Celestia Blob Pricing Trends: What Influences Blob Market Value?

Celestia’s blobspace is making headlines for all the right reasons: surging adoption, explosive data growth, and a rapidly evolving pricing landscape. If you’ve been tracking Celestia blob pricing, you know the past two weeks have been anything but ordinary. The average blob size on Celestia has soared from 1.18 GB to a staggering 11.4 GB, while daily transactions have jumped from 44,000 to 71,000. This surge is largely attributed to an NFT minting frenzy and fresh integrations by new projects tapping Celestia as their data availability backbone.

Blob Market Trends: What’s Driving the Value of Celestia Data Blobs?

The market value of data blobs on Celestia is far from static. It’s shaped by a web of interconnected factors that reflect both network fundamentals and broader crypto sentiment. Let’s break down what’s moving the needle right now:

- Network Demand and Usage: As more projects leverage Celestia for scalable data storage, demand for blobspace intensifies. The recent NFT mint not only drove up average blob sizes nearly tenfold but also set a new baseline for network activity.

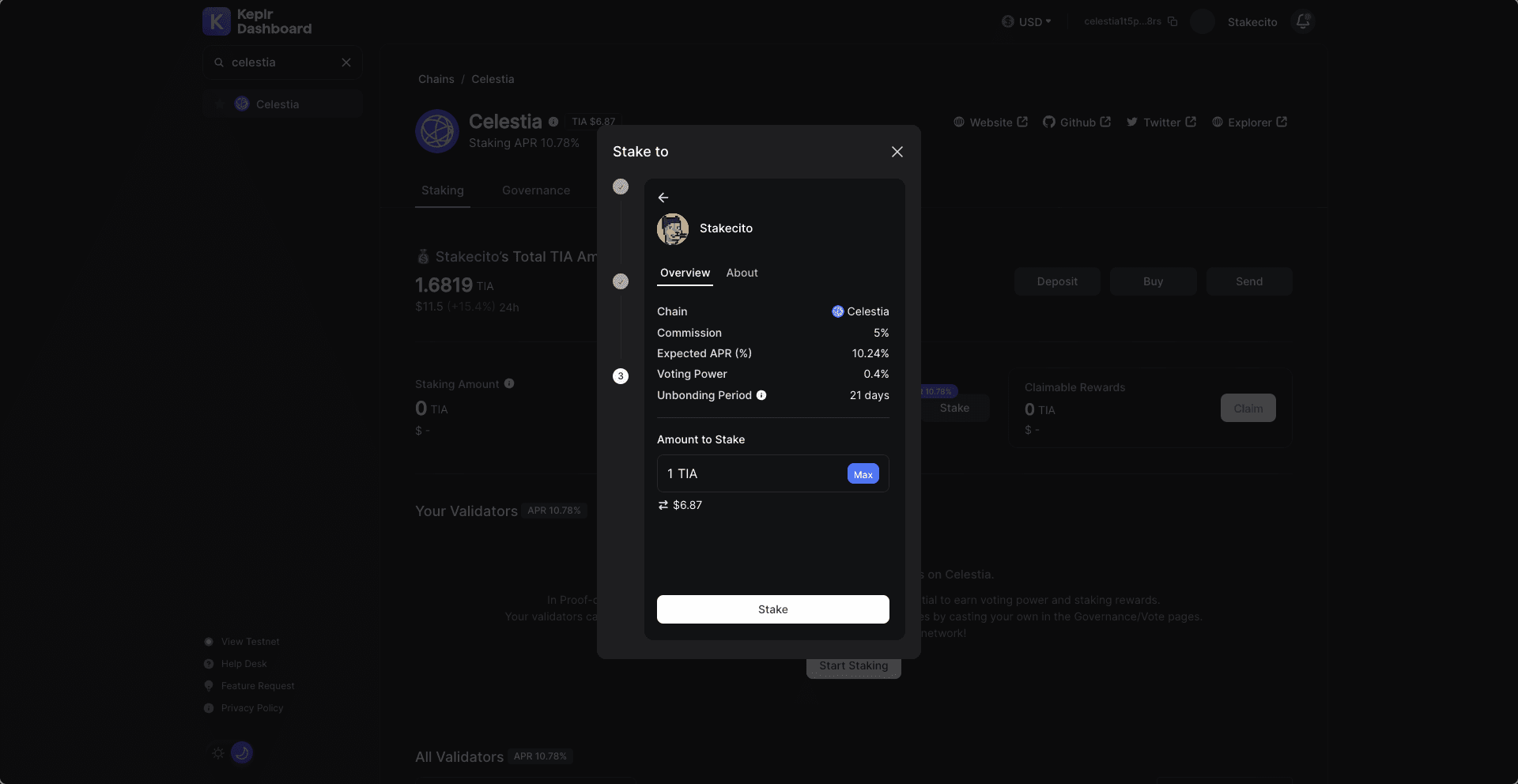

- Transaction Fees and Data Costs: Storing and retrieving blobs isn’t free – users pay fees in TIA tokens that fluctuate based on congestion and overall data volume. With TIA trading at $1.72, even minor shifts in token price or fee structure can ripple through the entire ecosystem.

- Developer Adoption: High-profile integrations (like Eclipse, an Ethereum L2) are fueling fresh demand for blobspace, as more teams choose Celestia for its modular design and cost-efficient scaling.

The nearly tenfold increase in blob sizes is likely due to an NFT mint that occurred during this period, as well as more projects choosing to build on Celestia.

Blob Pricing Mechanics: How Are Blobs Valued?

Understanding how blobs are priced requires zooming in on both protocol-level economics and market forces. At its core, blob pricing on Celestia is determined by:

- Fee Markets: Users bid for limited space within each block’s available blobspace; fees adjust dynamically based on demand.

- TIA Token Dynamics: Since all fees are paid in TIA, token volatility directly impacts the real-world cost of storing data.

- Data Volume and Congestion: When network usage spikes (as seen with recent NFT mints), fees can rise sharply – making timely analytics essential for traders and builders alike.

This dynamic interplay means that the cost of submitting a single large blob versus several smaller ones can vary day-to-day – or even hour-to-hour – depending on network congestion and TIA price swings.

Celestia (TIA) Price Prediction 2026-2031

Forecast based on current network trends, adoption rates, and market dynamics as of September 2025.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $1.20 | $1.75 | $3.10 | +3% | Recovery phase after 2025 downturn; steady adoption, but volatility persists |

| 2027 | $1.40 | $2.70 | $5.50 | +54% | Major adoption of modular blockchains, several new integrations, bullish sentiment |

| 2028 | $1.95 | $3.60 | $7.80 | +33% | Network effect compounds, NFT/data markets expand, competition intensifies |

| 2029 | $2.25 | $4.25 | $9.20 | +18% | Blobspace monetization matures, staking participation high, regulatory clarity improves |

| 2030 | $2.10 | $4.70 | $11.00 | +11% | Market stabilizes, Celestia secures niche as data availability layer |

| 2031 | $1.80 | $4.10 | $10.00 | -13% | Potential bear market cycle or increased competition; price consolidates |

Price Prediction Summary

Celestia (TIA) is projected to recover from its late-2024/2025 downturn, with steady growth driven by increasing adoption of modular blockchain solutions and expanding use cases for blobspace. Prices may see significant upside if network demand continues to surge, but volatility and competitive risks remain. Peak average prices are likely around 2030, with a possible consolidation or correction by 2031 as the market matures.

Key Factors Affecting Celestia Price

- Network demand for data availability and blobspace (especially from NFTs and new blockchain projects)

- Tokenomics, staking rewards, and TIA supply/demand dynamics

- Broader crypto market cycles and investor sentiment

- Regulatory developments affecting blockchain data markets

- Competition from alternative data availability and modular blockchain solutions

- Technological upgrades and integrations with major projects (e.g., Ethereum L2s, cross-chain ecosystems)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

TIA Price Action Anchors Blob Economics

The value of the TIA token underpins every aspect of Celestia’s blob market. As of today, TIA trades at $1.72, reflecting a slight dip (-0.0601%) over the past 24 hours with highs of $1.85 and lows at $1.71 (source). These fluctuations aren’t just numbers – they set the baseline cost for every transaction and storage operation across the network.

Bullish or bearish sentiment around TIA often translates directly into changes in developer behavior: when prices drop, some projects may delay large-scale deployments; when prices climb, increased validator rewards can fuel further adoption as more teams join the ecosystem.

Blobspace analytics show that the recent surge in blob size and transaction count is more than a one-off event. It’s a bellwether for how external events, like NFT mints or new protocol launches, can create sudden, volatile shifts in both blob demand and pricing. For traders and data scientists, this means that staying ahead of the curve is all about watching real-time metrics and anticipating how upcoming network activity might impact fee markets.

From a pricing perspective, the variance of demand is just as crucial as the average level. When activity becomes erratic, say, during a hyped NFT drop or a major project onboarding, blob fees can spike unpredictably. This creates unique opportunities for arbitrage and strategic deployment, but also raises the stakes for anyone managing large-scale data flows on Celestia.

Blobspace Analytics: Navigating Volatility

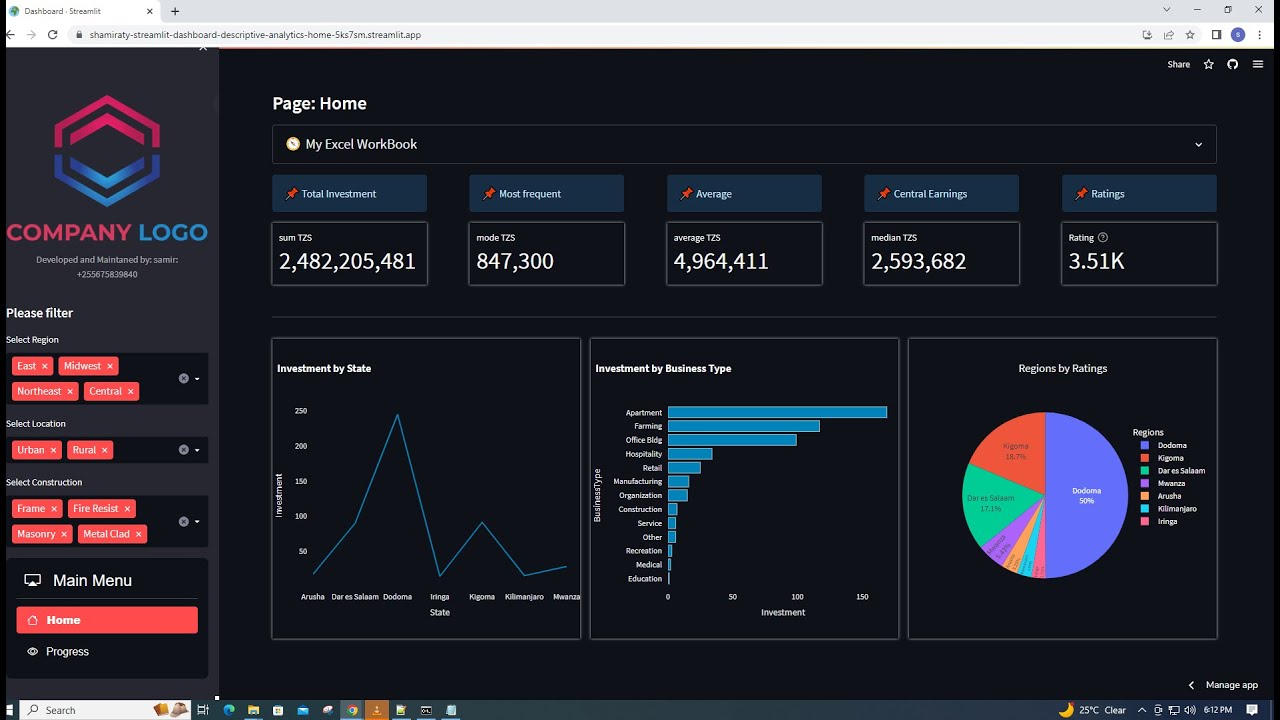

For anyone serious about trading blobs or optimizing data costs, leveraging advanced blobspace analytics is non-negotiable. Platforms like the Celestia dashboard offer live feeds on blob usage, staking dynamics, and financial flows across the network (source). Keeping tabs on these analytics helps users:

Top 5 Tips for Navigating Celestia Blob Market Volatility

-

Monitor Real-Time Network Analytics: Use the Celestia Analytics Dashboard to track blobspace usage, transaction volumes, and network congestion. Staying updated on these metrics helps you anticipate fee spikes and market shifts.

-

Keep an Eye on TIA Price Fluctuations: The cost of storing blobs is directly tied to TIA’s price, which is currently $1.70 (down 6.08% in 24h). Use platforms like KuCoin or MarketCapOf for live price tracking and historical trends.

-

Watch for Major Adoption Events: Surges in blob size and transaction volume often follow NFT mints or new project integrations, such as Eclipse using Celestia as a data layer. Stay informed about ecosystem developments to anticipate volatility.

-

Factor in Data Availability and Transaction Fees: Blob fees are based on size and network activity. During high-demand periods, fees can rise sharply. Review fee structures on resources like Canvas Business Model to plan your trades.

-

Leverage Staking and Tokenomics Insights: Staking TIA can provide rewards and hedge exposure to fee volatility. Analyze staking data and token supply schedules on analytics sites to inform your trading strategy.

- Monitor real-time congestion: Spikes in transaction volume often precede fee surges.

- Track TIA price movements: Even small changes in TIA price can alter effective blob costs.

- Diversify deployment timing: Avoid peak congestion periods to minimize fees.

- Analyze project launches: Major integrations can drive sudden demand increases.

- Leverage predictive analytics: Use market forecasts to anticipate future pricing swings.

The interplay between network adoption, tokenomics, and user activity means that no two weeks look quite the same in Celestia’s evolving ecosystem. As more projects choose modular blockchain designs and as NFT-related activity ebbs and flows, expect continued volatility, but also fresh opportunity, for those who know where to look.

The surge in blob sizes isn’t just technical noise, it’s a signpost for where blockchain data markets are headed next.

Looking Ahead: The Future of Blockchain Data Pricing

If current trends hold, we’re likely to see even greater sophistication in how blobs are priced and traded. Expect innovations like dynamic fee markets tuned to specific use cases (NFTs vs. rollups), new analytics tools for tracking cross-chain data flows, and deeper integration with DeFi protocols seeking efficient off-chain storage solutions.

The bottom line? Whether you’re a builder deploying your first dApp or a trader eyeing arbitrage opportunities as TIA hovers at $1.72, understanding Celestia’s blob market mechanics is essential for success in this next phase of modular blockchain infrastructure.