility means new blockchains or applications can tap into Celestia’s cheap, permanent blobspace without being locked into a single VM or protocol stack. For the rapidly evolving world of rollups and appchains, this is a serious edge.

Ethereum’s monolithic design still boasts the largest ecosystem and deepest liquidity pools, but it comes with tradeoffs: less freedom for custom execution environments and higher integration costs for projects that want to innovate beyond standard EVM logic.

Top 5 Benefits of Celestia’s Modular Design for Blob Traders

-

Significantly Lower Data Availability Costs: Celestia’s modular architecture enables dramatically cheaper data posting for blob traders—$7.31 per MB compared to Ethereum’s $20.56 per MB, with SuperBlobs reducing fees further to $0.81 per MB (Conduit.xyz).

-

Permanent Data Availability: Unlike Ethereum’s ephemeral blobs (pruned after ~14 days), Celestia stores blobs indefinitely, ensuring traders and rollups can always verify and access historical data (Datawallet.com).

-

Massive Scalability and Throughput: Celestia’s modular design allows scaling block sizes up to 1 gigabyte, supporting surges in blob sizes (recently up to 11.4 GB) and high transaction volumes—ideal for active data traders (Cointelegraph).

-

Flexible Integration for Rollups and Blockchains: Developers can choose custom execution environments and seamlessly connect various rollups or blockchains to Celestia’s data availability layer, fostering innovation and interoperability (AICoin.com).

-

Optimized Resource Allocation: By separating consensus and data availability from execution, Celestia enables more efficient use of network resources, resulting in lower operational costs and improved performance for blob-based trading strategies.

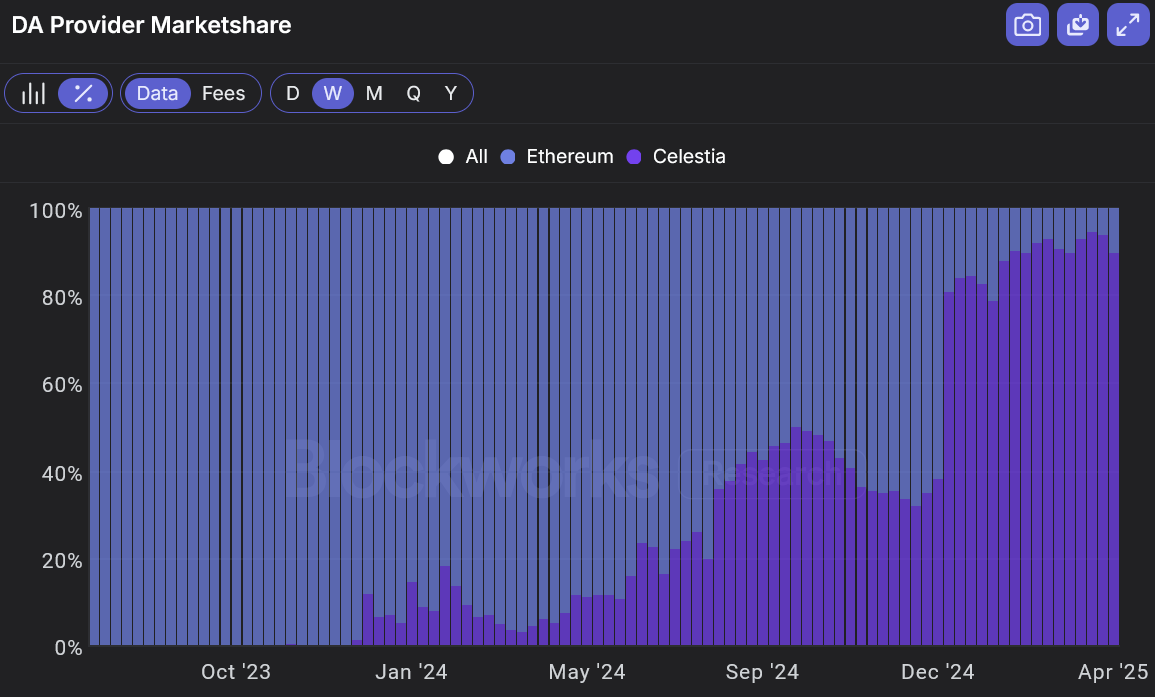

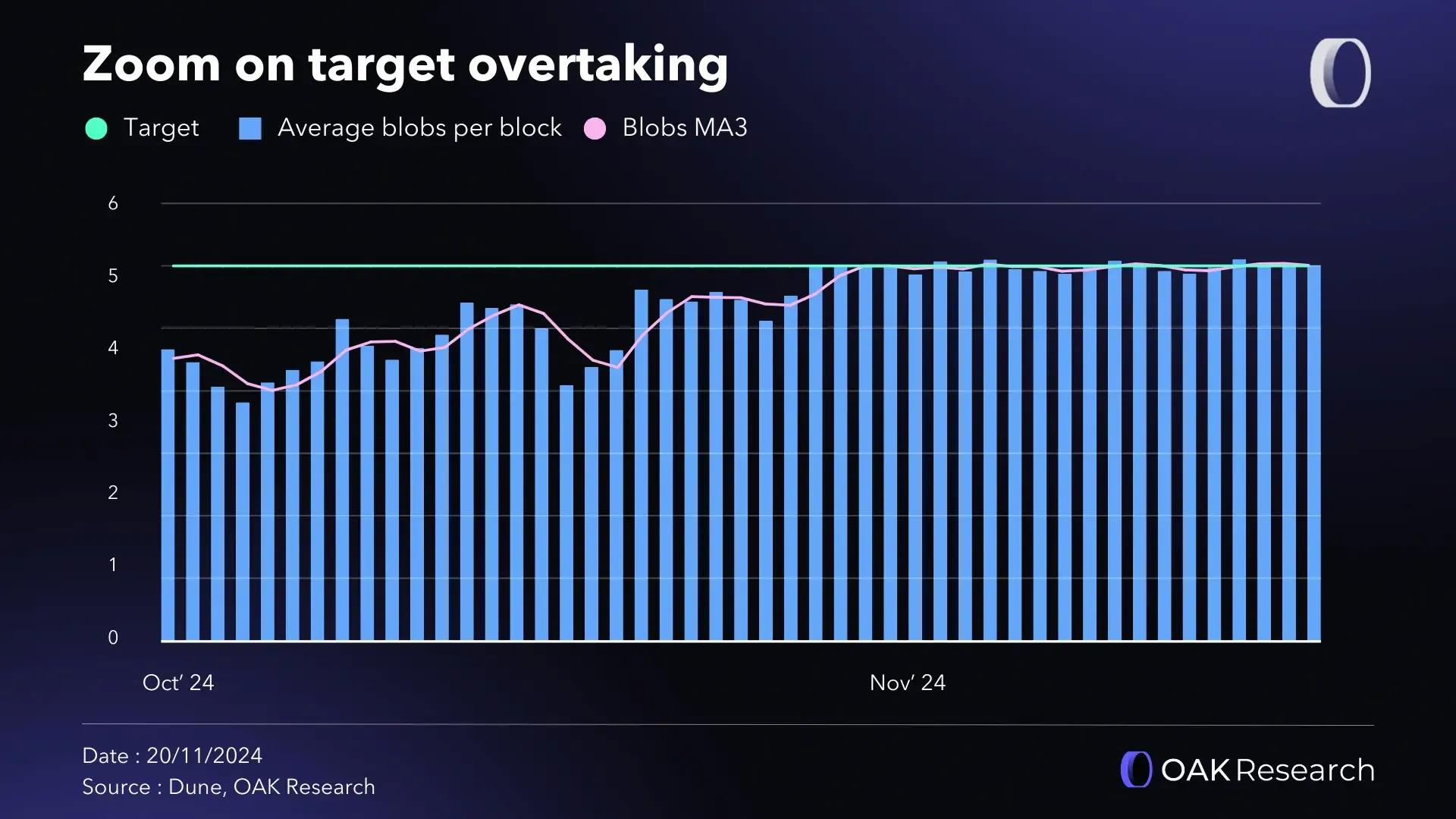

Market Momentum: Blobspace Growth and Future Outlook

The numbers tell the story: Celestia blob sizes have surged 10x, reaching up to 11.4 GB as transaction volume climbs 60%. This explosive growth signals that builders are flocking to Celestia for its cost savings and scalability. Meanwhile, Ethereum continues its balancing act, trying to serve both high-value DeFi users and layer-2 rollups within tight block space constraints.

For now, the price gap remains stark: Celestia at $7.31 per MB (and sometimes as low as $0.10 per MB), versus Ethereum at $20.56 per MB (with recent spikes up to $66.88 per MB). If you’re optimizing for cost efficiency at scale, or want the freedom to build novel data-driven products, Celestia is the clear favorite today.

The bottom line: While Ethereum blobs have lowered the barrier for L2 data posting in its ecosystem, Celestia is carving out a dominant role as the go-to platform for scalable, permanent, and affordable blobspace.

For more technical comparisons of DA solutions, including how erasure coding and namespace commitments work under the hood, see this deep dive from 0xemre: Comparison of Data Availability Solutions or by 0xemre – Medium.