A Guide to Trading Celestia Data Blobs: Best Practices for Blobspace Markets

Celestia’s modular blockchain architecture has redefined data availability, making trading Celestia data blobs an essential activity for developers, rollup operators, and market participants seeking to optimize costs and capture alpha. With the current Celestia (TIA) price at $1.70 and daily blob sizes surging to 11.4 GB amid a 60% spike in transaction volume, the blobspace market is more dynamic than ever. This guide breaks down the top five best practices for trading data blobs on Blobspace Markets, tailored for today’s high-demand environment.

1. Monitor Real-Time Blob Market Data and Pricing Trends

The first rule of effective blobspace trading is to stay laser-focused on real-time market data. Blobs are not static commodities – their value fluctuates with network congestion, NFT mints, rollup launches, and macro shifts in TIA pricing. With TIA currently priced at $1.70 after a 6% daily decrease (see source), traders must track blob fees, demand spikes, and volume patterns minute by minute.

Blobspace Markets’ dashboards aggregate live metrics such as average blob fee per byte, blockspace utilization rates, and trending namespaces. This data-driven approach enables participants to identify arbitrage windows or avoid overpaying during peak congestion.

2. Optimize Blob Submission Timing to Minimize Fees

Timing is critical in the blob markets. As observed during recent NFT surges and Eclipse’s integration with Celestia, submitting blobs during periods of low network activity can reduce costs by up to 30%. Since PayForBlobs transactions are subject to variable demand-based fees denominated in TIA, traders should analyze block-by-block fee trends before submission.

Tactical tip: Use historical congestion heatmaps on Blobspace Markets to identify time-of-day patterns when network usage dips below average. Automated scripts can be configured to submit blobs only when fees fall beneath a user-defined threshold.

3. Leverage Namespace Strategies for Enhanced Data Availability

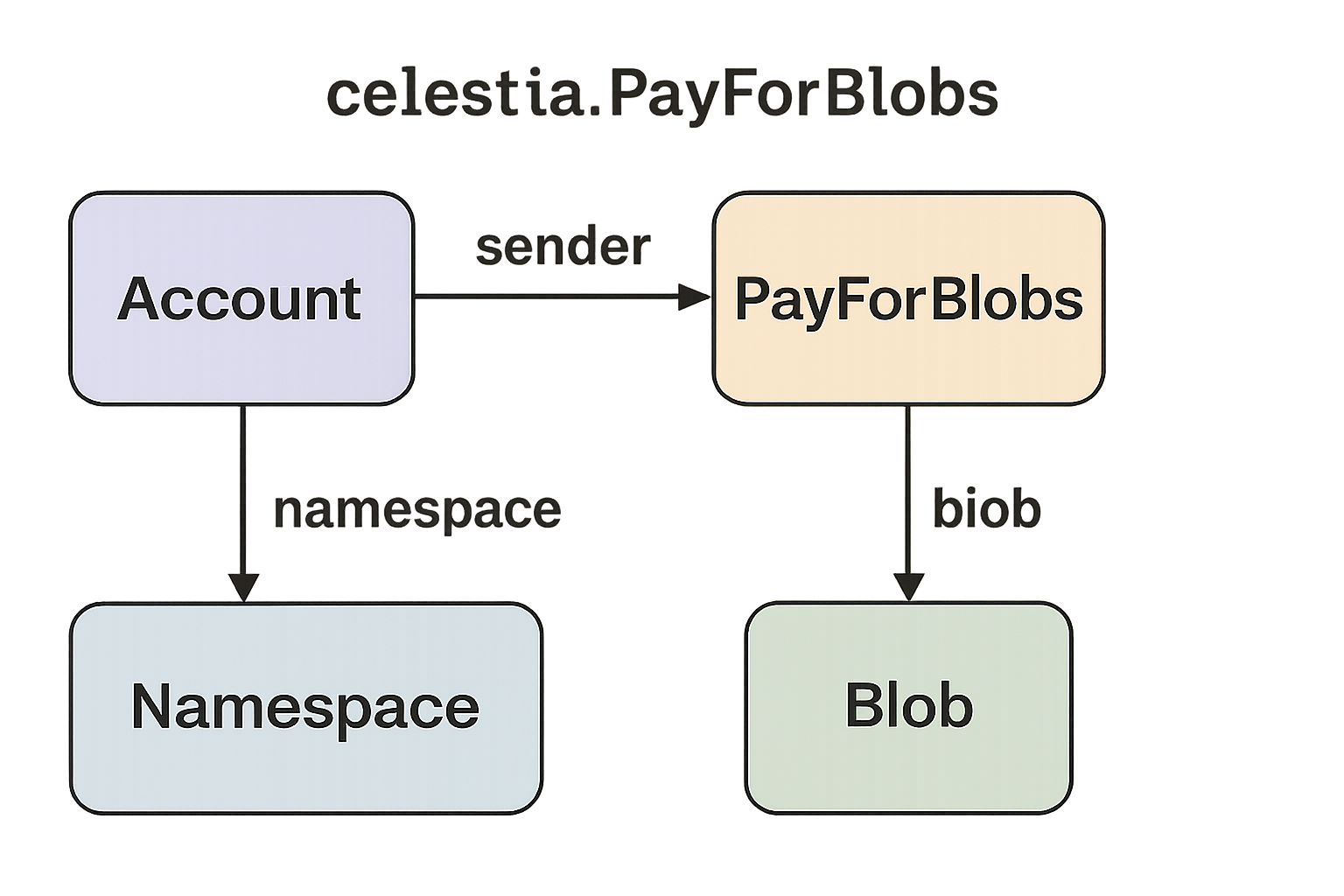

The namespace field within each PayForBlobs transaction offers both flexibility and strategic potential. Namespaces enable rollups and dApps to segment their data for efficient retrieval or prioritization within Celestia’s matrix structure (see technical details). Savvy traders leverage unique namespaces to:

- Avoid contention: Isolating blobs in underutilized namespaces reduces competition for space.

- Enhance discoverability: Custom namespaces make it easier for downstream consumers or indexers to find relevant blobs quickly.

- Create premium segments: Some projects monetize access by controlling high-value namespaces tied to exclusive datasets or rollup state commitments.

Selecting the right namespace is not just about technical correctness – it’s a market positioning tool that can drive liquidity or exclusivity depending on your goals.

Celestia (TIA) Price Prediction 2026-2031

Professional outlook based on current adoption, blobspace demand, and blockchain data availability trends.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Potential % Change (Avg) |

|---|---|---|---|---|

| 2026 | $1.35 | $2.10 | $3.25 | +23% |

| 2027 | $1.20 | $2.40 | $4.10 | +14% |

| 2028 | $1.10 | $2.95 | $5.00 | +23% |

| 2029 | $1.25 | $3.60 | $6.20 | +22% |

| 2030 | $1.50 | $4.25 | $7.80 | +18% |

| 2031 | $1.80 | $5.10 | $9.50 | +20% |

Price Prediction Summary

Celestia (TIA) is expected to see gradual and progressive price growth from 2026 through 2031, driven mainly by expanding blobspace demand, increasing adoption of modular blockchain architectures, and the overall trend towards scalable data availability layers. While volatility and market cycles may cause temporary downturns, the long-term outlook remains positive as blockchain data needs grow. The average price is projected to increase steadily, with potential for significant upside in bullish scenarios if Celestia cements itself as the leading data availability solution.

Key Factors Affecting Celestia Price

- Rising demand for blobspace due to NFT mints, rollup adoption, and modular blockchain trends.

- Increased transaction volume and blob sizes on Celestia, indicating active network usage.

- Potential for further technology upgrades (e.g., blob aggregation, scalability improvements) to enhance throughput and reduce costs.

- Competition from other data availability layers (e.g., Ethereum, EigenDA) could impact market share.

- Regulatory clarity or uncertainty affecting the broader crypto market.

- Macro market conditions, including Bitcoin cycles and overall risk appetite.

- Partnerships or major integrations with leading L2s and rollups.

- Tokenomics changes or supply shocks affecting TIA liquidity.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Importance of Transaction Verification Before Trading Blobs

Avoiding costly mistakes starts with meticulous verification of every transaction detail before trading or submitting blobs. Each PayForBlobs transaction contains critical fields: sender identity, data payload, size in bytes, namespace identifier, and digital signature. Inaccuracies can result in lost funds or failed submissions – especially as average blob sizes now exceed 11 GB per day.

Best practice: Implement automated pre-trade checks that validate namespace formats, confirm fee estimates against live rates (currently anchored by TIA at $1.70), and cross-reference sender credentials with whitelists where applicable.

Manual oversight remains crucial, but integrating validation scripts into your workflow can dramatically reduce human error. As the Celestia ecosystem matures and transaction volumes grow, rigorous verification protocols will separate successful traders from those exposed to unnecessary risk.

5. Utilize Analytics Tools to Identify High-Demand Blobspace Opportunities

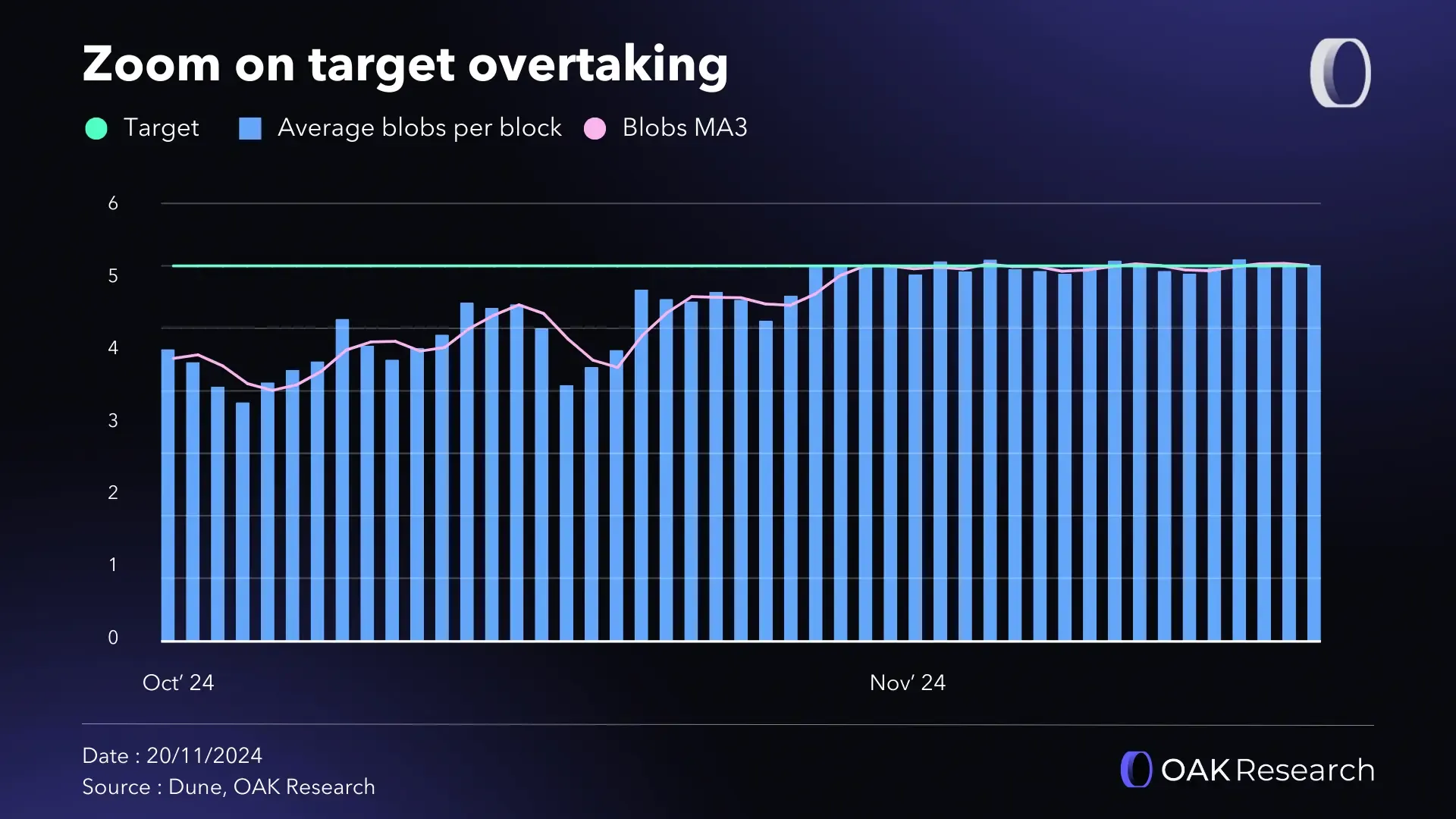

Analytics are the backbone of any data-driven trading strategy, especially in a rapidly evolving market like Celestia’s blobspace. With daily blob sizes surging and TIA price volatility at $1.70, it’s not enough to react, you need to anticipate where demand is headed next. Advanced analytics on Blobspace Markets surface actionable insights: which namespaces are gaining traction, which time windows see unusual volume spikes, and how fee curves correlate with NFT mints or rollup activity.

For example, tracking rolling averages of blob submissions by namespace can reveal emerging trends before they hit mainstream awareness. Heatmaps and historical fee charts help you pinpoint cyclical patterns, such as weekend slowdowns or post-update surges, that can be exploited for better entry or exit points.

Top 5 Best Practices for Trading Celestia Data Blobs

-

Monitor Real-Time Blob Market Data and Pricing Trends: Stay updated on Celestia (TIA) price movements—currently $1.70—and observe blob size and transaction volume surges, as seen with recent NFT mints and projects like Eclipse. Tracking platforms such as AICoin and CoinGecko provides actionable market intelligence.

-

Optimize Blob Submission Timing to Minimize Fees: Submit blobs during periods of lower network activity to reduce costs. Celestia’s PayForBlobs transaction fees fluctuate with demand; tools like Celestia Explorer and Mintscan help identify optimal windows for submission.

-

Leverage Namespace Strategies for Enhanced Data Availability: Utilize namespaces within PayForBlobs transactions to efficiently organize and prioritize data. Refer to Celestia Docs for best practices on namespace allocation, which can improve discoverability and retrieval speed for your blobs.

-

Verify Transaction Details Before Trading or Submitting Blobs: Double-check sender identity, data size, namespace, and signatures in every PayForBlobs transaction. Use trusted explorers like Mintscan and Celestia Explorer to validate transaction integrity and prevent costly errors.

-

Utilize Analytics Tools to Identify High-Demand Blobspace Opportunities: Platforms such as Dune Analytics and Flipside Crypto offer dashboards to analyze blobspace usage trends, helping traders spot profitable opportunities during surges in demand, like recent NFT mint events.

Pro tip: Set up custom alerts for high-fee events or sudden increases in blob submission rates. These tools not only protect you from adverse conditions but also help you capitalize on arbitrage or liquidity mismatches as they appear.

Putting It All Together: Trading Blobs with Confidence Amid Surging Demand

The past quarter has demonstrated just how quickly the Celestia blobspace landscape can shift. With transaction counts up 60% and average daily blob volume now topping 11.4 GB (source), agility is non-negotiable. By combining real-time monitoring, strategic timing, namespace optimization, rigorous verification, and deep analytics, traders position themselves to maximize returns while minimizing exposure to volatility and congestion risk.

As new rollups and dApps continue to onboard to Celestia, staying ahead means leveraging every available tool, and never losing sight of the fundamentals outlined here. Whether you’re trading blobs for profit or optimizing data availability for your project’s users, these best practices will keep you at the forefront of the modular blockchain revolution.